TransCentury Plc, a listed infrastructure investment group has recently reported its first annual net profit since 2013, marking a turnaround amidst ongoing legal battles with Equity Bank over its subsidiary, East African Cables (EA Cables).

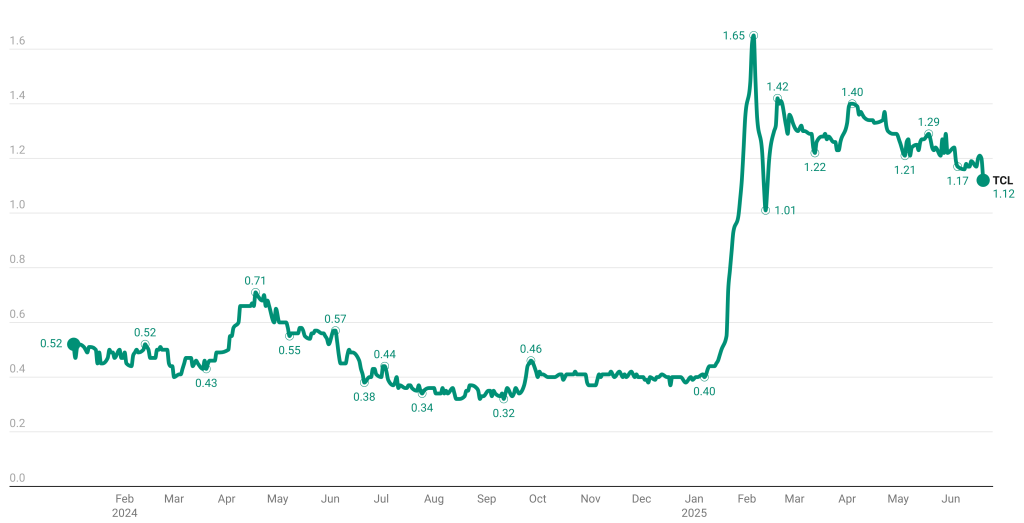

- •TransCentury has been the best-performing NSE stock in 2025 with +187% year-to-date gain

- •Despite TransCentury’s turnaround, Equity Bank has seized EA Cables, with the matter slated for a court mention on July 24.

