During a recent webinar hosted by The Kenyan WallStreet in collaboration with Tarra Agility Africa, a boutique international tax and legal advisory firm, we delved into the business tax landscape in Kenya.

Here are some of the highlights from our conversation with Tarra Agility’s CPA Beatrice Njeri and Sarah Mungai on how you can restructure your business for tax optimization.

Common Business Vehicles in Kenya

Limited Liability Partnerships (LLP)

Fiscally transparent where partners are taxed as individuals in proportion to their stake in the LLP. Essentially, the gains or profits of a partner from a partnership shall be the remuneration payable to him by the partnership, together with interest on capital so payable, and his share of the total income of the partnership.

Limited Liability Company (LLC)

The tax structure for LLCs is dependent on whether they are resident or non-resident entities. A company is considered tax resident if:

- •A person incorporates a company under Kenyan law in Kenya

- •Management and control of the company affairs are exercised in Kenya

- •The Cabinet secretary, National treasury and Planning designates the company as tax resident.

The tax structure for LLC’s includes tax obligations such as:

- •Corporate Tax: 30 percent corporate tax subject to resident companies and 37.5 percent corporate tax for Non-Resident Companies (Finance Act 2022).

- •Withholding Tax: Distribution of dividends from a Kenyan company to its shareholders is subject to withholding tax (WTH) at 5 percent for resident shareholders and 15 percent for non-resident shareholders. Where a Kenyan company owns 12.5 percent or more of the shareholding of another Kenyan company, any payment of dividends by the subsidiary to the shareholder is exempt from withholding tax.

- •Digital Service Tax 1.5 percent of the income received in the digital marketplace – a platform that allows interaction between buyers and sellers – applicable only to non-residents.

- •Capital Gains Tax -15 percent on property such as land.

- •Value Added Tax – (vatable supplies plus threshold) threshold proposed to be increased (0, 8 and 16 percent)

- •Excise duty (varied rates) commonly known as ‘luxury tax.’

- •Stamp Duty (varied rates) documentation , land etc.

- •Import (Customs) Duty

Kenya as a source-based Income tax regime

Kenya applies a source-based income tax system, where income tax is charged for each year of income, upon all the income of a person whether resident or non-resident, which is accrued in or was derived from Kenya.

“All income – resident or non resident – derived in Kenya is taxed in Kenya. Conversely, only income generated in Kenya is taxed here,” Sarah Mungai noted.

Specified sources of income in Kenya for taxation purposes where income and expenditure cannot be mixed and aggregated together. Losses from one source can only be carried forward to offset gains from the same source. Notably, only specified sources are taxable in Kenya.

The specified sources include:

- •Business income from any ace or erotession

- •Employment income

- •Rent income

- •Dividend and Interest

- •Pension income

- •Income from a Digital Marketplace

- •Natural resource income – mining

Why Mauritius and the United Arab Emirates are attractive Investment Destinations

Mauritius

Mauritius operates a territorial tax system which implies only income derived from Mauritius is subject to tax. The corporate tax rate is attractive at 15 percent compared to 30 percent in Kenya.

Double Taxation Agreement: Mauritius has an extensive network of double dividends paid to foreign shareholders.

Tax Incentives: Mauritius offers various tax incentives for specific industries and activities, such as freeport operations and global business companies.

UAE

The UAE offers a federal corporate tax regime with a 0% tax rate for mainland businesses operating outside of Free Zones (FZs). nowever. Some emirates levy corporate income taxes within their FZs.

Free Zones: FZs offer significant benefits, including 0% corporate tax, import and export duty exemptions, and simplified repatriation of profits

Popular options include Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM).

