There are only 7 forex brokers in Kenya who accept MPesa according to our research. Most of these forex brokers are regulated by the CMA except for a few.

For this guide, we first checked if the broker is regulated by CMA as a non-dealing forex broker or not a, and then we checked their fees under different account types.

Based on multiple factors that we will explain below, HFM is the best Forex broker that accepts MPesa in Kenya.

List of Best Forex Brokers with M-PESA in Kenya

- •HF Markets – Overall Best Forex broker in Kenya with MPesa

- •FXPesa – Best forex broker for Beginners with MPesa

- •Exness – Best ECN Type forex broker with MPesa

- •FxPro – Forex broker for Pro Traders with MPesa

- •Scope Markets – CMA regulated forex broker with MPesa

- •Pepperstone – Best forex broker in Kenya with Zero Minimum Deposit for MPesa

- •FXTM – Low commission forex broker that accepts MPesa

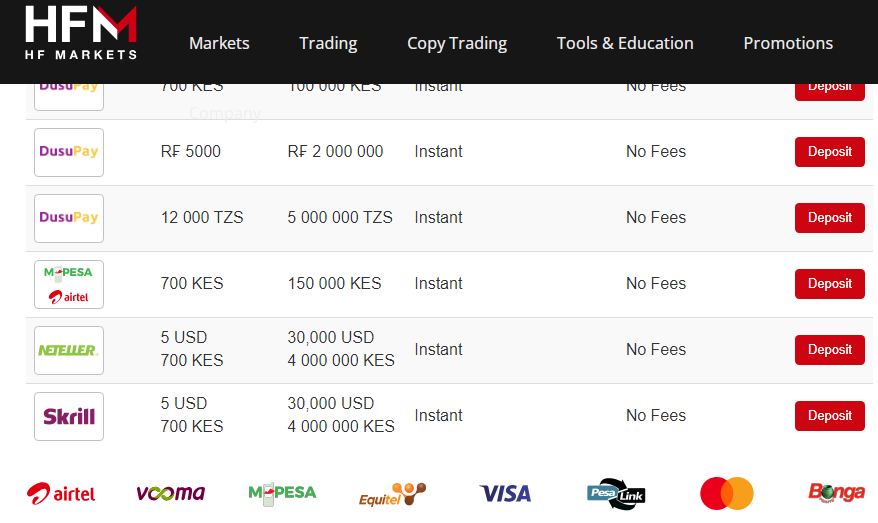

#1 HF Markets (formerly HotForex) – Overall Best Forex Broker in Kenya with M-PESA

HFM is a CFD brokerage firm that was established in 2010. In 2015, they were incorporated in St. Vincent and the Grenadines as an International Business Company with registration number 22747 IBC 2015.

The HFM trading name belongs to HFM Investments Ltd. who are regulated by Kenya’s Capital Market Authority (CMA) with license number 155 as a non-dealing online foreign exchange broker.

Trading conditions

| 🏦 HFM Minimum Deposit | Cent, Premium, & Zero A/C 700 KES or $5 PRO A/C: 13,000 KES or $100 PRO PLUS A/C: 40,400 KES or $250 |

| 💵 HFM Spread | From 1.2 pips on Premium A/C From 1.0 pip on Cent A/C From 0.5 pips on PRO A/C From 0.2 pips on PRO PLUS A/C From 0.0 pip on Zero Spread A/c |

| 💵 Commission on forex trading | $3 per side only on the Zero Spread A/C |

| 💵 Inactivity fee | $5 |

| 💵 Overnight swap fees | $0 on major forex pairs, & gold only |

| 🎯 KES Base Currency | Yes |

M-PESA Payment Conditions

There is no direct M-PESA icon in your personal MyHF area however HFM has integrated several secure payment gateways which enable you to deposit or withdraw funds to & from M-PESA. Some of the gateways are:

(a) Fasapay to M-PESA: you can deposit or withdraw funds to your M-PESA phone number when you select Fasapay as payment method and input your M-PESA phone number.

Deposits & withdrawals to your M-PESA using Fasapay gateway are instant and free of charge. Minimum deposit is 5 USD and maximum deposit is 5,000 USD.

Minimum withdrawal is 5 USD. You will be required to input your M-PESA phone number so the payment can be consummated.

(b) Neteller to M-PESA: Deposits & withdrawals to your M-PESA phone number using Neteller gateway are free of charge. Deposits take 10 minutes or more to impact, & withdrawals are instant. Minimum deposit is 5 USD and maximum deposit is 10, 000 USD. Minimum withdrawal is 5 USD.

