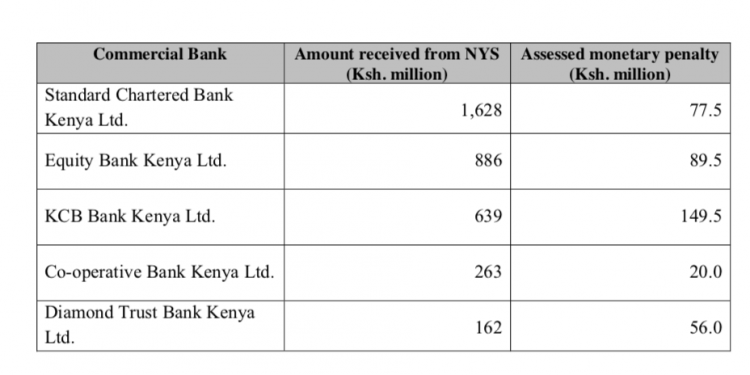

The Central Bank of Kenya (CBK) has penalized five banks in relation to the recent National Youth Service scandal. The five banks, Standard Chartered Bank Kenya Limited, Equity Bank of Kenya, Kenya Commercial Bank, Co-operative Bank of Kenya Limited and Diamond trust Bank are said to have transacted the largest flows.

The CBK says the banks are being penalized for failure to report large cash transactions, failure to undertake adequate customer due diligence, lack of supporting documents and lack of reporting Suspicious Transaction Report (STR) as required.

Kenya Commercial Bank (KCB) which transacted Sh639 Million will pay the heftiest fine of Sh149 Million, followed by Equity Bank which will pay Sh89 Million. Standard Chartered Bank, Diamond Trust Bank and Co-operative will pay Sh77 Million, Sh56 Million and Sh20 Million respectively.

‘’The main objective of the investigations was to examine the operations of the NYS-related bank accounts and transactions, and in each instance asses the bank’s compliance in the with the requirements of Kenya Anti-Money Laundering /Combating Financing of terrorism (AML/CFT) laws and regulations.’’ Said the CBK.

The second phase of the investigations into the NYS scandal is expected to involve findings by other investigators as well as the DCI and ODPP.

The CBK says the each bank is expected to provide an action plan to that seeks to address the loopholes and commitment to compliance to all aspects of the law.

‘’These action plans will be submitted within fourteen days (14) days and CBK will closely monitor their implementation.’’ CBK said.

Adding that they will continue to enforce strict adherence to the application of the laws and regulation to safeguard stakeholder interest and maintain a healthy financial sector. The CBK actions comes amid a heightened fight against corruption by the government.

RELATED; Court Declines to Stop Prosecution of Cytonn Managers Over Sh 1.1B Theft