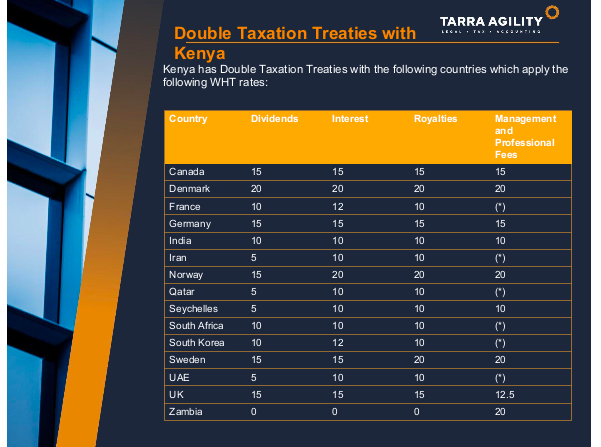

Countries with double taxation agreements with Kenya

A Double Taxation Treaty (DTT) is an agreement entered into between two states, with a view to protecting the residents of the two states from having their income taxed twice (double taxation).

A resident company which also derives income from outside Kenya is likely to suffer double taxation since the income earned outside will be taxed in the country where it was derived from and again taxed in Kenya upon remittance.

“In cases where it is higher, they favor the lower rate.”

Kenya has Double Taxation Treaties with the following countries which apply the following WHT rates:

Limitation of Benefits exclusion

An important caveat to DTT benefits is the LOB clause – which aims to prevent abuse of DTTs by companies or individuals who are not genuinely residents of the treaty country.

The LOB clause typically restricts treaty benefits to the “beneficial owner” of the income. This can be relevant if the business owner resides in a low-tax jurisdiction.

To qualify for DTT benefits under the LOB clause, the owner may need to demonstrate:

Substance: The owner has a legitimate business presence in the treaty country and is not merely a shell company

Activity: The owner is actively engaged in generating the income, not simply acting as a conduit to channel income to a low-tax jurisdiction.

Tax implications of taking equity or debt funding in Kenya

Equity Funding considerations

Increase of share capital subject to 1% stamp duty on the value of the increased shares

Because of loss of control – shareholder agreements are important to govern the rights and liabilities of the parties.

Debt Funding considerations

Deemed Interest – applicable on interest-free borrowings received by foreign-controlled entities in Kenya. The ‘deemed interest’ is based on the Commissioner’s prescribed rates.

WHT is due on the ‘deemed interest’.

Interest deductibility

When determining income of a Kenyan entity, a deduction for interest is allowed only to the extent that the borrowings are used for the purpose of trade i.e. to generate taxable business income.

The TA limits the deduction of interest expenses to a maximum of 30% of earnings before interest, tax, depreciation, and amortization (EBITDA) of the company.

Transfer Pricing

Where the loan is interest bearing and has been advanced by a foreign related party, there would be a requirement for an arm’s length interest to be charged, based on a transfer pricing benchmarking analysis.

Profit Extraction

Dividends

Any distribution whether in cash or kind, made before or during winding-up of a company to its shareholders with respect to their equity interest in the company is regarded as dividends for purposes of taxation.

WHT on dividends paid to Kenyan residents or to citizens of the East African Community on listed shares applies at a rate of 5%. A rate of 15% is applicable to non-residents.

Interest

Interest income earned from loans is subject to a WHT of 15% for both residents and non-residents.

Royalties

Kenya applies a withholding tax (WHT) on royalty income received for the use of intellectual property (e.g.

Patents, copyrights).

The rate applied to residents is 5% and 20% for non-residents. The royalties paid by the user are typically tax-deductible expenses for the business.

Management and Professional Fees

Kenya applies a WHT on management and professional fees paid to residents at the rate of 5% and to non-residents at 20%.

Fiscal Benefits of Special Economic Zones (SEZs)

- •Income Tax Incentives

- •The supply of goods or taxable services to an SEZ is zero-rated.

- •Exemption from stamp duty of any executing documents on instruments relating to the business activities of SEZ enterprises.

- • Exemption of dividends paid to non-resident persons from

- •Reduced withholding tax rate of 5% on the gross amount payable on management fees,

- •royalties and payment made by the SEZ enterprise to interest persons.

- • Exemption from export duty the exports listed on the First Schedule to the Miscellaneous Fees and Levies Act, 2016.

- •Exemption from payment of import declaration fee on goods when imported or purchased before clearance.