For HFM all funding requests must be initiated before 10 am if they are to reflect same day. You can also use other payment gateways such as Perfect Money, & Skrill in the MyHF area as seen below:

| Payment Gateway | 💰Fees | 💰Min. Deposit | ⌚ Deposit time | 💰Min. Withdrawal | ⌚ Withdrawal time |

| M-PESA | Zero | 5 USD (700 KES) | Instant | 5 USD (700 KES) | Instant |

Read about HFM’s trading account & MPesa terms

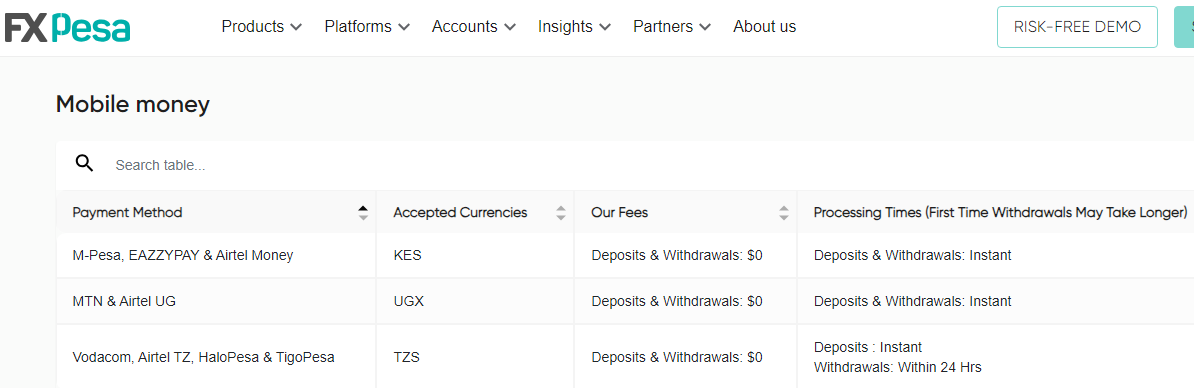

#2 FXPesa – Best Forex Broker for Beginners with M-PESA

FxPesa was founded in 2019 and is the trading name of EGM Securities Ltd, who are regulated by the Capital Markets Authority (CMA) of Kenya with license number 107.

Trading conditions

| 🏦 FXPesa Minimum Deposit | Standard A/C $0 Premiere A/C $100 |

| 💵 FXPesa spread | From 1.4 pips Standard A/C From 0.0 Pips (on forex) Premiere A/C |

| 💵 Commission | $3.5 per side on Premiere A/C only |

| 💵 Inactivity fee | 0.03% + SOFR rate |

| 💵 Overnight swap fees | Yes |

| 🎯 KES Base Currency | No |

M-PESA Payment Conditions

FxPesa does not charge any deposit or withdrawal fees for M-PESA, and the money reflects in your account instantly. Withdrawal requests must be made before 2pm if it is to be treated same day.

The minimum deposit when using the executive account is $5, while for the premiere account, the minimum deposit is $100

| Payment Gateway | 💰 Fees | 💰 Min. Deposit | ⌚ Deposit time | 💰 Min. Withdrawal | ⌚ Withdrawal time |

| M-PESA | Zero | 5 USD | Instant | x | Instant |

| Neteller to M-PESA | Withdrawal fee of 1% up to 30 USD | 5 USD | Instant | x | 1-2 working days |

| Skrill to M-PESA | Withdrawal fee of 1% up to 30 USD | 10 USD | Instant | x | 1-2 working days |

