Article first seen on Investment Frontier

I&M Bank Rwanda IPO is a good bet.

I&M Bank of Rwanda is launching its IPO on the RSE (Rwanda Stock Exchange), with an anticipated list date of March 31, 2017. The prospectus has been distributed here. This post endeavors to provide you with a brief overview of this opportunity to invest.

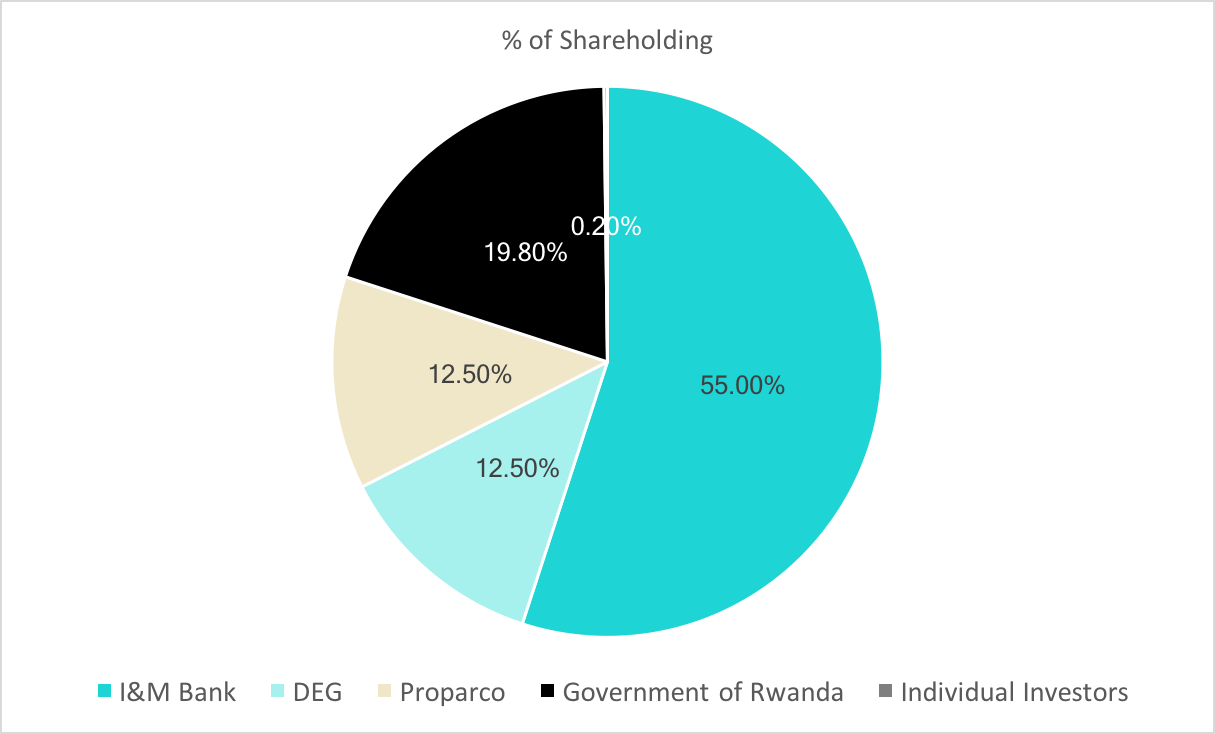

The objective is to raise approximately $10.8mm through the public offering, selling the Government of Rwanda’s stake in the bank which represents approximately 20% of the issued share capital of the bank. The government will be using the proceeds to help with the construction of its international airport. 40% of the shares are available for foreign investors, 15% are for QII in Rwanda, 15% are for QII in East Africa, 5% is for employees of the bank, and 25% is for retail in East Africa.

The bank was started in 1963 as Rwanda’s first commercial bank, it was then sold to a private equity firm in 2004 and later purchased by I&M Bank of Kenya. I&M operates a total of 74 branches around East Africa with 16 in Rwanda. The bank will retain its majority stake in the bank.

