Ethiopia has introduced a comprehensive directive—effective June 25, 2025—governing the licensing and operations of foreign banking institutions.

- •The directive provides entry avenues for foreign banks through three channels: wholly owned subsidiaries, foreign bank branches, and representative offices.

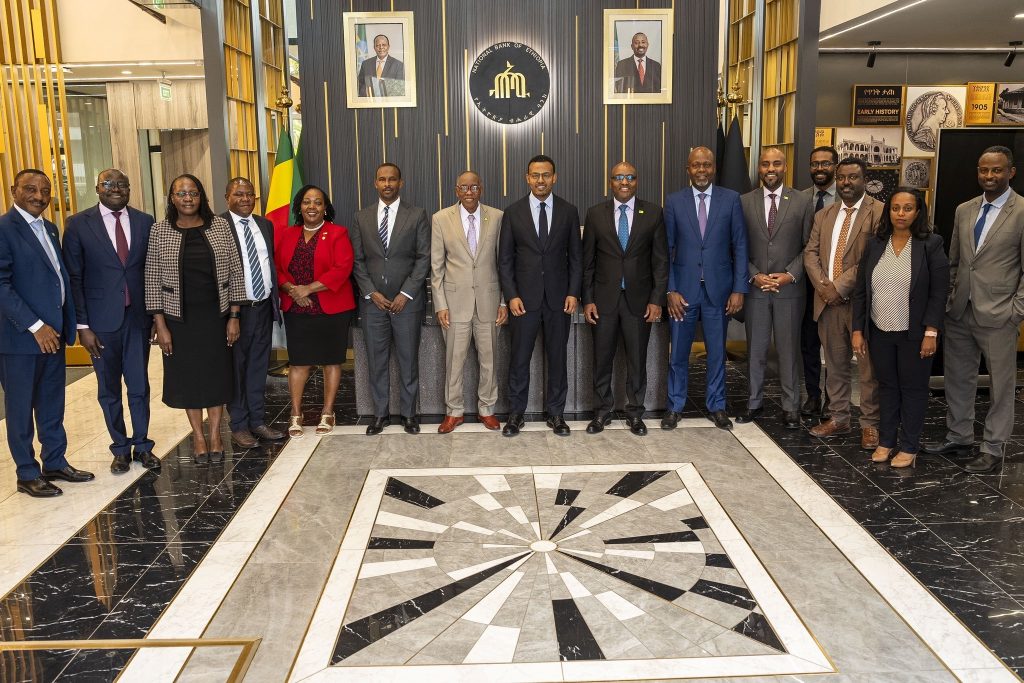

- •KCB Group Chairman Dr. Joseph Kinyua and CEO Paul Russo met with the National Bank of Ethiopia earlier this month, signaling plans to enter the country’s newly liberalized banking sector.

- •Their visit comes amid sweeping reforms that are opening Ethiopia’s economy—long closed to foreign banks—to regional integration and cross-border financial expansion.

While this move signals a major liberalization of one of Africa’s last closed banking systems, it is also accompanied by robust regulatory safeguards and strict compliance conditions.

According to the directive, foreign banks can now enter Ethiopia via three pathways:

- •Wholly owned subsidiaries

- •Foreign bank branches

- •Representative offices

Each route follows distinct eligibility requirements, capital obligations, and compliance standards.

Subsidiaries: Full Banking Operations with Local Incorporation

Foreign banks may establish locally incorporated subsidiaries. To do so, they must:

- •Inject a minimum paid-up capital of Birr 5 billion (approximately USD 36.7 million).

- •Obtain a no-objection letter from their home regulator.

- •Present detailed business plans, governance frameworks, IT systems, and risk control policies.

- •Ensure all customer data is stored and processed within Ethiopia.

Licensing Costs:

- •Investigation Fee: USD 2,500

- •License Fee: USD 150,000

- •Annual Renewal: Birr 200,000

Branches: Parent-Linked Operations with Supervisory Oversight

Alternatively, foreign banks may choose to establish branches. These branches can be either deposit-taking or non-deposit-taking, but not both simultaneously. Branches must:

- •Satisfy the same governance and capital standards as local banks.

- •Remain under consolidated supervision from their parent regulator.

- •Adhere to internationally accepted frameworks, such as Basel standards.

Notably, the first branch serves as the administrative headquarters for all future branches within the country.

Representative Offices: Limited Scope, No Transactions

Foreign banks also have the option to open representative offices. These offices are allowed to:

- •Promote parent bank services and liaise with local stakeholders.

- •Conduct market research and support investment efforts.

However, they are prohibited from:

- •Accepting deposits or offering credit.

- •Using the word “bank” in their title unless explicitly labeled as a “Representative Office of…”

Licensing Costs:

- •Investigation Fee: USD 500

- •License Fee: USD 1,500

- •Annual Renewal: Birr 75,000

The directive emphasizes data sovereignty. Consequently:

- •All customer-related data—both primary and backup—must remain within Ethiopia.

- •Any transfer of non-customer data to foreign jurisdictions must be pre-approved by the NBE and meet stringent encryption and access standards.

All licensed entities are required to:

- •Renew licenses annually between July 1 and September 30.

- •Ensure representative offices maintain a deposit of USD 100,000 to cover operational costs.

- •Display original licenses prominently at their physical locations.

With over 120 million people, a young population, growing digital infrastructure, and stabilizing macroeconomic indicators, Ethiopia presents a compelling opportunity for regional banks seeking cross-border expansion. This reform comes at a decisive moment for lenders like KCB and Equity Group, both expanding across East and Central Africa. KCB’s early dialogue with Ethiopian regulators positions it for a potential first-mover advantage.

Nonetheless, while the upside is considerable, successful market entry will require financial strength, regulatory alignment, and strict adherence to Ethiopia’s operational and data compliance standards.