The Hustler Fund, which is a government-backed lending program aimed at empowering small businesses and individuals, is facing a major repayment crisis as 64% of the Fund’s total loan portfolio—equivalent to Ksh 8.74 billion — remains unpaid for over a year, according to the Auditor General.

- •The Fund, officially known as the Financial Inclusion Fund, had Ksh 13.57 billion in total outstanding loans as of June 30, 2024 — including Ksh 12.33 billion in principal loans and Ksh 1.2 billion in interest receivables.

- •The high level of overdue loans casts doubt on whether the Fund will recover a significant portion of its disbursed capital.

- •With such a high Non-Performing Loan (NPL) ratio, the Hustler Fund significantly exceeds standard microfinance industry benchmarks, where sustainable lending institutions typically maintain NPLs below 10%.

The report highlights serious weaknesses in loan collection efforts as the Fund lacks a dedicated loan management system and relies heavily on private service providers such as Kenya Commercial Bank, Family Bank, and mobile operators like Safaricom, Airtel, and Telkom for disbursement and tracking. However, no evidence of a structured debt recovery framework was provided, leaving the government exposed to significant financial losses.

According to the government’s latest figures, the fund has registered more than 23.29 million members since 2022. The government has contemplated tracking down defaulters and compelling them to repay loans taken, but pundits have argued that would be an expensive exercise.

Meanwhile, the government has tried to incentivize repayment by rewarding those with good credit scores. The Hustlers Fund has also intensified its focus on small community groups that are more likely to utilize the loans productively and repay them as required.

However, the absence of a credit policy or repayment enforcement strategy means borrowers face little consequence for defaulting. The staggering default rate threatens the Fund’s ability to operate effectively, as repayments are crucial for issuing new loans and covering administrative costs.

Underage Borrowers?

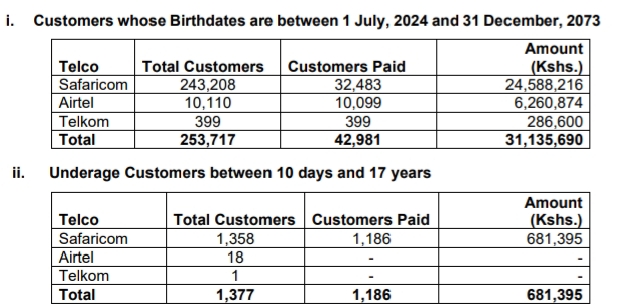

The report further reveals that loans were even issued to 1,377 underage borrowers, some as young as 10 days old — receiving collectively over KSh 0.6 million.

Safaricom, Airtel, and Telkom also collectively processed loans for over 250,000 individuals, with birth dates between 1st July and 31st December 2073. The disbursements made for these individuals exceeded Ksh 31 million.

The implications — according to the Auditor General — are significant because loan agreements with minors are potentially unenforceable, heightening the risk of default. However, the data raises serious concerns about the Fund’s due diligence processes and integrity — as such revelations could point to potential fraud.

The Financial Gaps

The Hustler Fund’s financial management has come under scrutiny due to unsupported cash and cash equivalents, raising concerns about transparency and oversight. A balance of Ksh 3.35 billion was recorded, but key supporting documents, including bank balance certificates for mobile money floats and a stale cheque — totalling over KSh 44 million were missing. This lack of verification leaves the fund’s financial position uncertain, undermining confidence in its operations.

Further issues emerged with the fund’s receivables and interest income reporting. A reported balance of Ksh 13.57 billion included interest receivables calculated on paid amounts rather than accrued interest, leading to discrepancies.

Additionally, service providers handling loan disbursements showed inconsistencies in remitting funds, with a variance of Ksh 16 million. These financial misstatements cast doubt on the fund’s ability to maintain accurate records and ensure proper loan recovery.

Operational Shortfalls

Despite an approved staffing level of 119, only 16 employees—seconded from the State Department for Micro, Small, and Medium Enterprises Development—are running the Fund’s operations, an 83% staffing gap.

Additionally, the CEO has been in an acting capacity for over two years, in violation of the Public Service Commission Act, which limits acting positions to six months.

The Fund’s failure to establish an Internal Audit Function and Audit Committee violated public finance laws, leaving it without key oversight. This weakened financial controls, risk management, and accountability, raising concerns about compliance and governance.