The country experienced a 5% dip in tea production in October 2024 due to low and poorly-distributed rains, the Tea Board of Kenya (TBK) says in a recent report.

- •Compared to October 2023 when tea production stood at 52.79 million kilograms, production declined to 50.06 million kilograms last October.

- •The month is characterized by ‘short-rains’ that are ideal for tea production but many areas located both east and west of the Rift Valley recorded insufficient downpour.

- •Exports of the beverage were also lower than the corresponding month in 2023 by 9%, driven primarily by a dip in demand from some of Kenya’s main export markets such as Pakistan and Egypt.

“Precipitation within the tea growing areas in the East of the Rift was relatively lower compared to the west of the Rift at between 1 mm to 35 mm daily,” TBK said. Only tea farms in Nandi and Kericho benefited from higher precipitation ranging between 20 to 73 millimetres daily throughout the month.

Despite this variance in rainfall, tea production in the East of the Rift Valley-encompassing regions across Central and the Mount Kenya region-rose by 7.13%. Smallholder KTDA farmers within this region salvaged the figure by increasing production from 14.13 million kilograms recorded in October 2023 to 15.88 million kilograms last year.

“Consequently, production in tea growing areas within the west of the Rift was significantly lower by 3.92 million kgs from 36.03 million kgs recorded in the month of October 2023 to 32.11 million kgs,” the report noted.

While tea production by KTDA smallholder farmers increased by 2%, larger estates experienced a slump in production by 17%. Similarly, Nyayo Tea Zones and Independent tea farmers saw tea production declined by 26% and 7% respectively last October compared to the same month in 2023.

“Lower production was mostly recorded by estate factories due to their wider coverage in areas that experienced low rainfall conditions within the west of the Rift, mostly in Bomet and Kisii/Nyamira counties,” the report detailed.

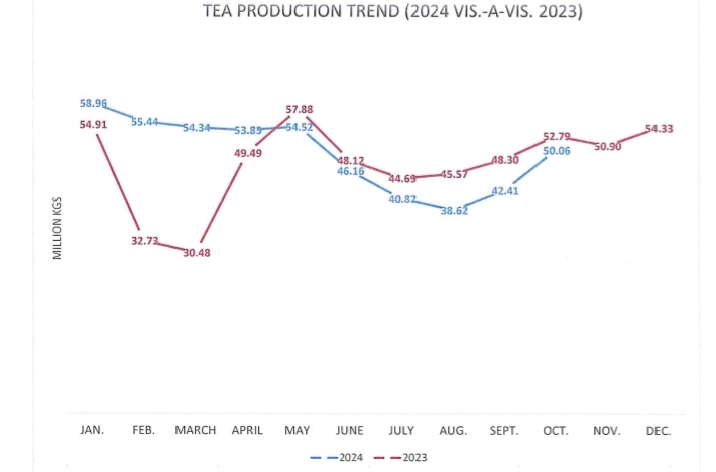

Tea production since May 2024 has been much lower than the corresponding months in 2023, fanning concerns from stakeholders in the sector. Tea auction sales last October stood at 32.58 million kilograms – a decline from 38.63 million kilograms in October 2023.

On the export market

The value of Kenyan tea exports between January and October grew from KSh 141.3 billion in 2023 to KSh 155.7 billion in 2024. The exported quantity also grew to 500 million kilograms in the period under review from 414.5 million kilograms in 2023.

There are emerging markets for Kenyan tea – including Germany, Sri Lanka, Ukraine, Qatar, Eritrea, and Oman – all of which ramped up their imports last year.

Although KTDA smallholder farmers fetched an average price of US$2.83 per kilogram in October 2024, higher than US$2.78 per kilogram recorded during the same month in 2023, higher supply and global economic shocks continue to stifle attractive prices at the auction.

The absorption rate of Kenyan tea at the auction improved in October after the government dropped the price floor set in 2022.