Read about FxPesa’s trading account & MPesa terms

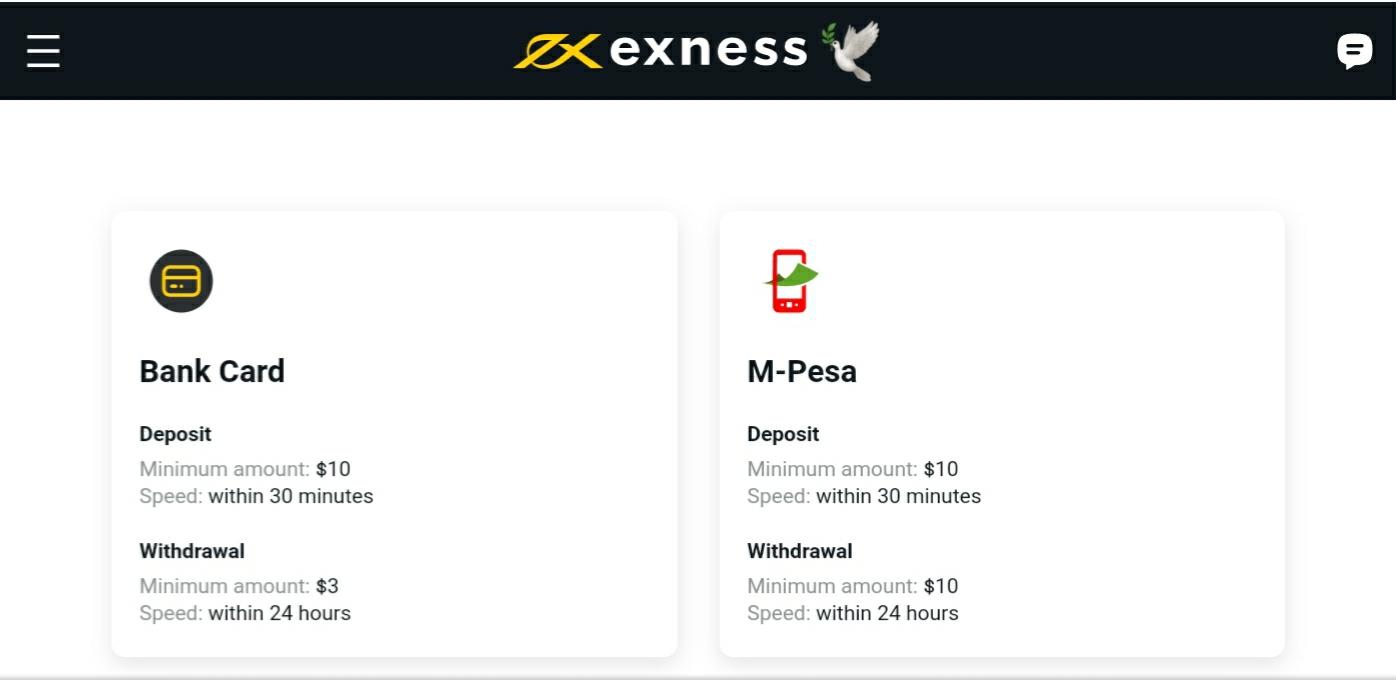

#3 Exness – Best ECN Type Forex Broker with M-PESA

Exness was established in 2008 and is registered in Kenya under Tadenex Limited who are regulated by the Capital Market Authority (CMA) as a non-dealing online foreign exchange broker with license number 162.

Trading conditions

| 🏦 Exness Minimum Deposit | Cent A/C 1,310 KES or $10 Standard A/C 1,310 KES or $10 Pro A/C 65,500 KES or $500 Raw Spread A/C 65,500 KES or $500 Zero Spread A/C 65,500 KES or $500 |

| 💵 Exness Spread | From 0.2 pips Standard A/C From 0.3 pips Cent A/C From 0.1 pips Pro A/C From 0.0 pips Raw Spread A/C From 0.0 pips Zero Spead A/C |

| 💵 Commission | 3.5 USD per side on Raw Spread Account Above 3.5 USD per side on Zero Spread Account |

| 💵 Inactivity fee | $0 |

| 💵 Overnight swap fee | $0 on major forex CFDs, Crypto, Indices, & Gold only. |

| 🎯 KES Base Currency | Yes |

M-PESA Payment Conditions

Exness accepts MPesa & has a minimum deposit of $10 (around 1,310 KES) and a maximum deposit of $820. The minimum withdrawal is also $10, while the maximum withdrawal is $550.

| Payment Gateway | 💰 Fees | 💰 Min. Deposit | ⌚ Deposit time | 💰 Min. Withdrawal | ⌚ Withdrawal time |

| M-PESA | Zero | 10 USD | 30 min | 10 USD | 24 hrs. |

Account base currencies are either KES or USD. If you want to deposit/withdraw in a currency different from your account base currency, conversion fees will apply

Read about Exness’s trading account types & MPesa terms

#4 FxPro – Best Forex Broker for Pro Traders that accepts M-PESA

FxPro Global Markets Ltd. is a CFD online broker that was established in 2006. FxPro is not regulated by the CMA Kenya however, they have tier 1 regulation from the Financial Conduct Authority (FCA) UK with license number 509956. They are also regulated by CySEC, FSCA, and SCB.