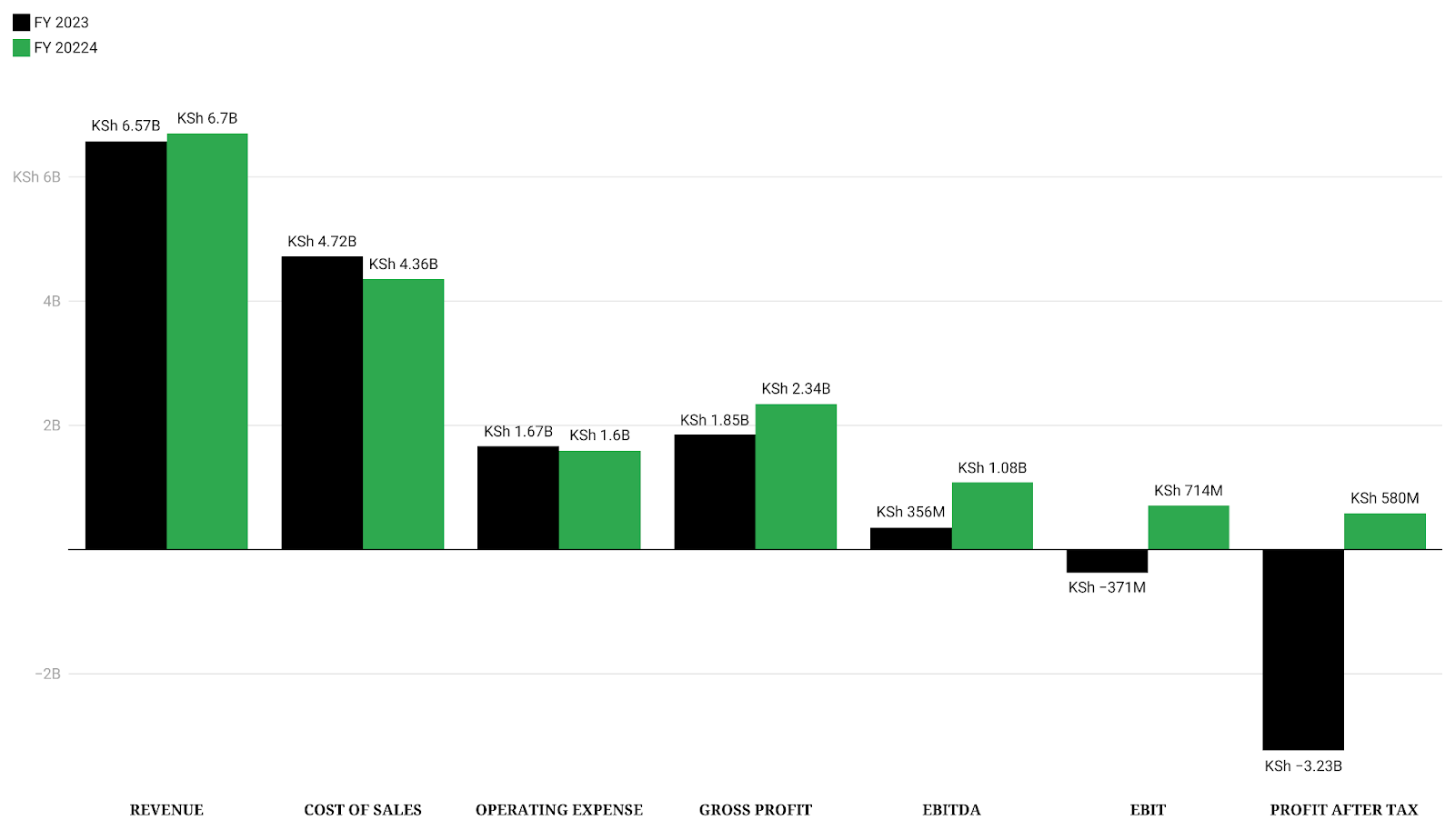

TransCentury, posted a net profit of KSh 580 million for the year ended December 2024, breaking a decade-long streak of losses.

This was driven by an increase in revenue to KSh 6.7 billion with a 27.1% rise in gross profit to KSh 2.34 billion. The company also achieved an operating profit of KSh 714.5 million, a full turnaround from a KSh 317.4 million loss in FY2023, and saw foreign exchange gains increase by 19.4% to KSh 1.23 billion.

187%; TransCentury Share Price 2024 – 2025

Dispute with Equity Bank

However, this financial progress is overshadowed by a protracted dispute with Equity Bank.

According to court documents obtained by the Kenyan Wall Street, Equity bank’s actions began when it took all of TransCentury’s TC & EAC security worth approximately KSh. 11bn and reneged on issuing working capital, further strangling the business. Court documents also reveal that the bank has continuously frustrated its efforts to raise funds from other interested financiers, leading to disruptions that scuttled potential funding transactions.

Equity Bank had moved to appoint receivers and administrators over TransCentury Plc and East African Cables Plc in June 2023. In response, both TransCentury and EA Cables filed applications in the High Court of Kenya at Nairobi, Commercial and Tax Division (Civil Suit No. E276 of 2023 for TransCentury and E277 of 2023 for EA Cables) seeking injunctions against these appointments.

Court documents show EA Cables had made substantial payments exceeding KSh. 669,576,299 to Equity Bank to help liquidate the debt since the facility’s disbursement, with further payments made since the suit was filed. Similarly, TransCentury stated it had paid over US$. 13,740,892 towards the debt. The companies contended that the bank’s actions were “unlawful” and “disregarded mandatory procedures,” emphasizing that such appointments would “completely cripple” their operations and massive projects. They also highlighted ongoing negotiations for debt financing, including a term sheet from Norfund for US$. 15m that allegedly fell through due to the bank’s actions.

Equity Bank, through its manager legal services Kariuki King’ori, argued in court that the companies failed to make necessary payments on credit facilities, leading to demands for payment.

On October 18, 2024, Justice A. Mabeya delivered rulings in both cases. The court found merit in the applications and partially succeeded, granting temporary injunctions restraining Equity Bank from exercising its power under the debentures to appoint administrators/receivers for a period of 120 days from the date of the ruling. The court highlighted that TransCentury and EA Cables had shown good faith in making repayments and were seeking time to reorganize.

Despite the court’s temporary reprieve, court documents indicate that the bank has “continuously… frustrated all efforts by TransCentury Group to raise funds from other interested financiers”. Instances outlined in court documents include:

- •In June 2023, a US$. 15m term sheet from Norfund reportedly fell through after the bank sent receivers and administrators to the company.

- •A 2024 transaction to sell EA Cables Tanzania, aimed at reducing debt by over KSh. 500m, is now at risk.

- •Confirmation from TLG Capital in June 2025 to fund the Group and its subsidiary is also at risk due to current disruptions.

- •The ongoing sale of property valued at over KSh. 400m, fully appraised by the bank, is also underway.

TransCentury Group expresses concern over the bank’s motive, as court documents suggest “bad faith,” especially as “every time the business is about to close a transaction the bank scuttles the efforts”.

East African Cables is a significant entity within TransCentury’s portfolio, listed as one of its key businesses alongside East African Cables Tanzania, Tanelec, and Transaero. The strategic importance of EA Cables is underlined by its ongoing legal battles with Equity Bank, which moved to appoint receivers and administrators over both EA Cables and its parent company, TransCentury Plc.

According to analysts, this kind of action by Equity Bank, which TransCentury claims has “frustrated all efforts by the Group to raise funds from other interested financiers”, poses a risk to foreign direct investment into Kenya. For instance, the US$15 million term sheet from Norfund in June 2023 and a potential funding agreement with TLG Capital in June 2025 were either jeopardized or fell through due to the bank’s actions.

Furthermore, the pursuit of receivership by Equity Bank against both East African Cables and TransCentury Plc carries a significant risk for the Nairobi Securities Exchange (NSE). The court explicitly stated that “receivership ought to be the last resort” and that if receivers were to take control, it “would spell a death knell” for the company, potentially leading to its collapse, layoffs, and a halt in trading activities. Should these two publicly traded companies be forced into collapse and subsequently delisted from the NSE, it would represent a considerable setback for the exchange.

ALSO READ; TransCentury Share Price Gains after First Half Year Profit since 2019