Equity Bank started 35 years ago as a small lender in Murang’a. It was established by the former Chairman Peter Munga. The lender has since evolved into a financial powerhouse with a presence in eight countries.

In 2004 Equity building society was converted into a fully-fledged bank. The lender listed on the Nairobi Bourse in 2006.

On 31st December 2014, Equity Building Society, as it had previously been known as, became Equity Group Holdings Limited (EGH), a non-operating holding company, after undergoing a process of restructuring.

According to third quarter 2019 results, the EGH assets stood at KSh 703 billion with the Kenyan operation accounting for KSh 500 billion.

In October 2019, the bank unveiled a new logo to mark 35 years anniversary. The new logo marks the beginning of a new identity, pertinent with its journey of transformation and regional expansion.

During the unveiling of the new look, Dr. Mwangi said that the brand intends to be customer-centric and focused on meeting all the needs of the stakeholders.

The new look entity launched in Kenya and gradually rolled out in Uganda, Tanzania, South Sudan, Rwanda, Democratic Republic of Congo, Zambia, Mozambique and Ethiopia.

Furthermore, it reveals a diversifed portfolio spanning insurance, banking and investment banking all housed under one roof.

In this case, a new identity creates a sustainable growth path and service delivery in today’s rapidly changing financial services environment.

Opportunities

As the bank races to the KSh 1 trillion valuation mark, regional expansion is an integral part of the strategy.

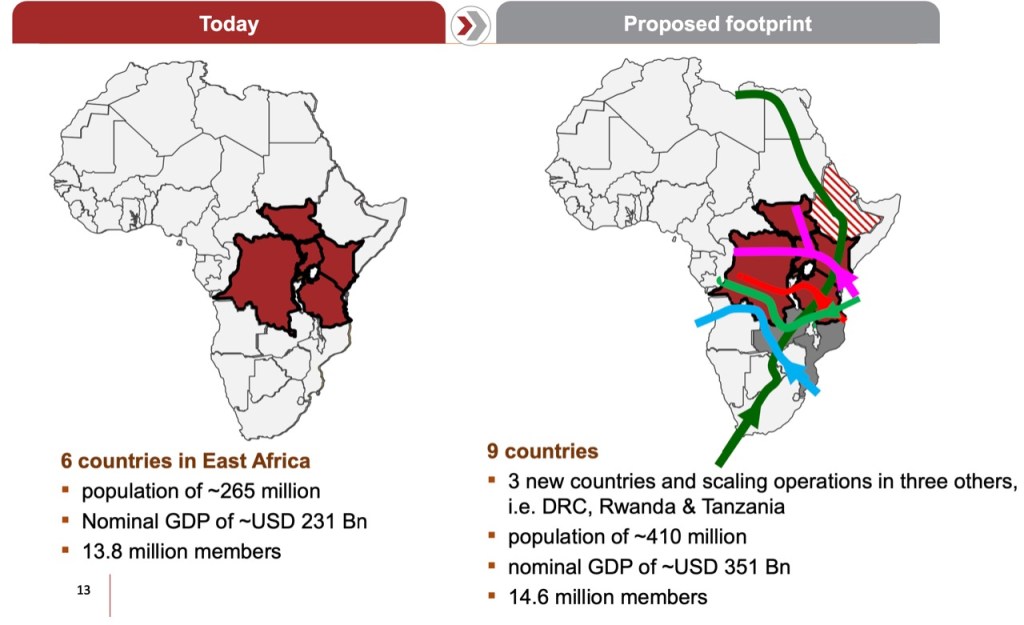

EGH is utilizing gradual acquisition of banking franchises in target markets to expand its foothold across Southern, Western, and Central Africa.

In June, EGH acquired a licence to operate in Ethiopia paving way for the opening of a Representative Office in Addis Ababa.

In November, EGH purchased a 66.53 per cent majority stake in Banque Commercial du Congo (BCDC), a bank licensed in the Democratic Republic of Congo (DRC).

The bank’s entry into Ethiopia will give the lender access to a combined 410 million people in the six markets it operates in including Uganda, Tanzania, Rwanda, South Sudan and the Democratic Republic of Congo.

Furthermore, quarter three 2019 results reveal that EGH intends to venture into 3 more countries while scaling operations in Tanzania, DRC, and Rwanda. The three include Ethiopia, Zambia, and Mozambique.

As a testament to his contribution, Bloomberg 50 honoured Mwangi for driving Equity Group aggressive expansion strategy that seeks to ensure Equity Bank’s presence in 10 African economies by the end of 2019 and 15 countries by 2026.

Ultimately, the refreshed brand identity demonstrates a lender with global capability, agile business model, and innovative culture.

Related:

Equity Bank in Talks to Enter Zimbabwe

World Bank Expatriate to drive Equity Bank’s Pan African expansion

Equity Bank to acquire Atlas Mara’s operations in 4 African Countries