The stock market has been considered one of the largest money-generating machines of all time. Many people often fear investing in the Kenyan Stock Market because they don’t understand how the whole system works. So let me guide you through the Kenyan Stock Market ecosystem. We are going to look at all the market players and the roles that each of them plays. Let’s get started:

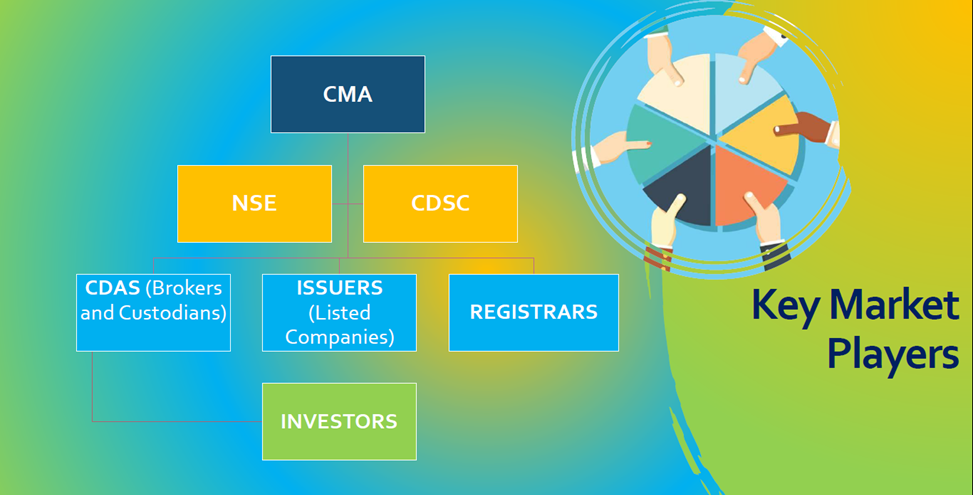

The general Kenyan stock market ecosystem looks like this:

The Capital Markets Authority (CMA)

The CMA is a regulating body charged with the prime responsibility of supervising, licensing, and monitoring the activities of all the market intermediaries, including the Nairobi Securities Exchange, the central depository and settlement system, and all the other market players. Basically, CMA is the watchdog of the Market. When looking for a stock broker, ensure that the stock broker is regulated by CMA.

List of CMA Regulated stockbrokers in Kenya

- •Dyer and Blair

- •Suntra Investment Bank

- •Old Mutual

- •SBG Securities

- •Kingdom Securities

- •AIB-AXYS Africa Ltd

- •ABC Capital

- •Sterling Capital

- •Faida Investment Bank

- •NCBA

- •Genghis Capital

- •Standard Investment Bank

- •Kestrel Capital

- •African Alliance

- •KCB Capital

THE NAIROBI SECURITIES EXCHANGE (NSE)

The NSE is the marketplace where buyers and sellers meet. It is the Largest Stock Exchange in East Africa; and the fifth in Africa, valued at about $23Bn or KES 2.3Trillion. It is the principal securities exchange in Kenya that offers an automated platform for the listing and trading of multiple securities. It offers a trading facility for local and international investors and issuers looking to gain exposure to Kenya’s and Africa’s economic growth.

The NSE has 63 Companies listed, with companies from a variety of sectors including:

Sectors:

- •Agricultural

- •Automobile and Accessories

- •Banking

- •Commercial and Services

- •Construction & Allied

- •Energy & Petroleum

- •Insurance

- •Investment Services

- •Manufacturing and Allied

- •Telecommunication and Technology

- •Real Estate Investment Trust

- •Exchange Traded Fund

THESE ARE THE TOP 5 BEST-PERFORMING STOCKS IN THE NSE IN 2022

| COMPANY | YTD % | SECTOR | LAST UPDATED |

| OLYMPIA | +51.52 | INVESTMENT | NOV 25, 2022 |

| LIMURU TEA | +27.27 | AGRICULTURAL | NOV 25, 2022 |

| CROWN PAINTS | +27.11 | CONSTRUCTION & ALLIED | NOV 25, 2022 |

| CARBACID | +24.55 | MANUFACTURING & ALLIED | NOV 25, 2022 |

| NCBA GROUP | +25.05 | BANKING | NOV 25, 2022 |

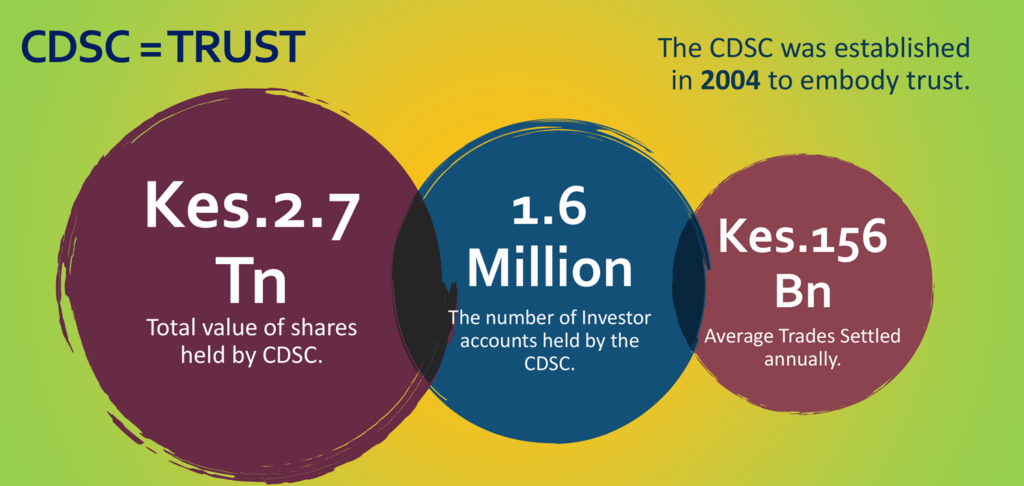

The Central Depository & Settlement Corporation Limited (CDSC)

The Central Depository Settlement Corporation Limited is a limited liability Company licensed and regulated by the Capital Markets Authority to provide automated clearing, delivery and settlement services for transactions carried out at the Nairobi Securities Exchange as well as holding of listed and non -listed securities including other documents of title on behalf of investors. The central depository system provides a centralized system for the transfer and registration of securities in an electronic format without the necessity of physical certificates.

Brief History:

Year 2000: Parliament passes the Central Depositories Act that allows the setting up of CDSC

Year 2004: CDSC starts operations with the goal of bringing efficiency to the depository and settlement activities on the Exchange.

Year 2012-2014: All listed securities (bonds and shares) at the NSE are irreversibly converted into electronic form data stored in the CDS.

A CDSC number is simply an official trading identifier number that every investor needs, to be able to buy and sell shares in the Kenyan Stock Market. You can get one by opening a new trading account with a licensed stock broker. We will talk more about this in the brokers section.

STOCK BROKERS

Brokers act as the middle men who facilitate trading on the NSE. Most brokers have allowed opening of a cds account online through their trading platforms.

Let me now guide you on how local stock brokers facilitate trading in the NSE.

Some of the local Stock Brokers have trading apps that allow you to open a cds account, buy & sell Kenyan stocks on their platforms at the comfort of your phone.

How is this possible?

This is made possible by the use of an API which is pluged in to the CDSC system. An API stands for application programming interface. An API is a way for two or more computer programs to communicate with each other. It is a type of software interface, offering a service to other pieces of software. In simple terms, it is a software intermediary that allows two applications to talk to each other. This API creates a link between the trading app and the CDSC system which is the depository for shares.

The API allows the trading app to plugin to the CDSC system hence allowing new investors to open a cds account directly on the app. Traditionally, you needed to physically fill a (CDS 1) form when opening a trading account. During the Covid -19 Pandemic, brokers petitioned CDSC to allow them to connect their trading apps with the cdsc system, making it possible for investors to open a cds account online easily.

A common question that most investors ask is whether they will lose their shares in a case where the broker goes bankrupt or goes under. The answer is NO. This is because your shares are stored in the CDSC system in a digitized format and not by the broker. The broker just acts as the middle man who allows investors to access the Market which is the NSE.

Simply put, CMA is the REGULATOR, NSE is the MARKET, Stock Brokers are Intermediaries allowing investors to access the Market and CDSC acts as the STORAGE/ BASKET for the shares.

A CDS Account then helps identify the different shareholders and the shares that they own in the depository system, just like a Bank Account helps identify different customers and the amount of money in their accounts.

This is why you need to open a cds account to be able to buy shares in the NSE. Once you open this account, you are able to access the market through your broker who often will have a trading application to make buying and selling of shares easy and efficient.

Note: It is possible to change your broker but your cds account remains the same. I hope now you know why that is the case. This is because, technically, when you opened the cds account, you opened an account with cdsc with facilitation from the broker through the trading app. Traditionally, to change your broker, you would need to fill a (CDS 4A/B) form, but that is being reviewed to make it possible to do it online.

Settlement is basically the process that marks the official transfer of shares to the buyer’s account and cash to the seller’s account.. Traditionally, this process takes T+3 days in the Kenyan Stock Market which means that after buying shares today, those shares will legally be yours 3 days after the day of purchase.

I hope you now have a basic overview of how the Kenyan stock Market operates and how various players facilitate the buying and selling of shares.

Investing 101: Stock Market Sectors

Kenya’s Securities Depository (CDSC) Gets Ready To Unveil Upgraded System With New API