Trading conditions

| 🏦 FxPro Minimum Deposit | $100 Standard A/C S500 Raw+ A/C $30k Elite A/C |

| 💵 FxPro Spread | From 1.2 pips Standard A/C From 0.0 pips Raw+ A/C From 0.0 pips (90% of the day plus discounts) Elite A/C From 0.0 pips (on forex) cTrader A/C |

| 💵 Commission | 3.5 USD per side on Raw A/C & cTrader A/C |

| 💵 Inactivity fee | $10 |

| 💵 Overnight swap fees | Yes, variable |

| 🎯 KES Base Currency | No |

M-PESA Payment Conditions

FxPro accepts MPesa & does not charge any deposit or withdrawal fees. You can fund your account with a minimum deposit of $100, but the recommended minimum deposit by FxPro is $1,000.

Deposits and withdrawals using M-PESA may be instant but may take longer in some cases. Note that if you used M-PESA to fund your FxPro wallet, you can withdraw the funds back to your M-PESA wallet.

| Payment Gateway | 💰 Fees | 💰 Min. Deposit | ⌚ Deposit time | 💰 Min. Withdrawal | ⌚ Withdrawal time |

| Neteller to M-PESA | Zero | 100 USD | 10 min | None | 1 Working Day |

| Skrill to M-PESA | Zero | 100 USD | 10 min | None | 1 Working Day |

Read about FxPro’s accounts for MPesa

#5 Scope Markets – CMA Regulated Forex Broker with M-PESA

SCFM Ltd, owners of Scope Markets trading name, was established in 1997. Scope Market is regulated by Kenya’s Capital Markets Authority (CMA) as a non-dealing online foreign exchange broker with license number 143.

Trading conditions

| 🏦 Scope Markets Minimum Deposit | $100 on all accounts |

| 💵 Spread | EUR/USD is 1.1 pips for Silver A/C & EUR/USD is 0.2 pips for Gold A/C |

| 💵 Commission | 3.5 USD per side for Gold A/C users and free for the silver account. |

| 💵 Inactivity fee | $10 |

| 💵 Overnight swap fees | Yes |

| 🎯 KES Base Currency | No |

M-PESA Payment Conditions

Withdrawal requests made after 6pm will be processed the next day. Once a withdrawal has been approved, you cannot cancel it.

| Payment Gateway | 💰 Fees | 💰 Min. Deposit | ⌚ Deposit time | 💰 Min. Withdrawal | ⌚ Withdrawal time |

| M-PESA | Zero | 100 USD | Instant | 5 USD | Instant |

Visit scope markets to read more about their MPesa conditions

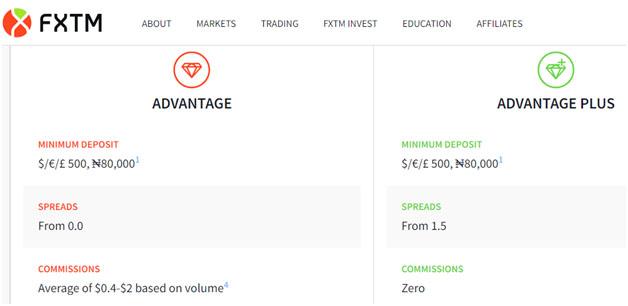

#6. FXTM – Low Commission Forex Broker that Accepts MPesa

FXTM are registered as Exinity Capital East Africa in the CMA books, and they are regulated by the CMA with license number 135. FXTM was established in 2011.

Trading conditions

| 🏦 FXTM Minimum Deposit | $500 (65,500 KES) on all accounts |

| 💵 FXTM Spread | From 1.5 pips with Advantage Plus A/C From 0.0 pip (on forex) with Advantage A/C |

| 💵 Commission | $2 per side on Advantage A/C |

| 💵 Inactivity fee | $5 |

| 💵 Overnight swap fees | $0 on major forex pairs & gold |

| 🎯 KES Base Currency | No |

MPESA payment conditions

FXTM accepts MPesa under the following conditions:

| Payment Gateway | 💰 Fees | 💰 Min. Deposit | ⌚ Deposit time | 💰 Min. Withdrawal | ⌚ Withdrawal time |

| M-PESA | Zero | 500 USD | Instant | 5 USD | Instant |

Learn more about how to deposit & withdraw with MPesa on FXTM

#7 Pepperstone – Best Forex Broker in Kenya with Zero Minimum Deposit & M-PESA

Pepperstone Markets Kenya Limited is regulated by the Capital Markets Authority (CMA) with license number 128.

