The world anticipates stocks on the Egyptian Stock Exchange (EGX) to rise further as the country cuts its interest rates. The country’s Monetary Policy Committee reduced Egypt’s benchmark deposit rate by 150 basis points. The country’s new deposit rate is 14.25 percent and its lending rate stands at 15.25 percent.

According to an expert, the reduction is larger than expected and will be well received by markets. Mohamed Abu Basha, a lead Macroeconomic analyst at EFG-Hermes says that the cut will provoke the capital expenditure cycle and boost business investment.

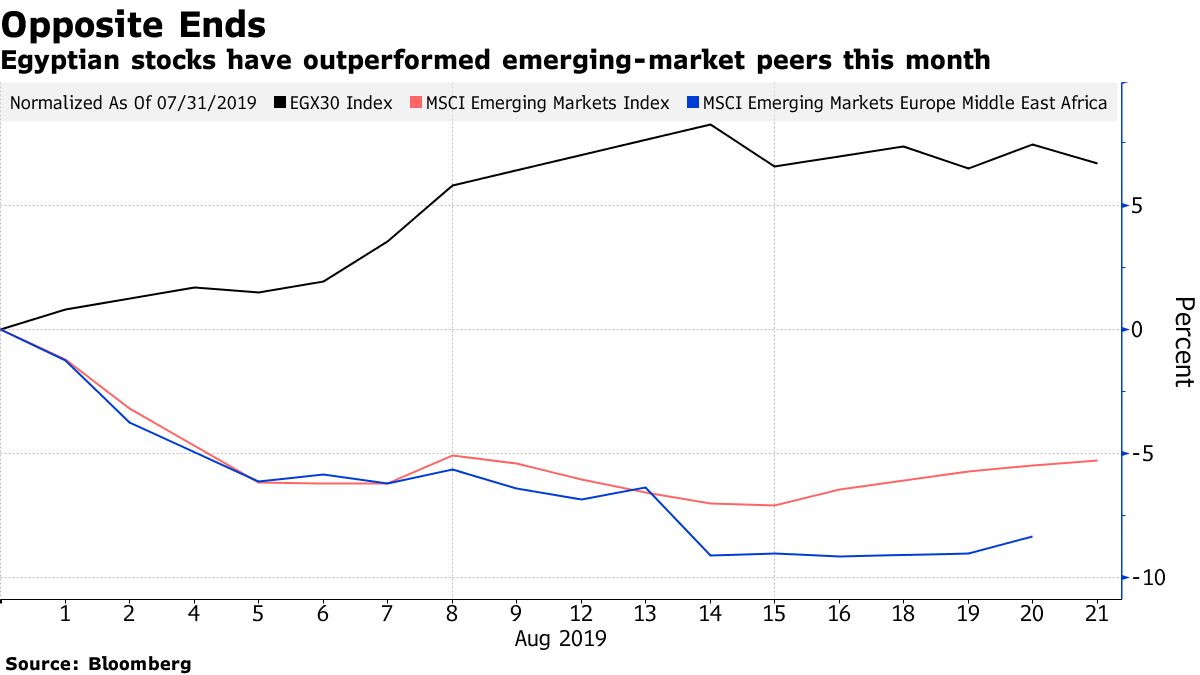

This month alone, Egypt’s EGX 30 stock market index rose by over 7%. The growth makes it the world’s best performing major gauge. This performance contradicts the behavior of peer markets which fell to as low as 5% this month.

Anticipation of lower interest rates helped protect Egypt’s Stock market from tensions in the rest of the world, thus its performance. The country’s Monetary Policy committee to moderate inflationary pressures. Moreover, Egypt’s central bank believes that the move is consistent to achieve lower inflation.

The country targets an inflation of 9 percent with a 3 percent margin towards the end of 2020. Additionally, it plans to achieve a price stability over the medium term.