Listed logistics and warehousing firm Express Kenya PLC has unveiled Project Nexus, a KSh 13 billion multi-phase development meant to reshape part of Nairobi’s urban corridor, as it seeks to diversify its revenue streams.

- •Project Nexus will be a four-phase initiative targeting residential, commercial, and medical developments along the growing Mombasa Road corridor.

- •The announcement coincides with the company’s ongoing financial challenges; in 2024, it posted a net loss of KSh 107.9 million, up from KSh 103.4 million the previous year.

- •To drive interest, Express Kenya will offer a 5% discount to shareholders and staff buying apartments between September 2025 and April 2026.

Project Breakdown

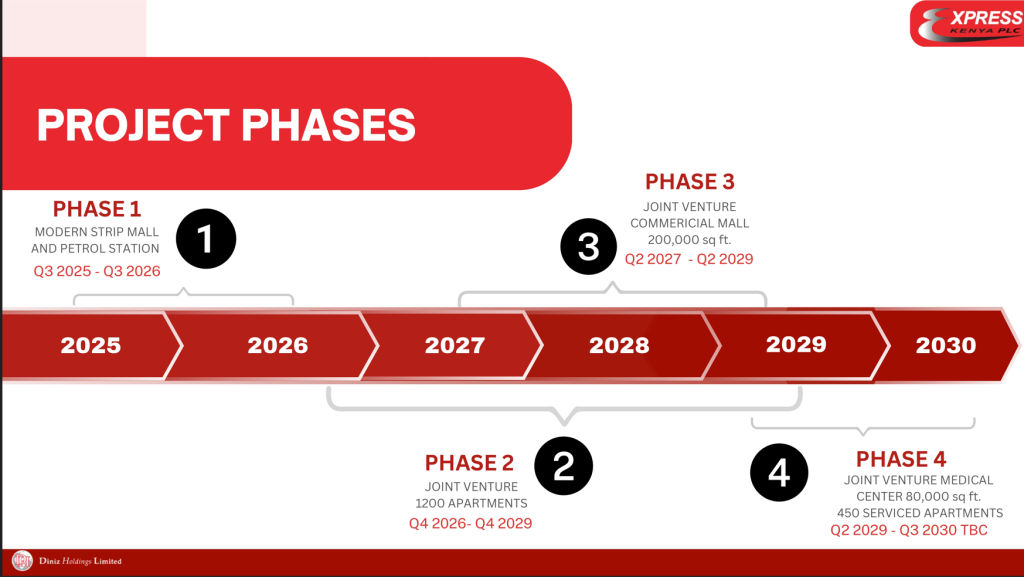

Over the next five years, Express Kenya will build out Project Nexus in stages, with a dedicated sales office set to open in September 2025.

• Phase 1 (KSh 0.25B): Express Kenya will develop a strip mall and petrol station by Q3 2026.

• Phase 2 (KSh 7.65B): In partnership with a joint venture, the firm will construct 1,200 apartments between Q4 2026 and Q4 2029.

• Phase 3 (KSh 2.1B): A 200,000 sq ft commercial mall will rise between Q2 2027 and Q2 2029.

• Phase 4 (KSh 3.0B): Plans include an 80,000 sq ft medical center and 450 serviced apartments by Q3 2030.

Despite its strategic ambition, Express Kenya remains under financial strain. In 2024, it recorded a 4% revenue decline, falling to KSh 26.4 million. Meanwhile, cash reserves shrank to KSh 608,000, and shareholders’ equity dropped to KSh 412 million from KSh 520 million. Furthermore, accumulated losses reached KSh 606.5 million.

Multiple factors contributed to this downturn. Rising direct costs, diminished warehousing income, and the exit of key clients—including East African Breweries Ltd (EABL)—negatively affected profitability. Nonetheless, the company continues to receive financial backing from its principal shareholder.