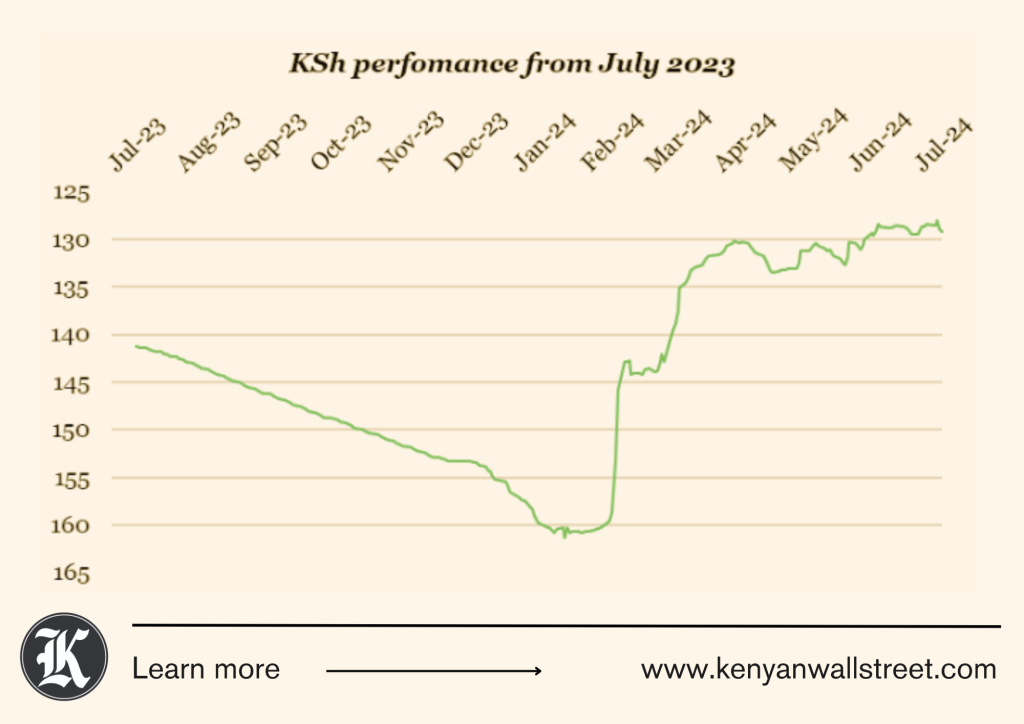

Last week, the Kenya Shilling weakened marginally against the US Dollar, closing the week at 129.3 from 128.5 the previous week. The Shilling’s 0.6% downtick dragged the year-to-date performance to 17.4% from 17.9% the week before.

- •The marginal weakening is attributed to high demand for dollars during the week, coupled with the recent Moody’s downgrade, implying higher borrowing requirements and consequently increasing Kenya’s liquidity risks.

- •The equities market closed the week on a bullish note, signaled by the NSE All Share Index (NASI), which was up marginally by 0.9% to close the week at 110.03.

- •Similarly, the year-to-date performance saw a 19.5% uptick, buoyed by impressive gains from large caps, signalling overall recovery.

In the international markets, yields on Kenya’s Eurobonds decreased by 36 basis points, reflecting improved investor sentiments, and contrasting Moody’s credit rating downgrade which was feared to propel jitters among investors both domestically and internationally.

Further, the value of bonds traded during the week increased to KSh44.3 billion from KSh34.4 billion recorded a week prior.

Liquidity conditions in the Money Market eased, with the average interbank rate falling marginally to 13.2% from 13.3% recorded a week prior, attributed to tax remittances outpacing government payments. The interbank rate trailed within the adjusted CBK range, with market operations remaining active.

Kenya’s usable forex reserves dropped slightly to US$ 7,896 million, enough to maintain 4.1 months of import cover from US$ 7,775 million the previous week.

Weekly Treasury Bills were oversubscribed, with the over-subscription rising marginally to 137.3% from 124.4% recorded the previous week. The Central Bank of Kenya (CBK) accepted bids worth KSh30.2 billion out of the KSh32.9 billion received, reflecting a 91.8% acceptance rate.

Demand remained pegged on the 91-day paper, which attracted bids worth KSh14.6 billion against the KSh4 billion on offer, an oversubscription of 364.7%. The CBK, however, accepted KSh13.1 billion on this tenor.

The accepted average yields on the three papers saw an uptick from the previous week, increasing to 15.99%, 16.82%, and 16.88% for the 91-day, 182- day and 364-day papers respectively. This comes amid looming rate cuts, with inflation rate now trailing within the lower bound target range.

See Also: