Equity Group released its third quarter 2017 results that saw the lender’s Profit before tax slip by 3.6% to KES 20.7 billion compared to KES 21.5 billion in Q3 2016. Profit after tax came in down by 2.7% to KES 14.6 billion compared to KES 15 billion.

Interest Income

The bank’s Net Interest Income came down by 15% to KES 27.5 billion compared to KES 32.3 billion in the previous period.

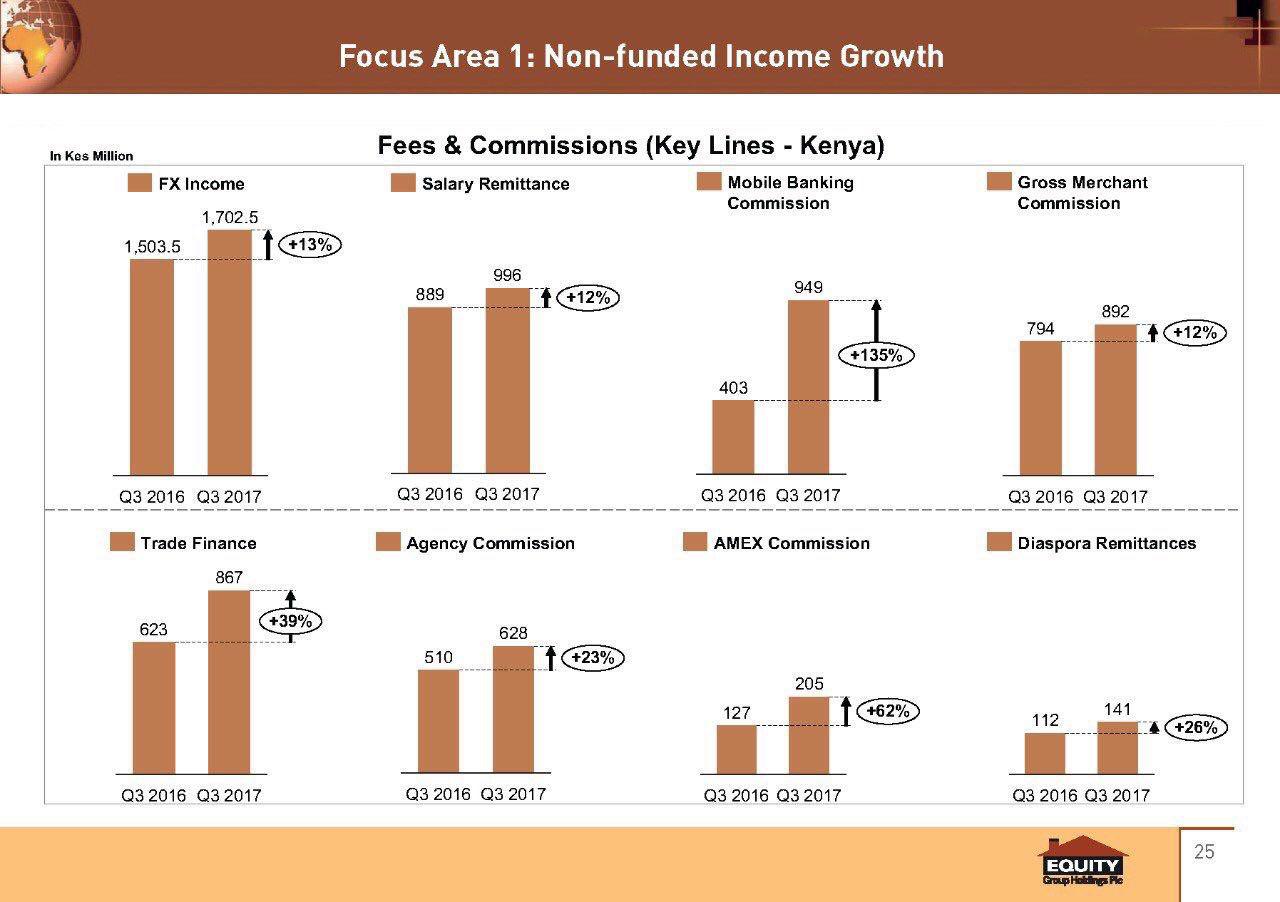

Non Funded Income

Equity Bank’s Non Funded Income grew impressively by 28.3% to KES 21.3 billion compared to KES 16.6 billion in the previous year’s quarter. This was contributed largely by growth in Fees and Commission income.

Operating Expenses

Total operating expenses increased by 2.2% to KES 28 billion in Q3 2017 compared to KES 27.4 billion in Q3 2016.

Share Price

Equity Bank closed at KES 36.50 per share on Monday’s trading session. The lenders share price is up by 21.7% on a year-to-date basis. On a 1 year basis the counter is up by 21.95%.

Results Download: Equity_Bank_Q3_30-Sep-17