Kenyans are persistently enraged over recent taxation policies and rightly so – no human being enjoys paying taxes.

The country is currently in debt KSh 10.5 trillion, meaning that every Kenyan would need to pay over 201,439.71 KShs. to pay off this amount.

- •The last Public Debt data sheet published by the CBK shows Kenya in 10.561 Trillion Shillings as of June 2024; 5.41 Trillion KShs. owed domestically (to Kenyans and local businesses) and 5.15 Trillion KShs. owed internationally.

- •The largest Public Debt figure ever recorded by the CBK was in January 2024 where the country owed 11.24 Trillion KShs. to creditors, 55.07% of which was owed to international creditors.

- •Between January 2010 and June 2024, Public Debt has increased by 761.63% in real terms (assuming the value of the Shilling remains the same) but when adjusted for currency devaluation, Public Debt has increased by 1,320.69%.

This is the reason the International Monetary Fund (IMF) and other multilateral institutions are pushing Kenya’s politicians to raise taxes. The rate of public debt growth is unsustainable and is pushing the Kenyan economy closer to bankruptcy.

What is “Public Debt”?

Citation: Britannica

Public debt essentially translates to the money that a government owes on a variety of things, from infrastructure loans, to government treasuries, and even debt of government-owned businesses.

One of the most crucial metrics in macroeconomics is the Debt-to-GDP ratio. This tells us how much of the country’s total economic output would be required to pay off the entire debt.

Economists utilize two types of Gross Domestic Product (GDP): Nominal and Real.

While Nominal GDP is important for more short-term analysis given that it measures output in current prices, Real GDP is adjusted for inflation and is preferred when conducting long-term analysis. Nominal GDP is almost always larger than Real GDP and this is particularly true because of long-term devaluation of currency.

Since we do not yet have figures on the 2024 data, let’s take a look at the 2023 numbers. The non-inflation adjusted (Public Debt-to-Nominal GDP) rate for Kenya was 73.73% at the close of 2023 while the inflation adjusted (Public Debt-to-Real GDP) rate for Kenya ended up being, for the only time in this entire study, above 100% at 107.11%.

The entire economic output of Kenya for an entire year is barely enough to cover its debts.

Public Debt per Kenyan

Between January 2010 and June 2024, per capita public debt has increased a whopping 534% – from KSh 31,754.40 to KSh 201,439.7. While the US is the world’s most indebted country, during this same period, per capita public debt only increased by 125%, meaning Kenya’s debt is increasing at a rate of over 4 times faster than that of the world’s most in debt population.

This rapid increase over the past 15 years is reason for concern. How many Kenyans can reasonably afford that amount? The short answer is only a select few.

If all Kenyans on average earned 287,537.42 (Gross National Income per capita), according to data from The World Bank, and everyone paid 100% of their income toward Kenya’s debt, it would require 8.4 months worth of salary. All other factors held constant.

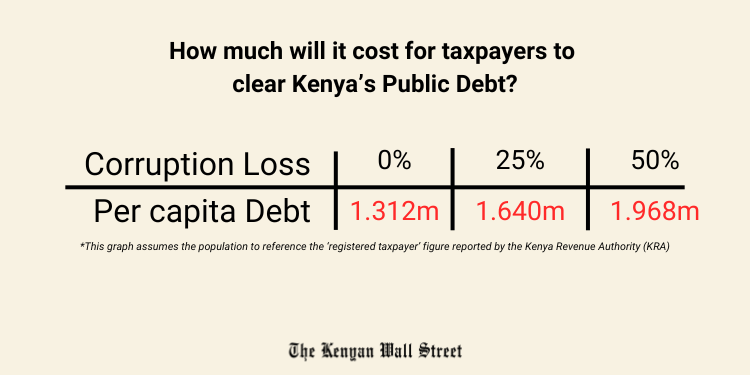

This example though is unrealistic – people must eat, pay rent, afford transport, school fees, etc. Additionally, not every Kenyan is a registered taxpayer. Of the current population, only 8,046,029 are tax payers – that’s a rather low 15.3% of the entire population.

If registered taxpayers alone took up the Public Debt bill, everyone would need to spend KSh 1,312,590.31. That is an atrocious 52.8 months or 4.4 years of salary.

Hearing this, it is no surprise why the KRA and President Ruto are keen to increase the tax base of the country. The more people that taxes can be spread across, the lower the individual tax burden.

Public Debt & Corruption

No one doubts the fact that corruption stands in the way of progress, particularly when it comes to issues of public finance.

Taking this analysis one step further, let’s assume that corruption robs the country of 25% of its national revenue. When paired with the number of registered taxpayers in Kenya, the per capita figure grows to a bleak KShs.1,640,737.9. It gets even worse the higher the corruption levels get.

If registered taxpayers forgo 100% of their income, and adjusted for corruption, it would take an estimated 68.5 months in order to pay off the public debt… that’s 5.7 years!

