First Published on January 18th, 2023 by Jonathan Weber for SureDividend

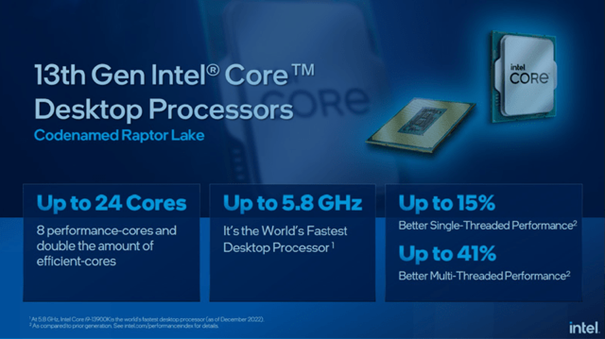

Intel Corporation (INTC) is an American semiconductor company that offers a high dividend yield of marginally less than 5% at current prices. Shares aren’t ultra-cheap based on the expected forward profits, but Intel is forecasted to see its earnings-per-share grow meaningfully over the coming years.

It is one of the high-yield stocks in our database.

Intel is part of our ‘High Dividend 50’ series, where we cover the 50 highest yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Intel Corporation.

Business Overview

Intel Corporation was founded more than 50 years ago and is headquartered in Santa Clara, California.

Intel is a semiconductor company that develops, manufactures, and sells a wide range of chips. This includes microprocessors for personal computers, servers and data centers, storage devices used for cloud computing, and so on.

Unlike many other semiconductor companies, Intel is not operating with a fabless model where so-called foundries manufacture these chips. Instead, Intel operates its own manufacturing plants, unlike peers such as Advanced Micro Devices (AMD) and NVIDIA (NVDA). This has a downside, as the building of new plants and the maintaining/upgrading of existing plants is very costly, which is why Intel’s free cash flows aren’t as high as those of its peers, relative to their respective revenues.

On the other hand, Intel’s own fabs allow it to be less dependent on foundries such as Taiwan Semiconductor Manufacturing Company (TSM). In case the Taiwan conflict were to escalate, Intel would be one of few semiconductor companies in the world that could still manufacture its own chips, making Intel more resilient versus this potential risk.

Intel has also been building out its own foundry business in recent years and plans to do the same going forward, which means Intel is not only manufacturing chips for itself, but also for other semiconductor companies that don’t have manufacturing capacity of their own. While this business unit is not profitable yet, Intel’s management believes that there is considerable growth potential in this space in the coming years.

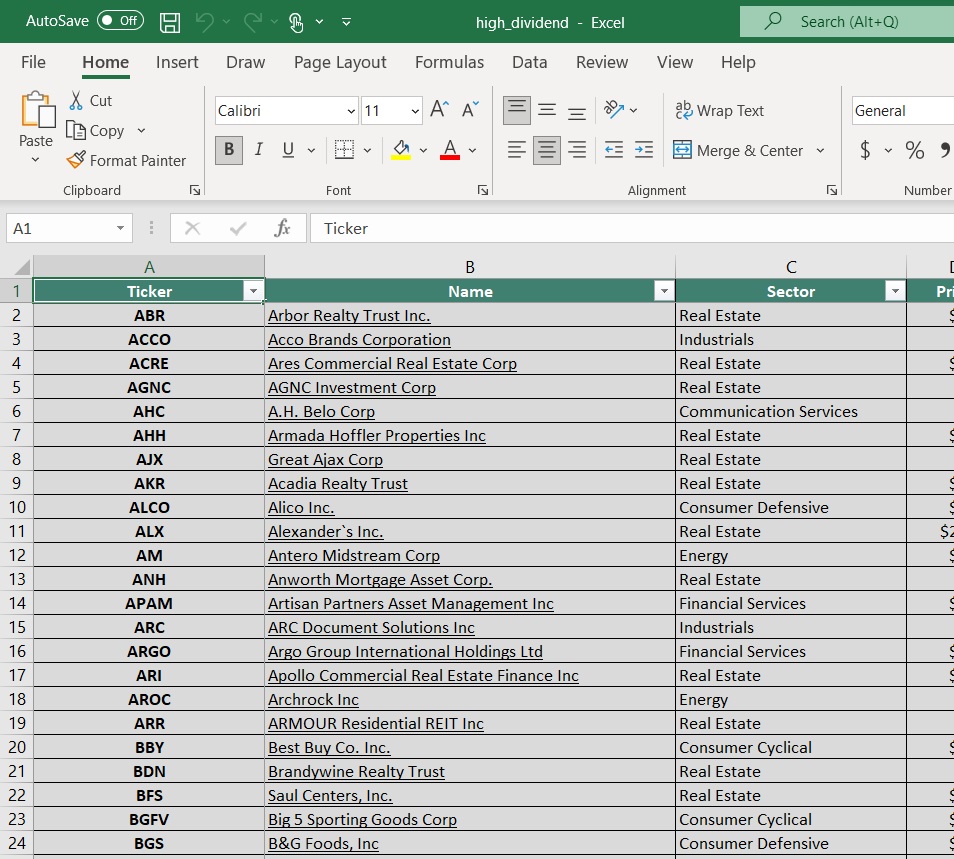

In the last couple of quarters, Intel has not delivered very strong results. Partially, this was the result of a weaker PC market:

Source: Investor Presentation

While demand had been stornger than expected during the first phase of the pandemic, normalization of demand levels and a worsening macro economic backdrop resulted in fewer PC shipments during the last year, which hurt Intel’s addressable market. On top of that, Intel has also been losing market share to its competitors AMD and NVIDIA in high-value areas such as data centers.

Overall, this resulted in a revenue decline of 20% during the most recent quarter, led by a 17% decline in the PC segment. Earnings-per-share fell as well, to $0.59 for the quarter, but still came in higher than expected, as analysts had predicted an even worse performance.

Growth Prospects

Overall, the semiconductor industry benefits from major long-term growth drivers. While year-to-year comparisons are impacted by factors such as economic activity and sentiment, major long-term trends such as digitalization, artificial intelligence, cloud computing, and so on bode well for the addressable market in different areas, especially in the server and data center businesses.

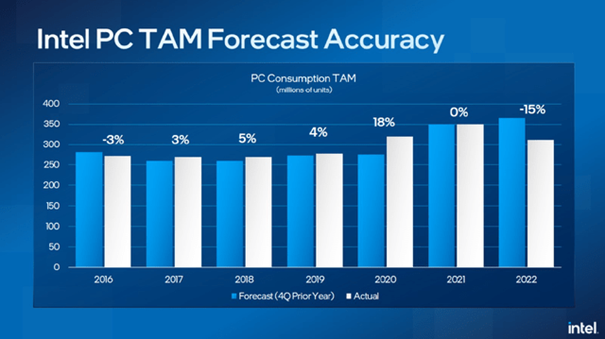

Unfortunately, Intel has been losing some of its market share versus peers in recent years. But with new product releases, Intel plans to improve its competitive position going forward. This includes, for example, new Decktop processors under the Raptor Lake series, including the fastest PC processor in the world:

Source: Investor Presentation

When execution with the rollout of these new processors is solid, Intel could regain some ground versus peers it has lost market share to. On top of that, Intel plans to increase profits via the ongoing investments in its foundry business, although investors should note that some execution risks remain. All in all, analysts believe that Intel will grow its earnings-per-share by around 40% between 2022 and 2024, which would be quite attractive, although earnings-per-share in 2024 would still be below the all-time high in this scenario.

Competitive Advantages

The semiconductor industry benefits from major growth tailwinds, but it can also be competitive. Market share increases and decreases can impact profitability heavily, which can be seen in Intel’s past results as well.

Intel’s recent model lineup is not too attractive versus what AMD and NVIDIA offer, especially in the data center space, which is why Intel lost some of its market share. Fortunately, it still owns a well-known and healthy brand.

Intel’s ability to produce its own chips, whereas peers are reliant on foundries such as Taiwan Semiconductor Manufacturing Company, can be seen as an advantage. Intel is more insulated versus a potentially escalating Taiwan conflict, and Intel will not be negatively impacted when TSM and other foundries push for price increases.

Dividend Analysis

Intel is currently paying out a dividend of $0.365 per share per quarter, which equates to an annual dividend of $1.46. With shares trading for $29.60 today, that makes for a dividend yield of 4.9%. Relative to Intel’s historic dividend yield, that is pretty elevated — in most of the years throughout the last decade, Intel’s dividend yield was in the 2%-4% range.

The yield is currently high due to shares trading at a low price, which is due to the earnings pullback we have seen in 2022. The downside of that is Intel’s above-average payout ratio today. Based on forecasted earnings-per-share for 2022 (Q4 results have not yet been released) and 2023, Intel’s payout ratio is around 75%. That compares unfavorably versus Intel’s dividend payout ratio in the past, averaging around 40% over the last decade. A 75% payout ratio does not necessarily result in a dividend cut risk, but the dividend cut risk is more pronounced today versus the last decade.

Intel has increased its dividend for 8 years in a row, but the dividend increases will likely be small in the foreseeable future, as Intel will work on lowering its dividend payout ratio back towards the historical level of less than 50%.

While Intel’s dividend yield is the highest it has been in a long time, the elevated dividend payout ratio and the fact that dividend growth will likely not be very high going forward means that Intel is not necessarily a great income investment today, despite its above-average income yield.

Final Thoughts

Intel is active in an industry that benefits from multiple long-term tailwinds. Unfortunately, Intel has not been able to capitalize on that in the recent past, due to some execution problems when it comes to rolling out new products, which made Intel lose market share versus better-performing competitors.

It looks like Intel is on track to tackle these problems, which is why profitability should improve in the coming two years. That being said, it is not guaranteed that these plans will work out, and the success of Intel’s foundry business is not guaranteed, either.

With shares trading for 15x this year’s profits, they aren’t cheap compared to Intel’s historic valuation. While the dividend yield is elevated, we still do not rate Intel a Buy at current prices, due to too many uncertainties.

Related:

These 81 Free Dividend Stock Resources Will Make You a Better Investor