To file nil returns to the Kenya Revenue Authority (KRA) is a non-negotiable responsibility for all registered taxpayers holding a KRA pin. Whether you’re a resident individual or a non-resident earning income in Kenya, adherence to annual return filing is mandatory.

Navigating the process of filing KRA returns can be manageable. Here’s a guide tailored for employment income and nil returns, ensuring compliance with KRA regulations.

Essential Requirements for Successful Nil KRA Returns:

- •KRA Pin

- •iTax login credentials

- •Access to the internet via Kenya Revenue Authority website or iTax mobile app, and an active email account

What is KRA Pin

A PIN, short for Personal Identification Number, serves as an identifier when engaging with the Kenya Revenue Authority (KRA), as well as other governmental bodies and service providers.

The term “personal” encompasses both individuals and legal entities such as companies, clubs, and trusts.

In the case of a sole proprietorship, the proprietor utilizes their PIN for all transactions.

Who Requires a PIN?

A PIN is mandatory for individuals who:

- •Are employed

- •Engage in business activities

- •Earn rental income

- •Seek to apply for a HELB Loan

- •Intend to undertake any of the transactions mentioned?

When Can the KRA PIN be Utilized?

The KRA PIN finds utility in various transactions, including but not limited to:

- •Title registration, instrument stamping by the Commissioner of Lands, and land rent payment

- •Plan approval, water deposit payment, business permit application, and land rent payment facilitated by Local Authorities

- •Motor vehicle registration and licensing under the Traffic Act (Cap 403) overseen by the Registrar of Motor Vehicles

- •Business names and companies registration is handled by the Registrars of Business Names and Companies

- •Trade licensing is managed by the Ministry of Commerce

- •Value Added Tax registration application

- •Insurance policy underwriting by Insurance Companies

- •Goods importation, customs clearance, and forwarding at the Commissioner of Customs and Excise offices

- •Power connection deposit payment at Kenya Power and Lighting Co. Ltd.

- •Facilitation of contracts for the supply of goods and services to Government Ministries and Public Bodies

Step-by-Step Process to File Nil Returns

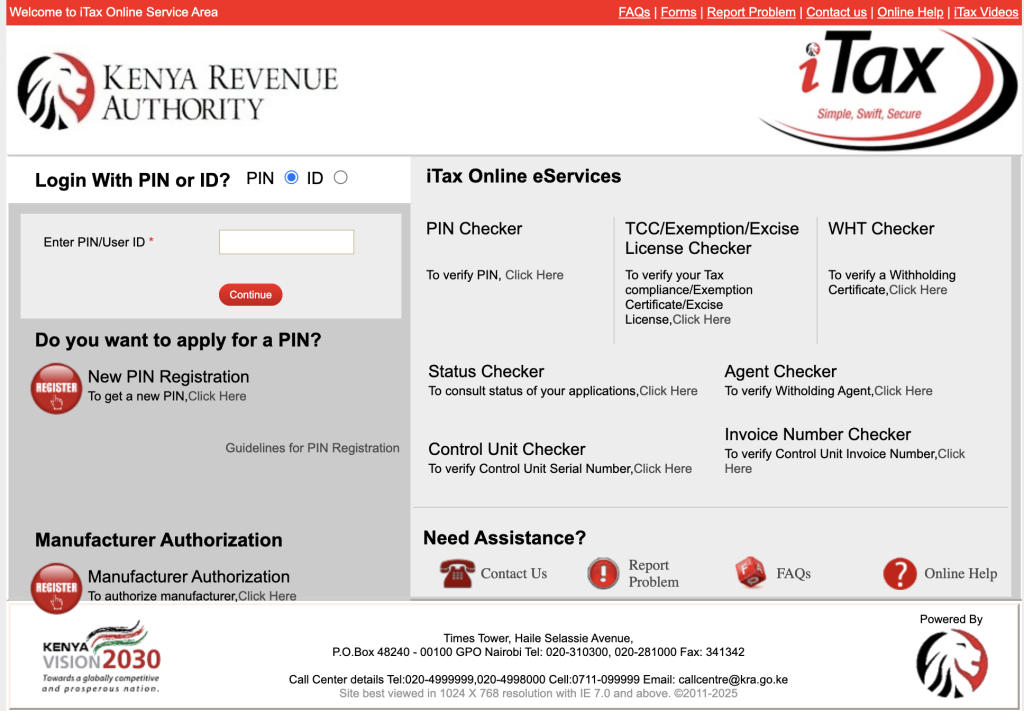

- •Access KRA’s official website through your preferred browser.

- •Log in using your credentials (PIN/User ID and password), ensuring accuracy.

- •Navigate to the Return Menu within your iTax account.

- •Select “Individual Tax Return (ITR) only” and proceed to fill in mandatory details, affirming your employment status.

- •Follow a systematic approach to complete each section of the return form, paying attention to details such as basic information, employment specifics, PAYE deductions, income paid in advance, and tax computation.

- •Upon thorough review, submit your filled data. A confirmation message, “Return Receipt Generated,” signifies successful submission.

- •Download your KRA Returns Receipt for documentation purposes.

Filing Nil KRA Returns:

- •Access KRA’s website or mobile app.

- •Log in to your portal using the provided credentials.

- •Navigate to the Return Menu and select “File Nil Returns.”

- •Choose the appropriate tax obligation and fill out the Nil e-Return form, indicating the return period.

- •Confirm submission of NIL return after completing the form.

- •Download the NIL return receipt for record-keeping.

Non-compliance with KRA Filing:

Failure to file or late submission of returns attracts penalties and interest.

Individual taxpayers face a penalty of Ksh. 2,000 or 5% of the tax due for late filing, while non-individuals incur a fine of Ksh. 20,000 or 5% of the tax owing.

Various offenses, including late filing of income tax and VAT, carry distinct penalties outlined by KRA.

Timely filing of KRA returns is imperative to avoid punitive measures and ensure adherence to tax regulations. The process, albeit critical, is streamlined and accessible, underscoring the significance of compliance in the fiscal landscape. For employers grappling with tax compliance, Workpay offers seamless solutions in payroll processing and regulatory adherence.

Disclaimer: This guide is for information purposes only. For accurate and up to date tax policies and procedures, please refer to the KRA website or your tax consultant.