This is why it is paramount that Kenya tackle its issue of corruption and theft of public resources. The worse the issue gets, the bleaker the future becomes.

Public Debt by Presidential Administration

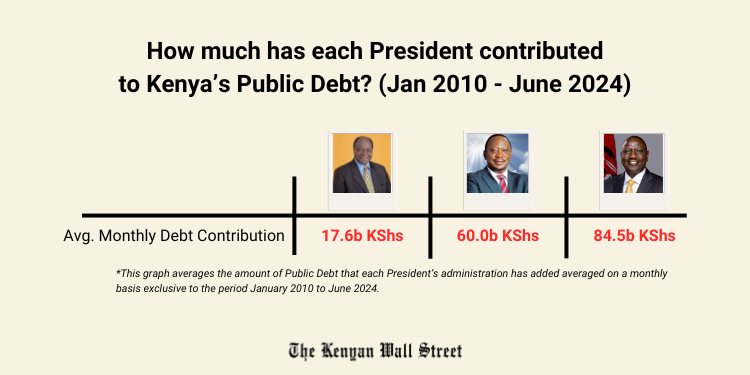

Each successive President between 2010 and today has seen an increase in monthly average public debt. While President Mwai Kibaki oversaw a KSh 17.649 billion monthly debt average, President Kenyatta increased Kenya’s debt bill by KSh 60.007 billion average each month with this average largely being skewed toward his second term in office. President Ruto has increased the bill by an average of KSh 84.548 billion each month.

John Mbadi, Cabinet Secretary (CS) for Treasury and Economic Planning and several other politicians have re-popularized the slogan, ‘Kenya loses KSh 2 billion per day to corruption.’

This is a worrying amount that first came into public discourse a few years ago.

If President Ruto could cut government corruption by half – to only KSh 1 billion per day – then the average monthly debt contribution would alone be brought to KSh 54.5 billion. If he is able to further cut the government operating budget by a few billion shillings per month simply via the termination of ghost workers and the reigning in of incessant opulence by officials, the monthly deficit would likely come down to below KSh 50 billion per month.

This study’s metrics only include data between January 2010 and June 20204; not including the entire terms of Presidents Kibaki (2003-2013) and Ruto (2022-current). In addition, it is important to reiterate that the figures mentioned in the previous paragraph are simply averages. Some months see a decrease in public debt and others see an increase; the bill of public debt each month changes and is not consistent.

The Harsh Reality

The figures paint a bleak picture of the country’s Public Debt situation and, these figures should worry all Kenyan citizens.

While the obvious solutions may be to raise taxes, there is a limit to what the government can collect; this limit is known in the field of economics as the Laffer Curve (learn more about the Laffer Curve). This economic phenomenon describes the relationship between tax rates and government collections.

Raising taxes should mean the government makes more money, but the Laffer Curve tells us that this is not the case; there is a theoretical limit. This phenomenon was beautifully witnessed during the Reagan administration in the United States (1981-1989) where the country witnessed some of the largest tax cuts in history while witnessing an increase in government revenue. It also explains some of President Kibaki’s early economic “magic.”

This is the awkward situation Kenya finds itself in today – the government needs to increase revenue to pay the Public Debt, run the government, and whatever else your imagination desires. Without increasing taxes from this moment forward, how does GoK hit its revenue targets?

The first hard truth is that the tax base must be widened.

This is not a pleasant matter – if you have never paid taxes, why would you want to start now? But giving to Ceasar what belongs to Ceaser is not always a winnable idea.

President Ruto’s administration has made significant headway on this matter (and the frustration of citizens has been clear). “As at 30th June, 2024, a total of 8,046,029 tax returns were filed, against a target of 7,187,932. This represents a growth of 26% compared to 6,385,523 tax returns filed last year” the KRA said in a July 8, 2024 press release.

How can we make tax payers who currently pay KSh 40,000 per year, the kind of taxpayers who can afford KSh 100,000 or even KSh 1,000,000 per year?

We must find a way to incentivize business and personal growth because as the economy grows, so do people’s ability (and even willingness) to pay taxes. With the understanding of the Laffer Curve, there must be a discussion on how taxpayers can make more money and grow their businesses instead of pushing them lower with additional taxes.

Lastly, the country must have an honest conversation about paying down the debt. How can costs be cut (and that includes corruption and theft too) to create an environment where GoK has a budget surplus, instead of a budget deficit. Or at least sustainable debt.

The views expressed here are the author’s own and do not necessarily reflect the editorial position of The Kenyan Wall Street.

Editorial note: All data points used in this analysis come from the Central Bank of Kenya, Kenyan National Bureau of Standards, Kenya Revenue Authority, and The World Bank; for further citations of particular data points and to see for yourself, you can download and review our Excel Spreadsheet here.