Trading conditions

| 🏦 Pepperstone Minimum Deposit | $0 |

| 💵 Spread | From 1.0 pips with Standard A/C From 0.0 pips with Razor A/C |

| 💵 Commission | $3.5 per side on MT4/5 $3 per side for cTrader & TradingView |

| 💵 Inactivity fee | $0 |

| 🎯 KES Base Currency | No |

| 💵 Overnight swap fees | Yes |

M-PESA Payment Conditions

Pepperstone Kenya works with MPesa & withdrawal requests should be made before 9 am so they can be treated the same day if not they will be treated the next working day.

| Payment Gateway | 💰 Fees | 💰 Min. Deposit | ⌚ Deposit time | 💰 Min. Withdrawal | ⌚ Withdrawal time |

| M-PESA | Zero | Zero | Instant | Zero | Instant |

Visit Pepperstone Kenya for MPesa deposit & withdrawal conditions

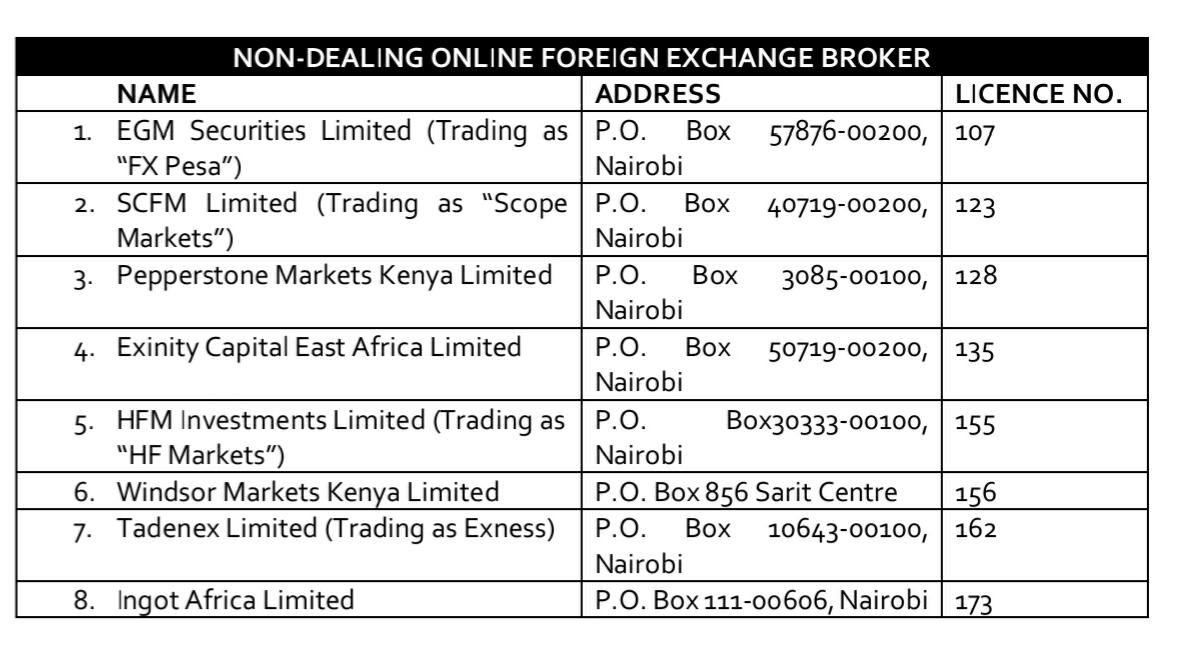

How to Choose a Forex Broker

1. Check whether the Forex Broker is regulated by CMA as Non-Dealing Member

The Capital Markets Authority (CMA) is responsible for regulating online forex trading in Kenya, and they have a downloadable list of regulated entities.

Trading via CMA licensed brokers is in your best interest, because they are incorporated in Kenya, and any legal disputes will be settled here in Kenya. They also undergo routine audits and checks from the CMA.

Use the following steps to download list of CMA licenses forex brokers in Kenya

- •Visit the official CMA website on https://www.cma.or.ke/

- •Click on “quick menu”

- •Click on ‘list of licensees”

- •Click on download

2. Check the Fees (spreads, commissions, other) charged by your Forex Broker

Fees are one of the factors you should thoroughly research when choosing a broker because when the fees are high, your profit will be affected.

