Extreme inequality is out of control in Kenya. Less than 0.1% of the population (8,300 people) own more wealth than the bottom 99.9% (more than 44 million people). Tackling inequality could help to lift millions out of poverty, secure sustainable economic growth and bring the country together.

A recent report by Oxfam argues that if Kenya increased its tax-to-GDP ratio by 3 percentage points in 2014 it could have raised enough additional funds to ensure quality healthcare for all Kenyans. By delivering on a five-point action plan by Oxfam to tax and spend effectively, the government would ensure a more equal and prosperous future for all Kenyans.

Despite the country posting tremendous growth figures of the last few years, the benefits are not being shared equally. The number of super-rich in Kenya is one of the fastest growing in the world. It is predicted that the number of millionaires in Kenya will grow by 80% over the next 10 years. In a decade, Kenya is forecast to rank third only to South Africa and Egypt for playing host to the highest number of super-rich on the African continent.

However, while a minority of super-rich Kenyans are accumulating wealth and income, the fruits of economic growth are failing to trickle down to the poorest.

In 2014, 40% of Kenyans – or approximately 19 million people – were categorized as poor in the Multidimensional Poverty Index, and 13% – approximately 6 million people – were categorized as ‘destitute’.

There are also wide regional disparities. For example, in Nairobi, average household monthly expenditure is Kenya Shillings 7,200 per adult equivalent, while in Wajir and Turkana, it is Kenya Shillings 1,440.

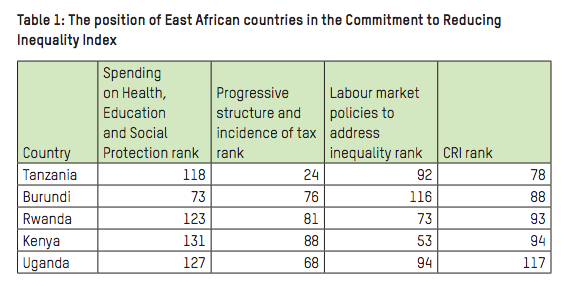

Kenya is ranked 94th out of 152 countries in the world in Oxfam’s Commitment to Reducing Inequality Index (CRI), which ranks states on what they are doing to tackle inequality.

Kenya scores lowest in the East Africa region for its public spending, for example, spending less than 6% of the budget on health. It also scores the lowest in the East Africa region for progressive taxation.

The average salary for a CEO in Kenya is $114,000 per annum (or KShs11,767,650), but they will pay the same top tax rate of 30% as someone earning KShs 47,059 from 2018.

Oxfam’s analysis of the VAT system in Kenya suggests that exempting basic commodities from VAT has reduced the regressivity of the tax as the whole, which is welcome. However, exempting non-food items from VAT has benefited the rich more than the poor, as the rich are more likely to buy these products.

Oxfam is calling on the Kenyan government to develop a national plan to reduce the gap between rich and poor, with clear time bound targets. Oxfam has identified five key steps that the government can take to deliver on such a plan, and reduce inequality in Kenya. By taxing effectively, it can redistribute income and wealth while raising much needed revenue to invest in quality, free public health and education services which are proven to reduce extreme inequality.

The analysis of the composition of Kenya’s tax base shows that the structure of the system is not levying taxpayers according to their ability to pay. Those who accumulate income and wealth on capital and financial assets they own or from which they benefit are not taxed proportionate to their level of income and wealth. Taxes on wealth, including recurrent taxes on wealth and property, and inheritance taxes, are an important tool to address inequality, since they are highly progressive, targeting only the richest group in society. Moreover, they are vital to prevent excessive concentrations of wealth and power in the hands of a few,