In recent years, the Kenyan business environment has faced numerous challenges, including the economic impact of the COVID-19 pandemic, the Russia-Ukraine War, and a decline in the value of the Kenyan Shilling against the US Dollar. These factors, combined with high taxation and other difficulties, have placed many companies in a precarious financial situation. As a result, the concept of receivership, which is intended to assist creditors in recovering funds, has been applied to several businesses. However, the consequences of receivership have often been detrimental, leaving stakeholders questioning whether alternative approaches could have been more effective in saving these companies.

Understanding Receivership:

Receivership is a legal process in which a court appoints an independent “receiver” or trustee to manage all aspects of a troubled company’s business. While receivership may benefit lenders by enabling them to recover funds from defaulting borrowers, it often poses challenges for other stakeholders, including employees, suppliers, and shareholders. During the receivership, the company’s principals retain little authority over the business, potentially exacerbating its difficulties.

Several Kenyan companies that have been put into receivership have faced significant challenges and failed to recover, highlighting the weaknesses in the country’s insolvency laws. Three notable examples are Nakumatt Holdings, ARM Cement Plc, and Deacons East Africa.

Nakumatt

Nakumatt Holdings was once one of East Africa’s largest supermarket chains, operating in Kenya, Uganda, Tanzania, and Rwanda. However, the company faced financial difficulties and was put into receivership in 2017. Despite attempts to restructure and recover, Nakumatt Holdings ultimately failed to overcome its financial challenges. The company was unable to pay its debts and meet its financial obligations, leading to liquidation and closure of its stores.

Chase Bank, Imperial Bank

The receivership of Chase Bank and Imperial Bank in 2015/16 had far-reaching consequences. Placed under receivership due to inappropriate banking practices, these banks suffered reputational damage, job losses, and panic among customers. The negative impact on the banking sector affected both individuals and businesses, hindering economic growth.

The Case of TransCentury:

TransCentury is Kenya’s best known investment group and kicked off its journey in 1998 with a membership of 29 and eventually went on to list on the Nairobi Securities Exchange in 2011.

TransCentury PLC invests in power infrastructure, transport infrastructure, and engineering industries in East, Central, and Southern Africa. The company operates through two segments: Power and Engineering.

The company on Saturday faced receivership after defaulting on a loan from Equity Bank and experiencing a failed rights issue.

Equity Bank appointed joint receivers and managers to oversee TransCentury’s affairs, while East African Cables Kenya, a subsidiary of TransCentury, was placed under joint administration. These actions stripped the directors of their authority and created uncertainties for the company’s future.

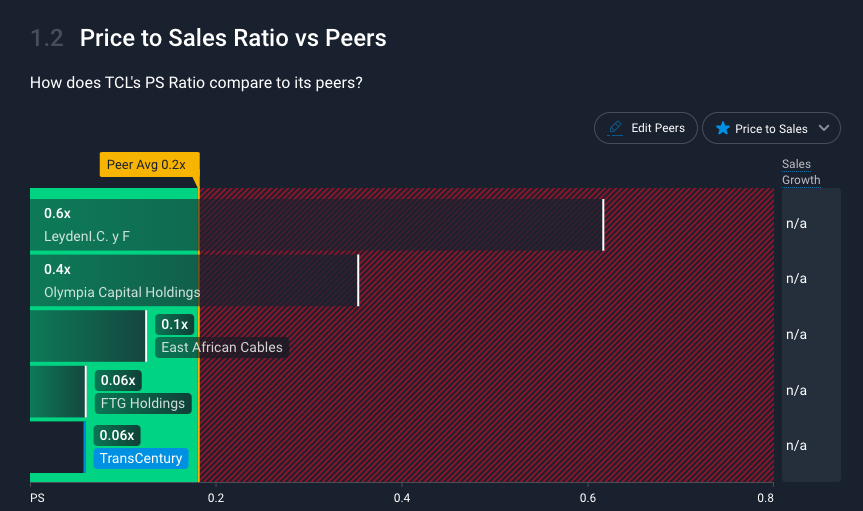

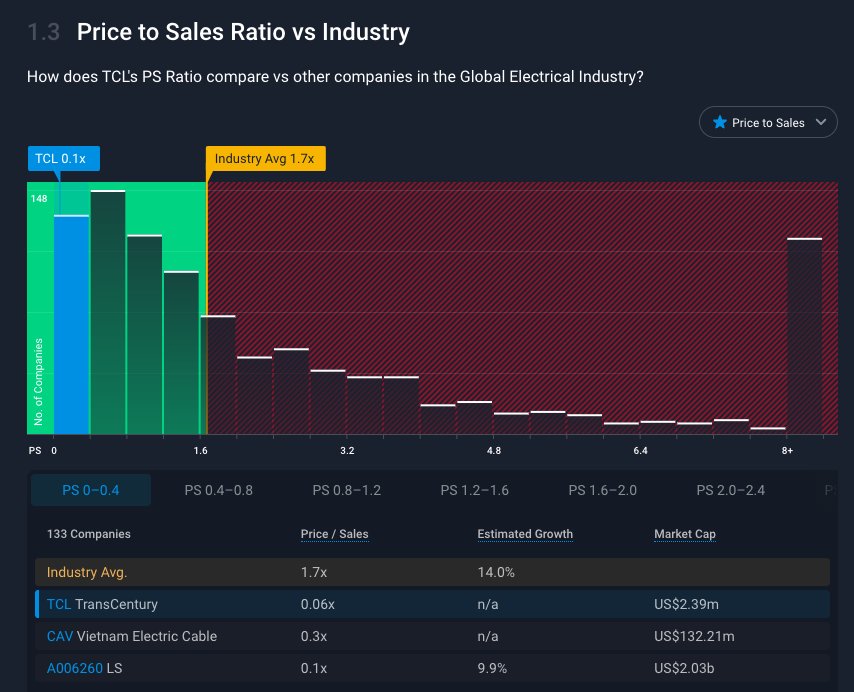

TransCentury has promising fundamentals with its Price-To-Sales ratio of 0.1x, compared to the peer average of 0.2x, suggesting that the company is undervalued in the market.

Similarly, when compared to the global electrical industry average, TransCentury’s Price-To-Sales ratio indicates it is good value. These positive indicators should be considered when evaluating the impact of receivership.

Negative Impact of Receivership:

- •Job Losses and Financial Losses: Placing a company under receivership often leads to the removal of directors, causing them to lose their jobs and any outstanding salaries. Furthermore, the assets of the company may be sold at a discount to expedite the debt recovery process. This can result in significant financial losses for stakeholders, including investors, creditors, and suppliers.

- •Reputation Damage: Receivership can tarnish a company’s reputation, which may have adverse effects on its ability to attract future investments or secure business relationships. The negative publicity associated with receivership can hinder the company’s prospects for recovery.

- •Disruption to Employees’ Livelihoods: The appointment of receivers can disrupt the livelihoods of employees, leading to layoffs or uncertainty about job security. This not only impacts individuals and their families but also undermines the overall socio-economic stability of the community.

- •Hindered Business Recovery: Placing a company under receivership may impede its chances of recovery. The sale of assets at a discount and the disruption caused by receivership can hinder the company’s ability to regain its financial health and resume operations effectively.

Placing a company into receivership should be the last resort, as it often leads to negative consequences. The negative consequences extend to employees, suppliers, and shareholders, as seen in various Kenyan cases. Instead of immediately resorting to receivership, exploring alternatives such as debt restructuring, government support, and capital market facilitation can provide struggling businesses with opportunities for recovery while preserving jobs and stimulating economic growth.

ALSO READ;

Kenya’s Stock Market Earns Title of Worst Performing Globally Amid Dollar Shortages

Kenya’s Firms Hit Hard by Weak Shilling, High Fuel Costs – May PMI Index