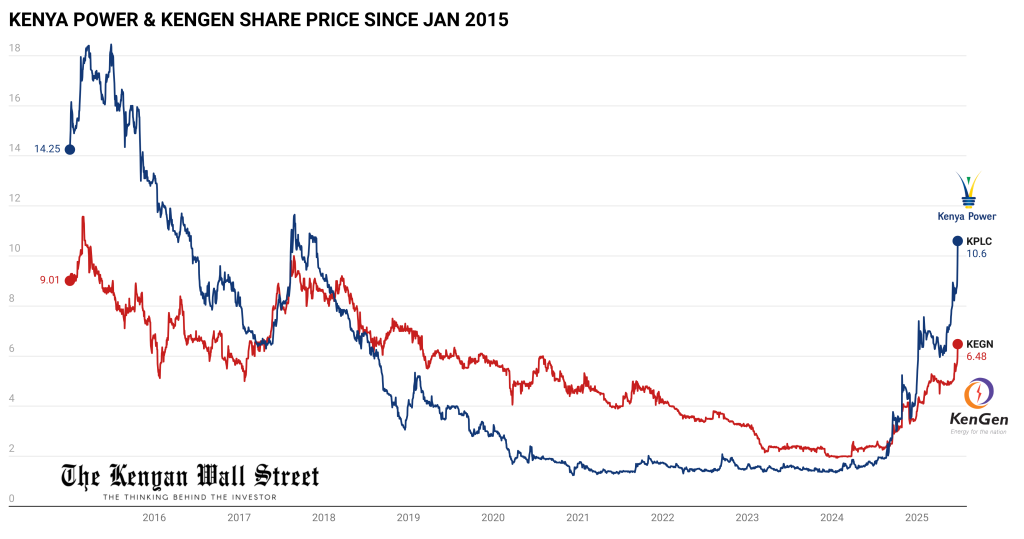

Kenya’s energy sector took center stage in the stock markets on Thursday with Kenya Power ($KPLC) and KenGen ($KEGN) share prices climbing to multi-year highs, helping lift broader sentiment across the Nairobi Securities Exchange (NSE).

- •KPLC closed at KSh 10.55, its highest level since November 2017, gaining 23.8% over the past week, 119% year-to-date, and 510% over the past 12 months.

- •This makes it the top-performing stock on the NSE in 2025, and the only counter with triple-digit gains so far this year.

- •KenGen closed at KSh 6.36 — a level last touched in February 2019-, gaining 15.6% this week, up 74.7% year-to-date, and returning 164% over the last 12 months.

The momentum in these counters set the tone for a strong day on the bourse. All four key NSE indices closed higher, extending their double-digit rallies for the year.

Indices Extend Gains for Second Year

For the second consecutive year, all major NSE indices are in double-digit territory, continuing the momentum seen in the historic 2024 performance.

- •The Nairobi All Share Index (NASI), which tracks all listed stocks based on market capitalization, closed at 149.88. This marks its strongest finish since April 28, 2022, and a 21.38% gain year-to-date, pushing total investor wealth at the NSE to KSh 2.34 trillion.

- •The NSE 20 Share Index, the oldest on the bourse, advanced to 2,342.91. This is its highest level since March 6, 2020, representing a 16.53% gain year-to-date.

- •The NSE 25 Share Index closed at 3,841.60, its highest since October 29, 2021, with a 12.90% year-to-date increase.

- •The NSE 10 Share Index, introduced in September 2023, reached a record high of 1,480.14. It is now up 13.65% year-to-date, reflecting strong performance from Kenya’s top blue-chip stocks.

Thursday’s performance underscores growing investor optimism. Improved earnings visibility, macroeconomic stability, and foreign interest in key sectors continue to boost market sentiment.