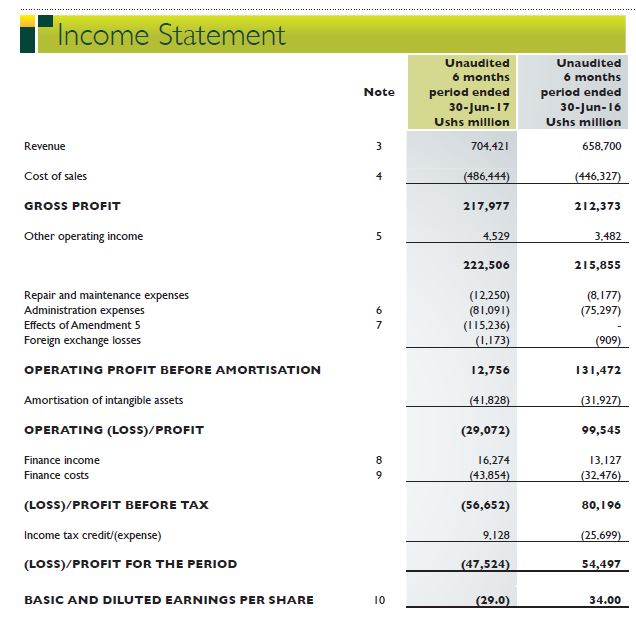

Ugandan energy company Umeme Limited released its results for the six month period ending 30 June 2017 that saw the company post a half year loss of Ushs. 56.7 billion (Ugandan Shillings) compared to the previous period where it made a profit of Ushs. 80.2 billion.

Revenues

The company recorded a 6.9% year on year revenue growth to Ushs. 704.4 billion driven by a 6.7% increase in units sold (GWh) and price adjustments. Electricity sales growth has been high in large industrial and domestic household

consumers. Customer numbers increased to 1,019,453 during the period, reflecting an annualized customer growth rate of 19%.

Regulatory Impact

Umeme’s half year performance was negatively affected by the issuance of Amendment 5 to it’s Supply License on 12th May 2017 by the Electricity Regulatory Authority, that led to impairment provisions for the previously accrued growth factor revenues, tax IN receivables and appeal costs receivable totaling Ushs 115.3 billion. The provision was made in line with International Accounting Standards (IAS) 39 – Financial instruments, recognition and measurements.

The company’s however believes it is entitled to these revenues and is pursuing recovery of the accrued amounts from the Government of Uganda, in line with the principles of the Consent Judgement reached with the Electricity Regulatory Authority (ERA) on 17th May 2016.

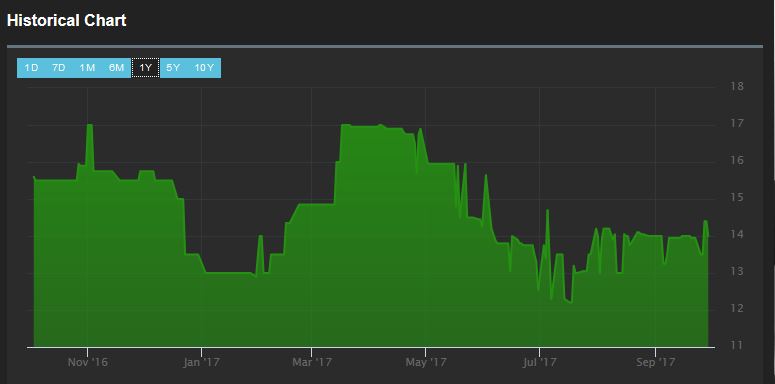

Share Price

Umeme last traded on Friday September 29, 2017 at KES 14.00 per share (Kenyan Shillings, the counter is cross-listed on the Nairobi Securities Exchange). The current 52 week range on the counter is KES 12.20 – 17.00. From a 1 year perspective the counter is down by 12.5%.

Source: Umeme, Nutcracker Analytics Portal