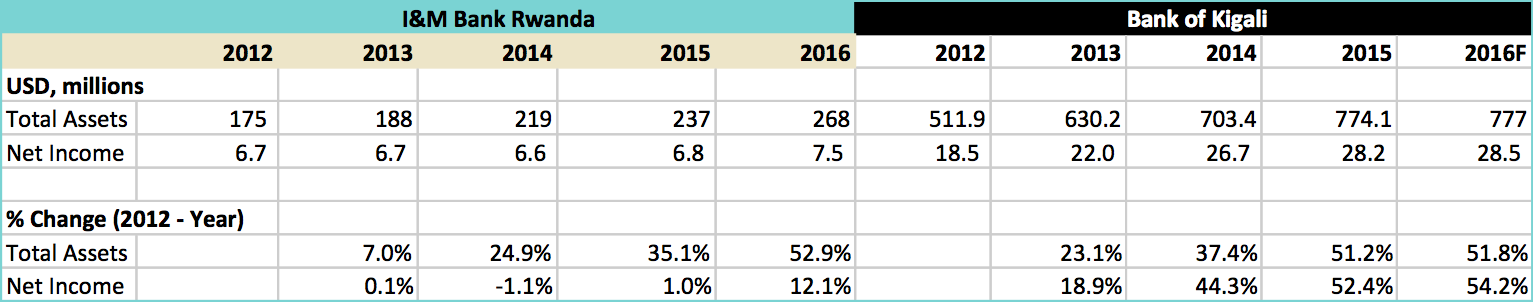

The bank offers the full gamut of banking services but has made a strategic focus on corporate lending, which makes sense given that it faces difficult competition from Bank of Kigali in the personal banking space. In the past 5 years, the bank has grown its loan book by over 40% to approximately ~$140mm while providing a relatively consistent payout ratio to shareholders of about 40%. During this time, net profit increased by 37% to $7mm in 2016, this growth, however, has lagged Bank of Kigali where over the same period essentially all metrics doubled. See the figure below for performance in USD, please note that percentages are different than what is shown above because it is being represented in USD. Between 2012 and 2016 the Rwandan Franc depreciated by -19% relative to USD.

The IPO offer price of 90 RWF/share implies a value for the company of approximately ~$54mm, suggesting that I&M’S stake is worth ~$30mm. This compares to a market cap of $301mm for the I&M holding group, we think that based on I&M’s financials, the stake in I&M Rwanda is worth about $31mm which suggests that this is the roundabout approach that was used to price the IPO.

I&M Rwanda is operating in a reasonably interesting area within an exciting country, however, their ability to compete relative to EcoBank and Bank of Kigali leaves a lot to be desired. Robin Bairstow joined as Managing Director in 2015 and since then we have seen a deliberate change in performance and aggressiveness at I&M. The bank was poorly run relative to its competitors until 2015. They were growing because of government affiliations and by simply being open in a country growing as quickly as Rwanda. However, they managed to lose market share to the dominant market player; Bank of Kigali. This is something unconscionable for a small player like I&M Rwanda with so much runway to grow and take share at the same time.

Metrics like Net Income and Total Loan Book were increasing between 5-8% a year until last year when they shot up +17%. We remain a little concerned at the quality and lethargy of the I&M Board as their Kenya operations have been moderately better, but as a bank, they are not the dominant player in execution or size in any of their markets. Even with these considerations, banks make a lot of money in emerging markets and they are positioned well enough to enjoy strong returns as these countries grow. I&M bank gained market share in 2016, which makes us positive on this IPO.

The Government of Rwanda has shown an ability to learn from each of its dispositions via IPO and has timed this one particularly well. Providing investors, particularly at the retail level a good experience from participating in IPOs is a key ingredient in our opinion, for the long-term success of a market.

I&M Rwanda is worth about 100 RWF per share but with strong upside, and so we think that the 90 RWF IPO price is a fair price and a reasonable investment for anyone wishing to gain additional exposure to an exciting East African growth story.

Original Source: https://www.investmentfrontier.com/2017/02/20/im-bank-rwanda-ipo-good-bet/

Author: Shalifay Investments