Kopo Kopo, a fintech that provides short-term loans, has appointed Dennis Ondeng as its new CEO, and made three other senior leadership changes amidst acquisition plans by Nigerian fintech giant Moniepoint.

- •Dennis Ondeng joined Kopo Kopo in 2011 and has served as the company’s Chief Technology Officer (CTO) since.

- •Kopo Kopo also appointed Chad Larson, who had joined the company in 2019 as CEO, as the Chief Financial Officer (CFO).

- •It also appointed Rosemary Muyeshi, an accountant who the company said is known “for her no-nonsense approach and strategic mindset” as the Chief Risk Officer (CRO), tasked with strategizing the company’s path to stability; and Kibet Yegon as the company’s new Chief Technology Officer (CTO).

“We are confident that this dynamic leadership team will further Kopo Kopo’s growth and continue to deliver solutions for businesses in Kenya,” Kopo Kopo announced.

A Deal in the Making

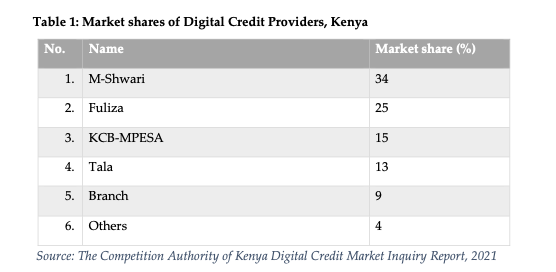

In August 2023, the Competition Authority of Kenya approved Moniepoint’s intent to acquire 100% of Kopo Kopo, saying a likely deal would not create unfavourable competition within Kenya’s digital credit market.

“We have a publicly stated interest in Kenya as part of our mission to provide financial happiness for people across Africa. We are delighted to have taken the first step by securing regulatory approval for our plans to provide financial happiness to Kenyans and look forward to progressing the transaction. A further update will be given when appropriate,” Tosin Eniolorunda, Group CEO, Moniepoint Inc., told The Kenyan Wall Street after the CAK review.

Enterprises seek the regulator’s approval if a deal, whether a merger or acquisition, is over KShs. 1bn in value. According to CAK’s review, the likely deal between Moniepoint, incorporated in the United States and with operations through subsidiaries in Nigeria, and Kopo Kopo, also incorporated in the US and with operations in Kenya, would not affect market dynamics.

The Nigerian neobank’s acquisition of Kopo Kopo is a strategic expansion into Kenya because the fintech has a viable customer base made up of small and medium-sized enterprises. Kopo Kopo has raised about US$5.6 million since its founding in 2011; garnering US$2.1 million in its 2015 Series B round.

Pending the acquisition, the Kenyan regulator maintained that all the 98 employees in Kopo Kopo will be retained by Moniepoint when the deal is finalized.