The controversial 20% excise duty on digital credit is likely to be counterproductive and result in less tax revenues, digital lenders and sector strategists have said.

Raising the cost of credit already means that fewer Kenyans can borrow from digital platforms, which are now only second to informal sources-such as friends, family, and chamas-in usage in the country. If this happens, it’s likely the government will not meet its revenue targets as there will be fewer loans disbursed, worsened by other factors such as increased defaults, growing regulation and unfair competition.

It would also increase the financial distress for Kenyan households and enterprises that use digital loans to cater to short-term needs.

The threat of excise duty to the sector lies in the fact that the private sector players invested in digital lending apply different business models, but equally face high default rates. A majority of them have the entirety of their funds in the loans books, and higher default rates in a sector where borrowers are already almost twice as likely to default would spell doom for their enterprises.

The duty will also exacerbate the negative effects of regulation currently in the sector, which forced lenders to shift from the more open “willingness to repay ” model to the more stringent “capacity to repay” model, according to accounting firm KPMG.

Digital lending has grown in popularity since the launch of M-Shwari in 2012, peaking in 2019 and early 2020 before COVID-19 interventions slowed down growth significantly. By the sector’s estimation, at least 20 million adult Kenyans use or have used digital platforms to access credit, often to meet short-term budgetary and capital needs. As of April 2021, lenders were disbursing over KSh 2bn per month in loans, providing much needed short-term financing to Kenyan households.

The sector now has 51 licensed players and hundreds of applications being reviewed, providing direct employment to thousands of Kenyans. In addition to income tax, digital lenders also pay 30% corporation tax.

How Excise Duty Will Impact Your Pocket

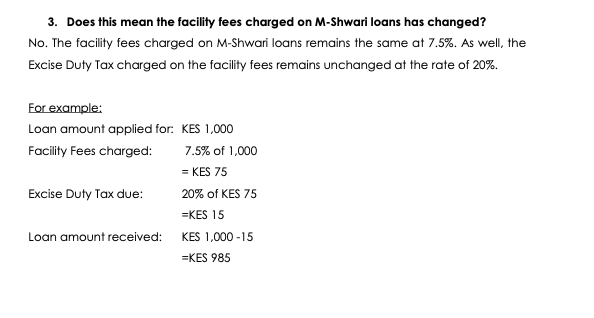

By definition, excise duty is a tax levied on specific goods and services, with a direct effect being that it is passed on to consumers. In March, pioneering digital lender MShwari announced it would start deducting the excise duty at the point of disbursement, which means that borrowers on the platform now receive their principal amount less the 20% excise duty on the platform’s processing fees.

This format is likely to become the norm if the duty remains, where borrowers receive their principal amount minus the excise duty, but are expected to pay the principal plus interest and/or processing fees. Default rates are likely to rise as a result because while the individual amounts involved may not seem significant at a glance, they will compound the financial pinch that makes people borrow in the first place.

Since the lenders will remit the excise duty at the point of disbursement, they will be paying a tax on the loan with the risk that the customers may default on it. Given how high that risk already is, the result is that some enterprises in the sector will have to close shop, denying borrowers the chance to access credit, and the government the chance to collect the already existing taxes.

One way to see it is this: if 100 people take mobile loans from a platform and 20 of them default, the lender has to remit excise duty for interest and fees for all 100 loans. A good proportion of the 80 who want to repay may also find it hard to due to the higher fees, since they are receiving less money than they borrowed, and paying back significantly more. Eventually, fewer loans will mean less tax revenues from the sector.

Some digital lenders may suffer more than others, especially as the pressures to increase usage, enhance repayment, meet regulatory rules, and process taxes makes the enterprises increasingly harder to run. Kenya’s brand as a pioneer in mobile money and mobile credit has already attracted a large number of local and international players, but its experimentations with increased taxes on services whose uptake is still nascent will harm how investors view the sustainability of the market.