According to the 2017 Ernest & Young attractiveness report, Africa’s key hub economies; South Africa, Nigeria, Kenya, Egypt and Morocco remain the continent’s top recipients by FDI projects. Collectively, these markets attracted 58% of the continent’s total FDI projects in 2016.

During the year, Africa attracted 676 FDI projects, which was down 12.3% from the previous year. These FDI projects created 129,150 jobs across the continent, a decline of 13.1% from 2015.

More positively though, in terms of capital investments, the flow of FDI into Africa recovered in 2016 after a dip in 2015. During 2016, capital investment into Africa rose 31.9%. Investment per project averaged US$139m, against US$92.5m in 2015. This surge was driven by several large, capital intensive projects in the real estate, hospitality and construction (RHC), and transport and logistics sectors. The continent’s share of global FDI capital flows increased to 11.4%, up from 9.4% in 2015. That made Africa the second fastest growing destination when measured by FDI capital.

With a 6.9% increase in FDI projects from 2015, South Africa maintained its position as the continent’s leader from an FDI projects perspective. Morocco regained its place as Africa’s second largest recipient of FDI, with projects and capital investment up 9.5% and 46.2%, respectively.

Egypt attracted 19.7% more FDI projects compared with 2015. Even more striking was the growth in capital investment, which almost trebled year-on-year, driven by large-ticket RHC projects.

In the west of Africa, recession in Nigeria resulted in FDI projects eazing 3.8% compared with 2015. With the plunge in crude prices, Africa’s largest oil exporter has been hit by a scarcity of foreign exchange, impacting businesses that are already grappling with issues, including insufficient power supply and complexity in paying taxes.

Kenya, which is East Africa’s anchor economy (and SSA’s fourth largest), saw investment flag in 2016 after a bumper year in 2015. FDI projects were down 57.9%, while capital investment declined by 55.5%.

Kenya had a strong 2015, mainly driven by a surge in projects from the UK. These understandably slowed in 2016, as the UK copes with uncertainty following the vote to leave the EU.

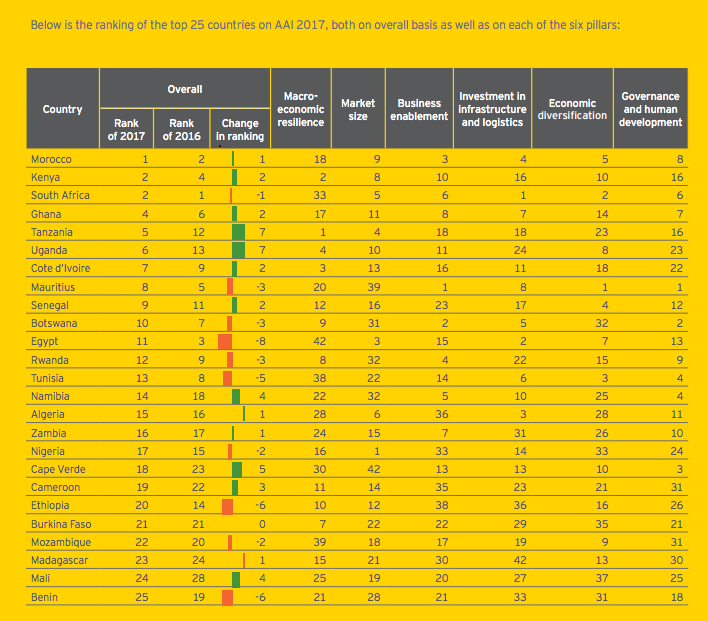

Most East African economies continued to grow strongly in 2016, with Kenya, Tanzania, Uganda, Rwanda and Ethiopia all among the fastest growing on the continent. Although there were year-on-year declines in FDI flows into East African markets generally, both Tanzania and Uganda are highly placed on the AAI 2017, ranking fifth and sixth in terms of FDI attractiveness respectively.