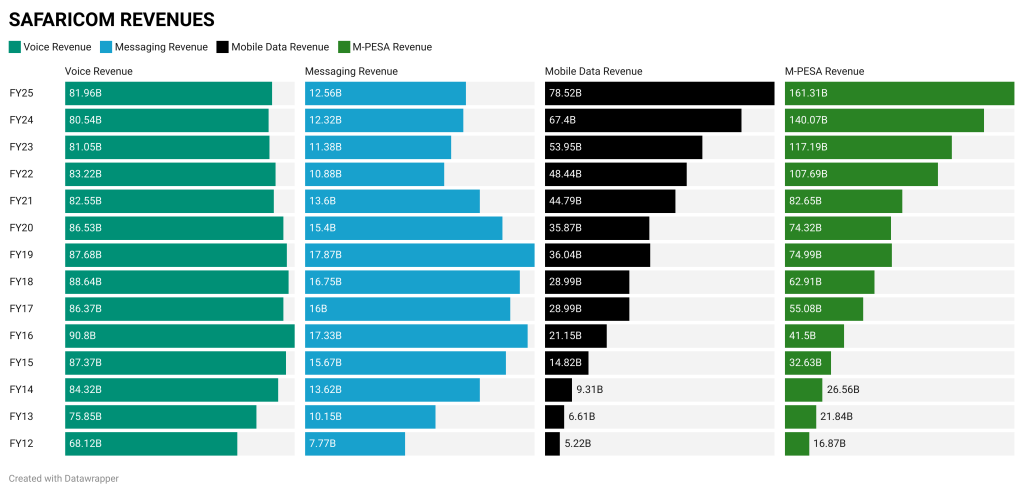

Over the past decade, telco giant Safaricom has undergone a shift in its revenue model, transitioning from a voice-centric telco to a data and mobile money-driven tech company.

- •An analysis of its financials from FY2012 to FY2025 reveals a fundamental realignment in what drives the company’s growth.

- •In its early years, particularly around 2012, Safaricom’s revenue model was heavily anchored in voice services.

- •Data from that period shows voice revenue contributing a significant KSh 68.1 billion, forming the backbone of the company’s KSh 107 billion total revenue.

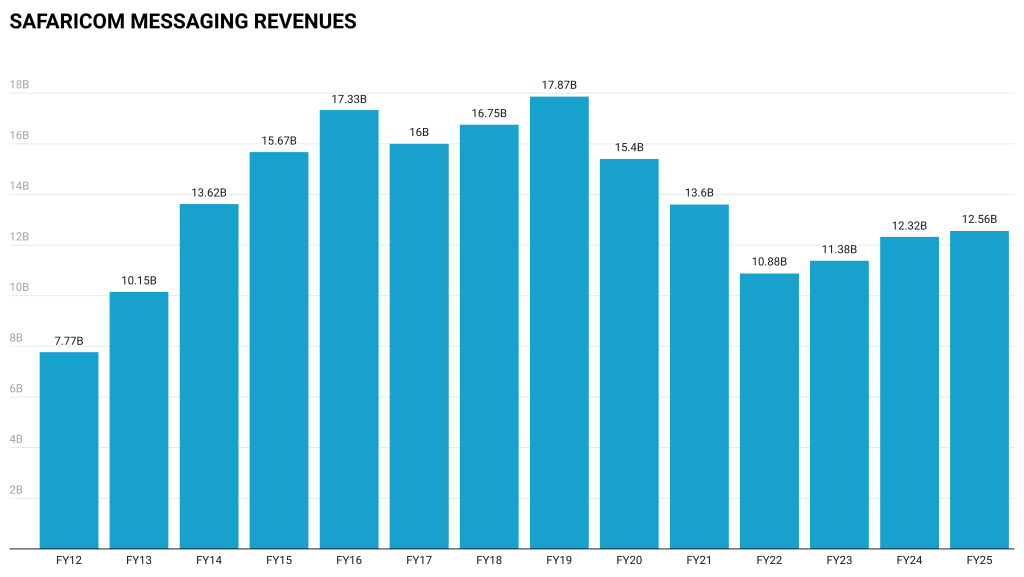

Messaging services, another traditional revenue stream, added KSh 7.8 billion, while mobile data was still nascent at KSh 5.2 billion. At the time, voice and messaging accounted for over 70% of service revenue.

