Kenya’s Vision 2030 seeks to create an industrialized, middle-income economy with Micro, Small and Medium-sized Enterprise (MSMEs) at the core of that strategy.

Data from Kenya Bankers Association Shared Value report shows that there are approximately 7 million MSMEs with more than 80 per cent being informal and unlicensed. The businesses employ about 13 million Kenyans contributing about 28 per cent of the national GDP.

However, despite MSMEs forming the driving force of the economy, a 2014 KBA survey reveals that many find it difficult to not only access finance but also get through the operational hurdles that see 80 per cent of startups fold within their first year.

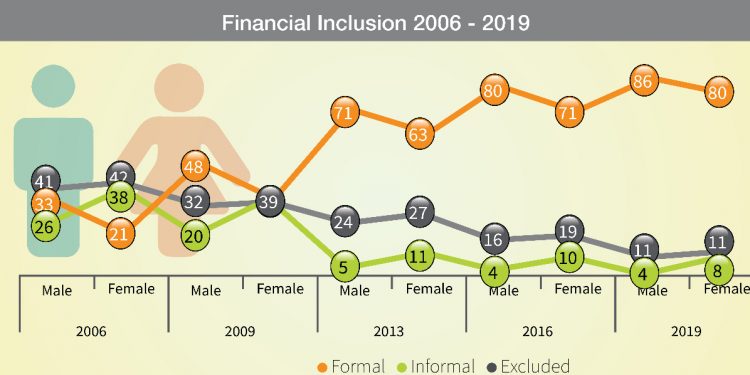

A 2019 FinAccess survey showed a 7.6 per cent increase in access to formal financial services as it rose from 75.3 per cent in 2016 to 82.9 per cent in 2019. The increased financial inclusion is due to mobile banking offered by banks in partnership with mobile network operators (MNOs), application programming interfaces (APIs), and the integration of the two through platforms such as Pesalink.

KBA and member banks have sponsored programs, services, and initiatives aimed at increasing financial inclusion in the MSMEs. Moreover, the programs aim to bridge gaps in financial literacy, management skills, strategic planning to scale operations and compliance with legal and regulatory requirements.

Gulf African Bank – Annisaa Biashara

In 2012, Gulf African Bank launched Annisaa Biashara Financing provides sharia-compliant interest and ledger fees-free products reserved for women. Actually, the service has now grown into a dedicated arm of the bank with the first women-only branches in East Africa personalized to the needs of women entrepreneurs. Gulf Bank structures the products and services with the goal of lowering the barriers to finance faced by underserved market segments.

KBA – Y-Bizna Initiative

KBA launched the Y-Bizna (Youth in Business) initiative in 2017 in partnership with the Kenya Community Development Foundation targeting 300 vulnerable young men living in Nairobi and Mombasa. KBA set a Ksh.1 Million fund to provide interest-free loans to the young men to start or scale-up micro-businesses.

Citi Bank – Smart Dukas

Citi Bank in partnership with TechnoServe, Moody’s Foundation, and MasterCard Center for Inclusive Growth facilitated training for more than 1000 kiosk owners. The program aimed to equip the business owners with necessary skills such as merchandising, financial planning, and supplier management. Furthermore, the partners will explore ways to further support the micro-entrepreneurs through digital payments and technology-enabled inventory management and customer relationship management.

KCB 2jiajiri

KCB Group launched a Sh50Bn enterprise development program for the informal sector aiming to ease the unemployment crisis. 2JIAJIRI will benefit at least 500,000 job opportunities as it provides the beneficiaries with vocational and enterprise development skills in sectors such as agricultural enterprise, automotive engineering, construction, beauty, and domestic services.

KBA – Inuka Enterprise Program

In October 2018, KBA launched the Inuka Enterprise program to facilitate access to finance through training, networking, and coaching opportunities. Entrepreneurs access an online platform (Inukasme.co.ke) for valuable information on how to overcome challenges that cripple their small businesses. On top of that, there are practical case studies on how to increase crop yields, rebuilding a business after a failed attempt, and marketing through cost-effective channels such as social media. Complementing the online program are a face-to-face training session.

KBA taking the lead in launching initiatives to incorporate MSMEs in the formal economy will enable the delivery of Vision2030. Furthermore, the programs will promote the employment of marginalized groups such as women, youth, and the disabled.