Listed agricultural company Eaagads Limited has reported a 45.5% rise in revenue to KSh 277.3 million for the financial year ended 31 March 2025, marking its strongest topline performance in over a decade.

- •The company’s pre-tax profit surged 147% to KSh 17.4 million, driven by improved pricing, increased sales volumes, and tight operational management — a sharp turnaround from its prior years of volatility.

- •Coffee production fell by 11% (37 tons) to 295 tons due to high temperatures, but sales surged by 29% (79 tons) to 351 tons, driven by stronger demand.

- •The average price rose 23% to USD 5.76/kg, boosting revenue and propelling pre-tax profit up 147% to KSh 17 million, up from KSh 7 million the prior year.

| Metric | FY2025 | FY2024 | YoY % |

|---|---|---|---|

| Revenue | 277.27 Mn | 190.62 Mn | +45.5% |

| Cost of Production | 193.62 Mn | 123.58 Mn | +56.7% |

| Gross Profit | 86.30 Mn | 67.80 Mn | +27.3% |

| Pre-Tax Profit | 17.43 Mn | 7.07 Mn | +146.6% |

| Net Profit | 11.85 Mn | 9.16 Mn | +29.3% |

| Earnings Per Share (EPS) | 0.37 | 0.29 | +27.6% |

| Operating Cash Flow | 22.91 Mn | (0.55 Mn) | +4,242.0% |

| Closing Cash Balance | 31.58 Mn | 14.55 Mn | +117.1% |

| Coffee Sales Volume | 351 tons | 272 tons | +29.0% |

| Average Price per Kg (USD) | 5.76 | 4.68 | +23.1% |

“Despite production challenges, the company capitalized on favorable pricing and sales growth to deliver significant profit expansion,” the board noted.

- •Gross profit climbed to KSh 86.3 million, a 27% increase from FY2024, while earnings per share rose to KSh 0.37, up from KSh 0.29.

- •Operating cash flow rebounded to KSh 22.9 million, reversing the previous year’s marginal outflow.

- •However, total assets contracted slightly to KSh 1.57 billion, down from a peak of KSh 1.76 billion in FY2024, largely due to revaluation adjustments.

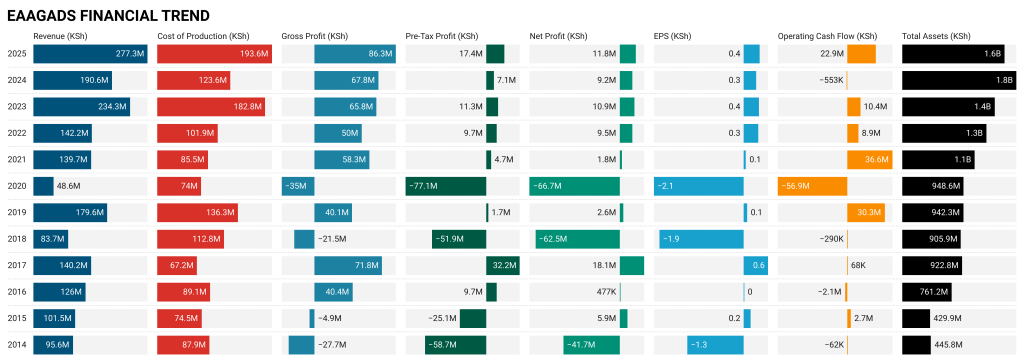

A Decade-Long Turnaround

The FY2025 results cap a multi-year recovery for Eaagads, which posted a KSh 66.7 million loss in FY2020 amid depressed coffee prices and adverse weather.

Since then, revenue has nearly tripled, and net profit has rebounded steadily in four consecutive years. From a low of KSh 48.6 million in revenue in FY2020, the company has steadily built back its earnings capacity, supported by asset revaluation and climate-resilient production practices.

“The outlook is promising, with robust flowering signaling potential recovery towards 290 tons (100T early + 190T late crop) for 2025/26,” the board stated. “While rainfall forecasts remain average, proactive climate-smart farming initiatives are enhancing yield stability. Strategic pricing and cost management continue to deliver strong margins, positioning the company for sustainable growth despite climatic headwinds.”

The board of directors did not recommend payment of a dividend for the year ended 31 March 2025 (31 March 2024: Nil), opting to reinvest earnings into field rehabilitation and sustainability efforts.