If you wish to find out the thoughtfulness and efficiency of future planning of an individual, you should discuss the concept of investments with them. If they believe in investing a portion of their income, you might want to stick around and stay connected. Anything otherwise means they aren’t as wise as they claim to be.

The concept of investing has always seen a lot of resistance from various kinds of people. These people are still under the impression that investments done in stocks or properties are likely to get drowned without providing you your desired returns, and you will be left with nothing but regrets.

Stock trading has mainly been the point of focus for this ideology, as it contains apparent risks that are difficult to avoid for beginners. While trading in the stock markets can be risky if your entire savings plan depends on your trading capital, you can still tread the paths carefully without liquidating all of your assets.

Since many people don’t know how to do that, this informative guide will help you devise a strong investment plan to survive in the fierce stock market.

How To Start Investing In Stocks?

Before committing your money into the stock market, you need to ask yourself, what kind of an investor do you want to be? The first question that you will be asked by your broker would be about your investment goals and how much are you willing to risk.

There are two major types of investors, people who want to be an active part of managing their money’s growth and people who prefer to forget about it to indulge themselves in other businesses.

To ensure that stock trading doesn’t get overwhelming from the start, you might want to go easy on yourself and open an online brokerage account to get the ball rolling. It will help you step into the market, and you can then rely on your research to move forward and make significant investment decisions.

Finding The Top Stocks To Invest In?

