Kenya is a bastion of financial technology innovation, having led the global revolution in mobile money.

When news hit the airwaves in February 2024 that Kenya had been ‘grey-listed’ by the Financial Action Task Force (FATF), that reputation as a global financial hub began dissolving.

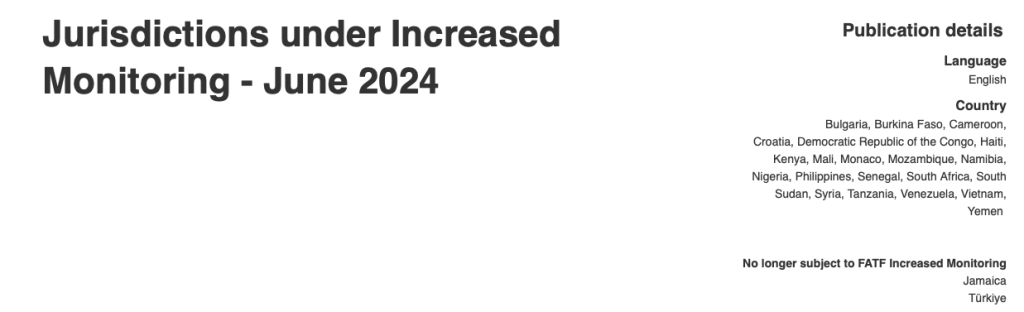

- •Kenya joined countries such as Syria, Yemen, Nigeria, South Sudan, and Haiti on the grey-list.

- •Grey-listing, also known as being placed under “increased monitoring,” means that the country has committed to working closely with FATF to resolve issues and strengthen their regulatory regime to counter money laundering, terrorist financing, and proliferation financing.

- •The FATF is an initiative founded in the late 1980’s by G7 countries and headquartered in Paris, with the primary mission of fighting money laundering, but since 2001, also combating terrorist financing.

Money laundering and terrorist financing – the major metrics that get one’s nation added to the ‘grey-list’ – take hold in markets where the proper processes, accountability, and regulation lack fortitude to stop and prosecute such crimes.

While it may take several years for Kenya to get off of this dreaded list, financial technology (fintech) can play a critical role in bringing the country back on track.

Fortunately, there is jargon which describes this perfectly – Anti-Money Laundering & Combating the Financing of Terrorism – or more conveniently referred to as, AML/CFT.

The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing (AML/CFT) in two FATF public documents that are issued three times a year. The FATF’s process to publicly list countries with weak AML/CFT regimes has proved effective.

As of June 2024, the FATF has reviewed 133 countries and jurisdictions and publicly identified 108 of them. Of these, 84 have since made the necessary reforms to address their AML/CFT weaknesses and have been removed from the process.

Real-Time Transaction Monitoring

Delayed data analysis expounded by outdated internal technologies is impeding financial institutions from efficiently identifying illicit transactions. Fintech however can harness real-time monitoring leveraging big data analytics. Machine learning algorithms can out-compete human analysts by tracking trends and flagging suspicious patterns that could indicate money laundering or terrorist financing.

A mandate to banking and payment providers by regulators to adopt these tools could enable the continuous, real-time scrutiny of financial flows further reducing the likelihood of bad actors exploiting the system.

Blockchain for Transparent, Immutable Records

One of the biggest enablers of money laundering and terrorist financing comes from within financial institutions themselves – their own employees. Blockchain is one of the most significant innovations in financial history. Leveraging a decentralized ledger system which is completely immutable and transparent, blockchain can keep both bank insiders and criminals from tampering with transaction histories.

Integrating blockchain technologies into financial infrastructure creates an easily auditable ‘paper trail’ making it significantly easier for regulators, watchdogs, and institutions to track suspicious transactions end-to-end.

Know-Your-Customer and Identity Verification Tools

One of the key challenges in AML efforts is the verification of customer and recipient identities. In countries such as Kenya where levels of financial inclusion are high and there is a lack of formal identification, fintechs can revolutionize the KYC process. Fintech platforms can combine digital ID systems and biometric verification tools to ensure that users are appropriately identified and verified before they may access financial services.

There is the opportunity to even pair blockchain technology with KYC/KYB protocols to build a decentralized database of identities that financial institutions and fintech companies can use to accurately verify transactions.

Artificial Intelligence for Risk-Based Analysis

Artificial intelligence (AI) isn’t just a buzzword; the technology can succor both regulators and financial institutions to implement a risk-based approach to AML/CFT. Comprehending the risk-profiles of individuals and transactions in real-time, AI can enable more focused investigations and reduce the time necessary for manual oversight. Such systems can also adapt to the rapidly evolving and increasingly more sophisticated money laundering and terrorism financing schemes used by bad actors.

Regulators should encourage institutions to adopt AI tools so that they may more quickly detect and prevent ML/TF at an unprecedented scale.

Becoming Africa’s Top Financial Crime Fighter

To move off of the FATF’s Grey-List, regulators and institutions should embrace a multi-faceted approach that integrates fintech in their core AML/CFT strategy. Collaborating closely with fintechs and financial institutions to develop protocols, establish a consistent regulatory framework, encourage innovation in compliance technologies, and invest in industry-wide capacity building are the clear next steps.

The world may have seen Kenya’s grey-listing as bad news, but today Kenya can turn that narrative into an opportunity to revolutionize and firmly establish its financial integrity. From loser to winner, adopting fintech solutions to enhance transparency, boost regulatory compliance, and ensure greater accountability will put Kenya on the path to being Africa’s leader in fighting financial crime.

Trust is the most important relationship-builder in the global financial ecosystem. When a country’s financial system is trusted, attracting foreign investment and promoting sustainable growth become natural.