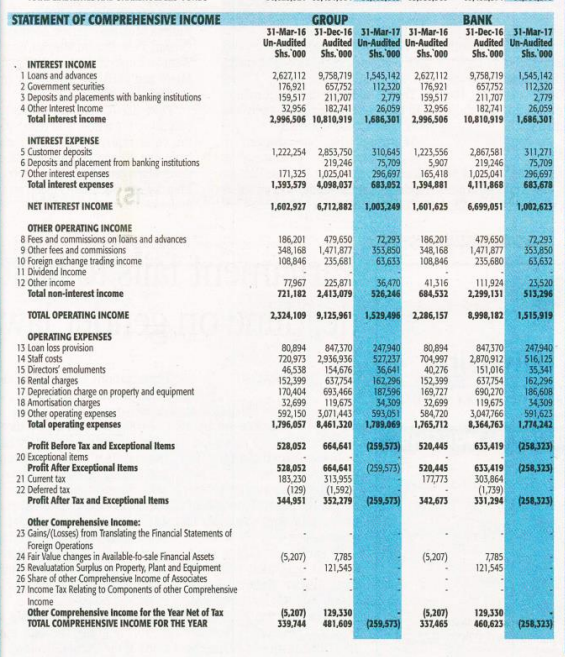

Family Bank Kenya has posted a net loss of Sh260 million in the first quarter of this year, amid declining outstanding loans and higher bad loans. This was poor when compared to a net profit of Sh344.9 million posted in a similar period in 2016.

The Bank’s gross non-performing loans rose by 92 percent to Sh8.3 billion from Sh 4.3 Billion as of March 2016.

Interest income fell by 44 percent to Sh1.69 billion on the back of reduced interest income from loans & advances to customers. The Bank’s loan book declined by a whopping Sh12 billion to Sh46.64 billion. Family Bank increased its loan loss provisions for the period by 206 percent from Sh 80.9 Million to Sh247.9 million.

Foreign exchange trading income fell from Sh 108 Million to Sh 63 Million.

In the full year period ended December 2016, the mid tier lender reported a drop of 82,21% in after tax profits to Sh352.5 million from the previous year’s Sh1.98 billion.

Family Bank Q1 2017 Statement of Comprehensive Income