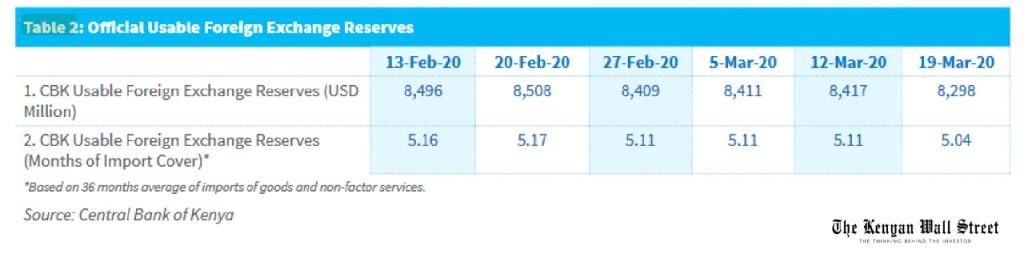

Kenya’s reserves got a beating last week that saw the shilling hit the multiyear low of KSh106.06 to the US dollar. The CBK usable foreign exchange reserves fell to USD 8,298.4 million (5.04 months of import cover) as at March 19 from USD 8,508 a month earlier on 20 February.

Analysts from Genghis Capital attribute the short fall in Forex reserve partly to maturity of 2-year USD 234 million syndicated loan. In addition, the fundamentals which have hitherto supported the local unit (tourism receipts, exports and diaspora remittances) have been under pressure in the COVID-19 pandemic era.

CBK weekly bulletin for the week ending Thursday 19 March showed the Kenyan shilling weakened against the US Dollar as it exchanged at KSh 104.22 per US Dollar on March 19, compared to KSh 102.47 on March 12.

Diaspora remittances fell in February 2020 to USD218.9 million compared to USD259.4 million in January. North America, Europe and the Rest of the World accounted for 51 percent, 18 percent and 31 percent, respectively, of the total diaspora remittances in February. With these regions affected by the COVID-19, remittances may sink further in March until the pandemic is contained.