At the point of account opening, choose an account that reflects your trading style & goals. Many brokers’ commission-free accounts but you pay a higher spread. Some offer zero-spread accounts which come with higher commissions. You need to choose which is suitable for you.

Experts suggest that if you intend to be a day trader or scalper, who opens & closes positions frequently, a commission-free account may be ideal for you.

On the other hand, experts suggest that if your strategy is position trading (where you leave positions open for weeks) you could consider a spread-free account. You also need to consider the margin interest payable nightly.

Other fees brokers charge includes deposit and withdrawal fees, and inactivity fees. Not all brokers charge these non-trading fees, so you can find a way to avoid them.

You may also want to consider brokers who offer KES account base currency, as this can help you avoid conversion fees.

3. Check funding methods & Time Taken for Withdrawal

A forex broker should have a variety of funding methods. This is important as there are times when you may need to fund your account urgently, and if one payment channel is down you should have an alternative.

Ensure there is a variety of both local funding options like local banks and M-PESA, and other international methods like Neteller, and Skrill.

4. Check trading platforms available

Does your preferred broker offer platforms like MT4, MT5, and cTrader? You may want to consider brokers who offer such platforms.

This is because MT4/5 and cTrader are popular trading platforms that are compatible with desktop, mobile, and the web.

MT4 is widely used and more suitable for forex trading however user interface is outdated as it hasn’t been upgraded in a while.

MT5 is a replacement for MT4 and has a more modern user interface, higher chart timeframes, advanced order management, and more indicators and graphs. However, MT5 is more suited for trading indices and other asset classes outside forex.

Comparison of Best Forex Brokers with M-PESA in Kenya

| 🪧 Broker | ⚖️ CMA Regulated | 💵 Minimum deposit via M-PESA | 💵 Commission per side | 💵 EUR/USD average spread | 💵 Inactivity fee |

| HF Markets | YES | 5 USD or 700 KES | 3 USD | 1.2 | 5 USD |

| FXPesa | YES | 5 USD | 3.5 USD | 1.4 | 0.03% + SOFR |

| Exness | YES | 10 USD | 3.5 USD | 1.0 | 0 |

| FXTM | Yes | $500 | $2 | 2.1 | $5 |

| FxPro | NO | 100 USD | 35 USD per 1 million USD | 1.54 | 10 USD |

| Scope Markets | YES | 50 USD | 3.5 USD | 1.1 | 10 USD |

| Pepperstone | YES | 0 USD | 3.5 USD | 1.0 | 0 |

Information on Forex Trading in Kenya using MPesa

We checked some of the important data points for forex traders in Kenya who are using MPesa for deposits & withdrawals.

| No. of Forex Brokers accepting MPesa | 7 |

| Best Forex Broker with MPesa | HF Markets |

| Forex Trading Regulator in Kenya | CMA |

| MPesa Broker with lowest spreads | Exness |

| Minimum deposit for Forex Trading using MPesa | KES 700 |

Frequently Asked Questions

Which forex broker in Kenya accepts M-PESA?

HFM, Pepperstone, FxPro, Scope Market, Exness, FXTM, and FXPesa are some of the brokers in Kenya that accept M-PESA.

How do I deposit money from M-PESA to my Forex trading account?

- •Go to your M-PESA wallet

- •Choose the trading account, and amount, and select the currency

- •Enter your M-PESA mobile number

- •Click on ‘pay’

- •Wait for confirmation

- •Follow the USSD instructions displayed on your screen

What are the withdrawal charges at Forex Brokers for MPesa?

This depends on the fees that your broker charges. Most of the forex brokers in Kenya like HFM, FxPesa, Pepperstone, FXTM & Exness, etc. don’t charge any extra fees for withdrawals with MPesa.

What are the trading platforms available for forex brokers that accept MPesa?

MT4, MT5, cTrader, & TradingView platforms are offered by brokers who support Mpesa in Kenya. These brokers also offer their own custom trading platforms, for example HF Markets has their ‘HFM’ custom trading app, Exness has their ‘Exness Trade’ custom trading app & web terminal, etc.

What are the advantages of using MPesa for forex trading?

One advantage is the speed, as deposits and withdrawals via MPesa are instant. Another advantage is that there are no deposit or withdrawal fees. Lastly, Mpesa transactions can be easily tracked, and problems resolved if any dispute arises.