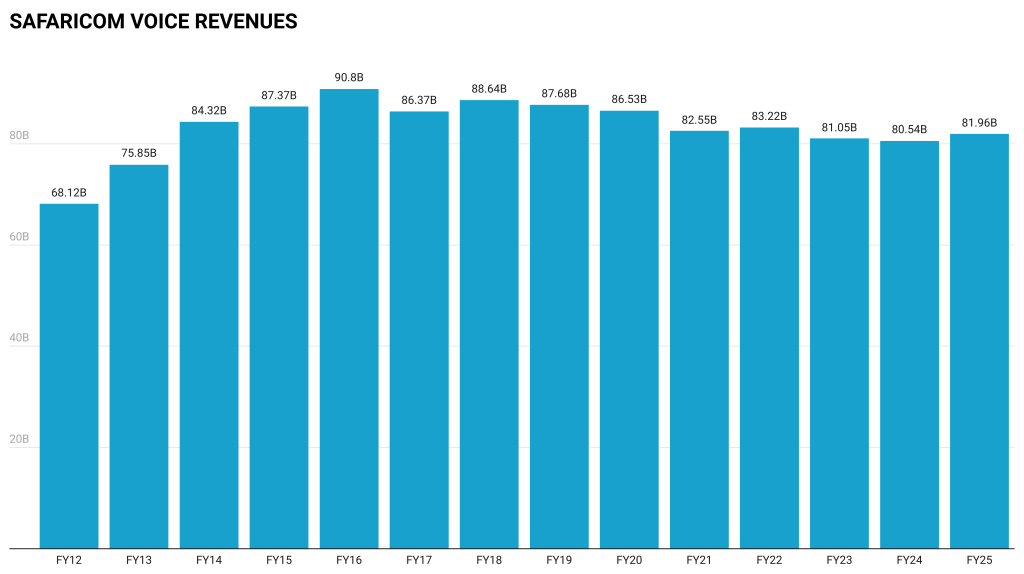

Voice Revenue: A Waning Giant

Voice revenue peaked at KSh 90.8 billion in FY2016, but has since experienced stagnation and decline—falling to KSh 82.0 billion in FY2025. This structural slowdown is attributed to pricing pressure, market saturation, and the migration to Over-The-Top (OTT) platforms such as WhatsApp.

By FY2025, voice only contributes 21% of total revenue, down from 64% in FY2012.

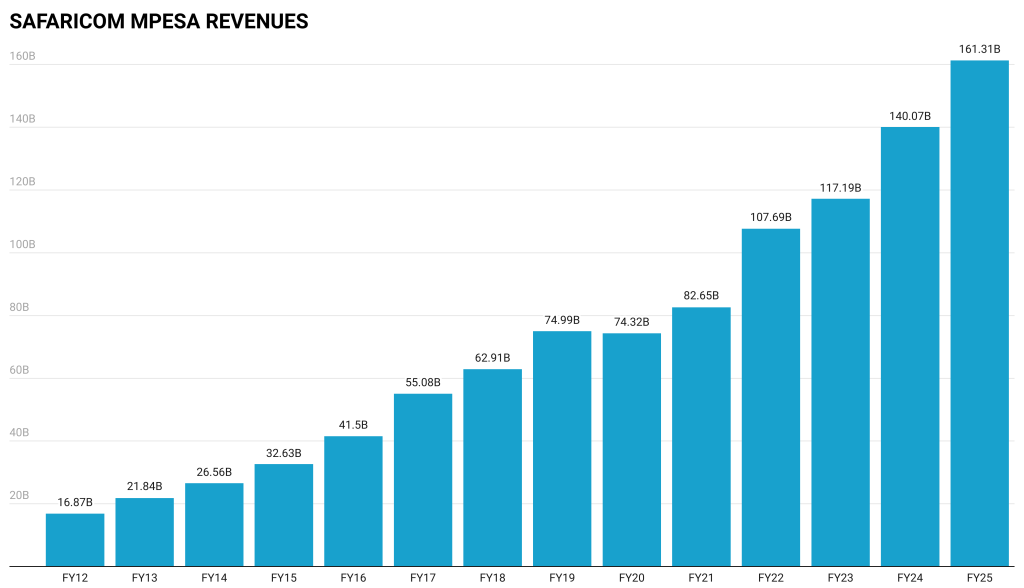

M-PESA: The Fintech Engine

The real game-changer came with the exponential growth of M-PESA, launched in 2007. From KSh 16.9 billion in FY2012, M-PESA revenue has surged to KSh 161.3 billion in FY2025—representing a 9.5x increase. It now contributes over 41% of total revenue.