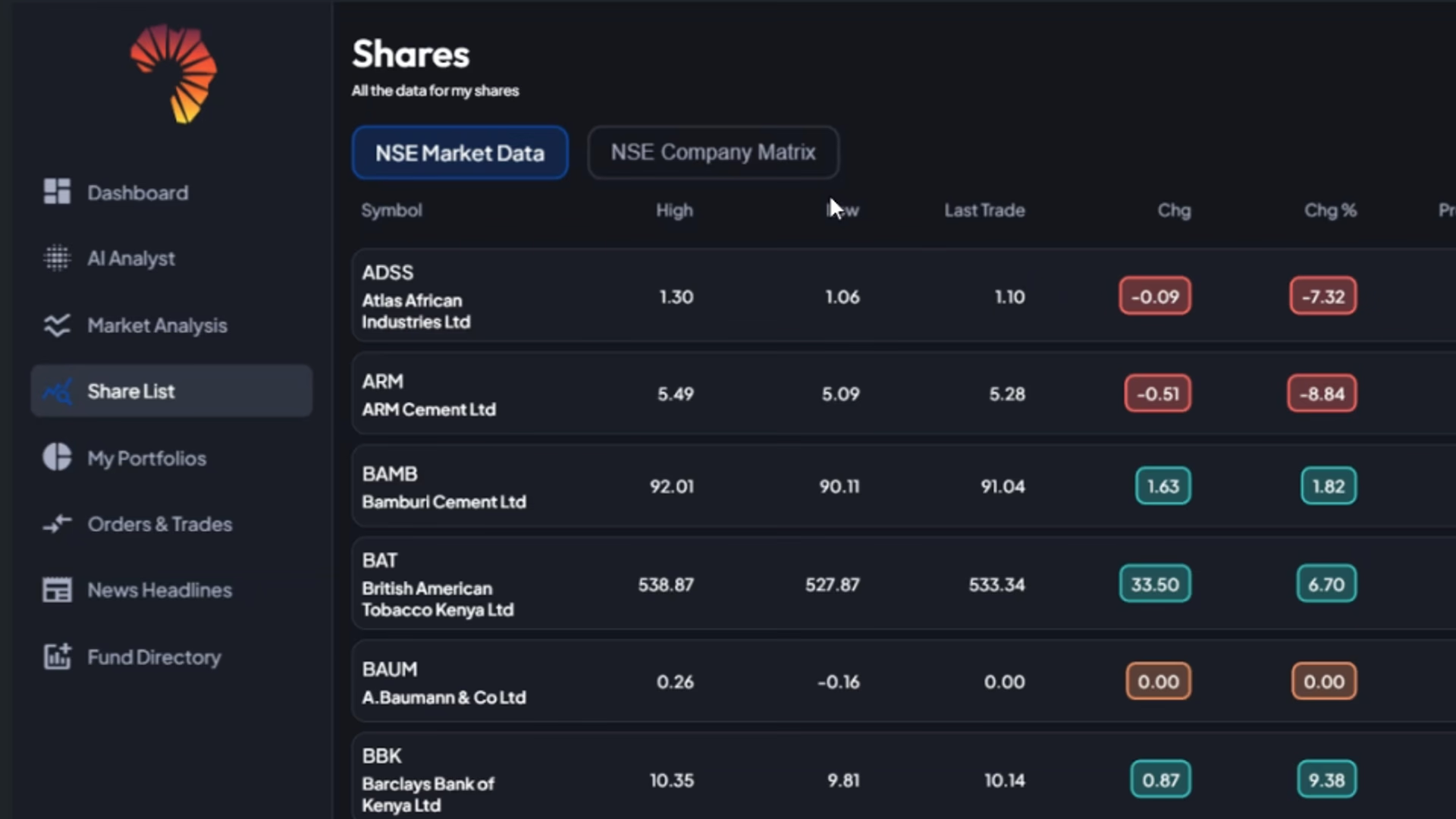

Finding the top stocks might seem like a lot of struggles at first considering the limited experience, it gets easier once you get the hang of it. The most important thing to remember before you start your search for top stocks is that your portfolio should always be diversified across different sectors.

Two basic types of stock analyses exist in the market today. Let’s have a look at both of them to understand their role in today’s stock market.

● Fundamental Analysis

The idea of fundamental analysis is to acknowledge the news around your targeted business and predict the price increase for your stock’s market price. This analysis is used to predict the revenue-generating potential of stock and has shown great results in the past.

● Technical Analysis

As discussed earlier, there are two basic types of analyses. While fundamental analysis entirely depends on the news related to the business, technical analysis heavily relies on certain qualitative and quantitative techniques known as technical indicators. The key motive of a trader is to identify an uptrend using the knowledge provided by the technical indicators.

Since there are thousands of stocks to choose from, how can you choose a stock that might be the best performer and provide you great returns? Certain rules of thumb can be followed to choose a stock:

● Choose Your Favorite Industry

In most cases, your instincts are correct in identifying the situation. So if you are impressed by the fundamentals, technology, and work of a stock company, you should check their stock price out and analyze its price action.

● Portfolio Goal

Your plans to achieve with your portfolio should be crystal clear, and you need to stick with your plan. This allows you to make long-term investments in your preferred stocks and trust the process.

Importance of Investing in Stocks

Although the concept of stock trading is already gaining a lot of popularity in the younger generation, certain basic factors can be used to attract the people hailing the ideology of storing the entirety of their wealth in the banks. So let’s have a look at some of the most common benefits of investing in stocks.

● Defeat Inflation

The concept of inflation is difficult to digest for people. Many people blame their governments for the increasing prices all around. However, they are unable to understand that inflation is only going to get stronger with time.

But what impact will it have on the investors? According to financial experts, to control inflation’s impact, investing can be considered as one of the most promising activities for anybody. Since the currency is bound to depreciate over time, it is only practical to increase the number of your holdings to ensure you don’t feel the change in value when the devaluation kicks in.

● High Investment Returns

As opposed to several other investment opportunities, the scale of return in stock trading is considered to be one of the best of the lot. Since stock trading deals in your investing in a business, it is bound to multiply with the success of the respective company. Furthermore, your engagement in the company’s growth is often rewarded by the company in the form of small tokens of appreciation.

● Financial Independence, Retire Early (FIRE)

The concept of FIRE has been on the rise among the young generation these days. The goal is the same as others to invest for the insurance of comfort in their retirement days when the sustenance of your lifestyle becomes difficult without a job. However, the pace is a lot faster and the younger generation is willing to invest increasingly high amounts of up to 70% of their income to ensure they can easily retire before their 50s.

Among the different kinds of investment opportunities, stock trading has got to be the most promising domain to multiplicate your portfolio and get wealthy. Trading in the stock markets can indeed be overwhelming, and you can make mistakes in your investment decisions, the scale of growth which is directly proportional to your strength of holding your assets can truly bamboozle you. Furthermore, if you learn the art of picking the top stocks, you will never have to worry about depending on some broker who is more interested in making its commission than helping you get maximum profit.

See Also: