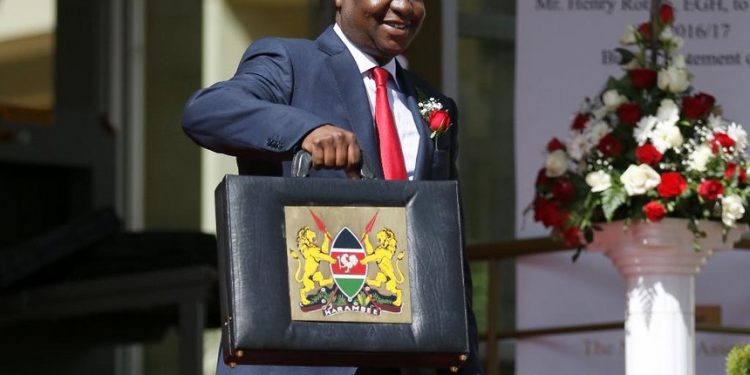

Henry Rotich’s 2019 draft Budget Policy Statement, introduced for public participation by the National Treasury before it is finalised and submitted to the cabinet for approval by 25 January 2019, reveals that the government does not intend to slow its appetite for risky borrowing.

In comparison to its September Budget Review and Outlook Paper, the draft BPS will raise Kenya’s deficit, debt and external commercial borrowing projections.

“Beyond unveiling worse fiscal and debt metrics, the government shows with this budget a higher tolerance for higher deficits at a time when fiscal policy credibility is particularly low,” says Moody’s Analytics in its recent Credit Outlook, listing Kenya’s move as credit negative.

The BPS points to continued fiscal consolidation, albeit at a slower pace than before, budgeting a deficit of 3.0 per cent by fiscal 2023.

Improved revenue collection will be key to achieving the authorities’ deficit reduction target. Government revenue declined to 17.6 per cent of GDP in fiscal 2018, down from 18.9 per cent in fiscal 2017 and 19.7 per cent in fiscal 2014.

Tax revenue underperformed the original target over the first five months of fiscal 2019, which ends 30 June 2019. The treasury has slashed its initial objective of increasing revenue collection to 18.7 per cent, compared to its earlier expectations of 20.3 per cent, of GDP in fiscal 2019.

“We expect The Finance Act 2018, adopted in September, and the modernised income tax bill currently being drafted to support improved tax collection, but only gradually,” says Moody’s.

Under the BPS, government expenditures reach 25.1 per cent of GDP in fiscal 2019, exceeding the 24.8 per cent originally forecast. The Treasury now projects higher development expenditures of 6.3 per cent of GDP this fiscal year, mostly because of capital investment.

Beyond 2019, the government intends to curb expenditures as a share of GDP through cuts in salaries and wages in order to support deficit reduction.

“Although the establishment of a public investment management unit will improve efficiency in spending, delivering on spending targets will be challenging given that President Uhuru Kenyatta’s economic policy agenda relies precisely on government spending,” added Moody’s.

The lack of an initiative to outline how the Treasury will lower Kenya’s deficit means that the government’s debt will rise higher than it was projected one year ago, which the government now project at 56.5 per cent of GDP at the end of fiscal 2019.

IThe Treasury projects external commercial financing at $2.0 billion in fiscal 2020, compared with its previous estimate of $1.1 billion. Higher reliance on external commercial debt raises exchange rate and refinancing risks amid tightening global liquidity, which translates into a stronger US dollar and higher interest rates.

“The 2019 Budget Policy Statement increases recourse to external commercial debt, which poses significant challenges,” says Moody’s.

The treasury has embedded in its projection higher interest payments, which it forecasts at 3.8 per cent of GDP in fiscal 2020, up from 3.4 per cent under the BROP.

“Our fiscal and debt forecasts remain broadly unchanged because we had expected fiscal slippages, with wider deficits of 6.5% this fiscal year, and slightly higher debt levels at around 58% of GDP for fiscal 2019-22,” adds Moody’s.

The country has recorded fiscal deficits in excess of 7 per cent of GDP four years in a row, pushing government debt to close to 60 per cent of GDP.

The government now projects a financial deficit of 6.3 per cent of GDP in fiscal 2019, up from 5.8 per cent in the September BROP, and a deficit of 5.0 per cent in fiscal 2020, up from 4.7% in the BROP.

“Over fiscal 2020-23, an increase in recourse to external commercial borrowing, which typically takes the form of Eurobonds, means higher than previously budgeted interest spending and therefore headline deficits,” signed off Moody’s.