M-PESA’s success stems from its wide usage—enabling millions to send money, pay bills, borrow, and save without formal banking. The COVID-19 pandemic further accelerated this shift to digital finance.

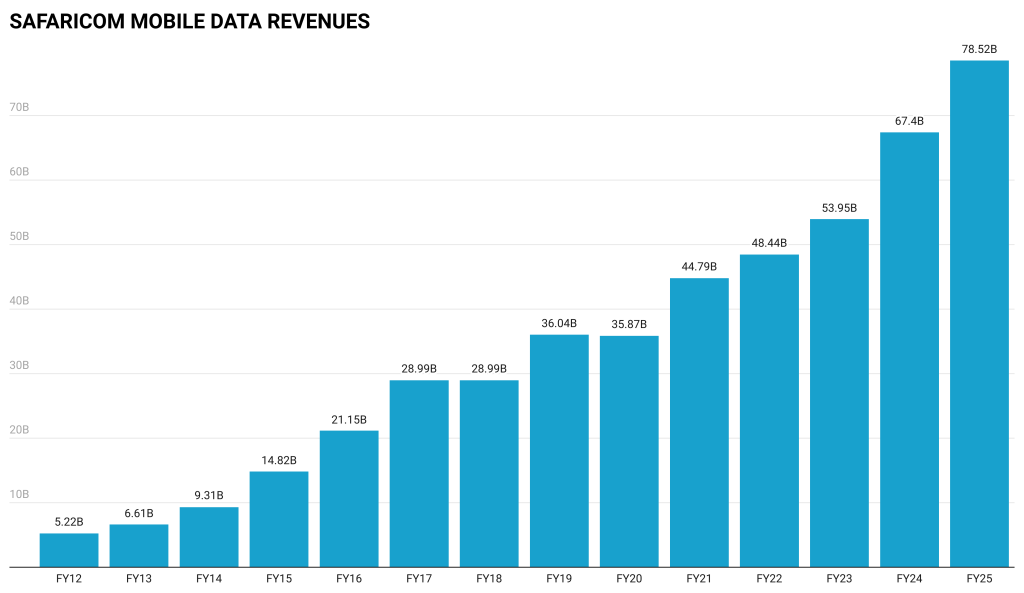

Mobile Data: From Backseat to Core

Mobile data revenue rose from KSh 5.2 billion in FY2012 to KSh 78.5 billion in FY2025—a 15x growth. Growth was modest early on but surged post-2016 with widespread 4G, affordable devices, and increased home internet usage.

By FY2025, mobile data contributes 20% of total revenue, making it the second-largest segment after M-PESA.

Messaging and Fixed: Mixed Signals

Messaging revenue declined from KSh 7.8 billion in FY2012 to KSh 12.6 billion in FY2025. Despite some growth in the mid-2010s, it’s been displaced by internet messaging platforms.

Fixed-line and wholesale transit services, on the other hand, rose steadily to KSh 16.8 billion in FY2025, driven by enterprise and broadband services.

Total Revenue: Doubled in a Decade

Safaricom’s total revenue increased from KSh 107.0 billion in FY2012 to KSh 388.7 billion in FY2025—more than 3.6x growth. More importantly, the revenue mix radically transformed:

- •Voice + Messaging: From 70%+ in FY2012 to just 25% in FY2025

- •M-PESA + Data: From under 25% to over 60% of total revenue

Table: Revenue Mix Over Time

Safaricom’s evolution wasn’t without cost. Direct costs, expected credit losses, and operating expenses rose sharply—from KSh 83 billion in 2021 to over KSh 112 billion in 2025. However, its EBITDA in FY2025 hit KSh 172.2 billion, underscoring its strong profitability.

The Telco’s journey from a traditional telco to a digital enabler reflects Kenya’s tech evolution. Today, growth is powered not by airtime sales, but by financial transactions, data consumption, and platform innovation. With strong free cash flow and strategic expansion into fintech, broadband, and enterprise, Safaricom is redefining the future of telecom in Africa.