African stock markets slumped this week as renewed global trade tensions, triggered by U.S. President Donald Trump’s sweeping new tariffs, roiled global financial markets. From Johannesburg to Casablanca, investors fled equities, worried that the escalating trade war could slow global growth and dent foreign investment flows into African economies.

Market Snapshot: Weekly Index Moves

| Exchange (Index) | Weekly Change | % Change |

|---|---|---|

| Johannesburg (JSE All-Share) | ≈ -250 points | ≈ -3% |

| Nigeria (NGX All-Share) | -1,295 points | -1.23% |

| Nairobi (NSE All-Share) | ≈ -8 points | ≈ -6% |

| Egypt (EGX 30) | -559 points | -1.86% (Wed); -3.3% (Sun) |

| Casablanca (MASI) | ≈ -800 points | -5% (Mon); est. -6–7% (week) |

Nairobi: NSE Hit Hard by Foreign Exits

Kenya’s Nairobi Securities Exchange (NSE) was among Africa’s hardest hit. The NSE All-Share Index dropped approximately 6% through mid-week, with Monday alone seeing a 1.8% decline. By Wednesday, investor wealth had shrunk by KSh124.4 billion, with blue chips like Safaricom (-7.5%), Equity Group (-9.7%), and KCB (-11.2%) leading the slide.

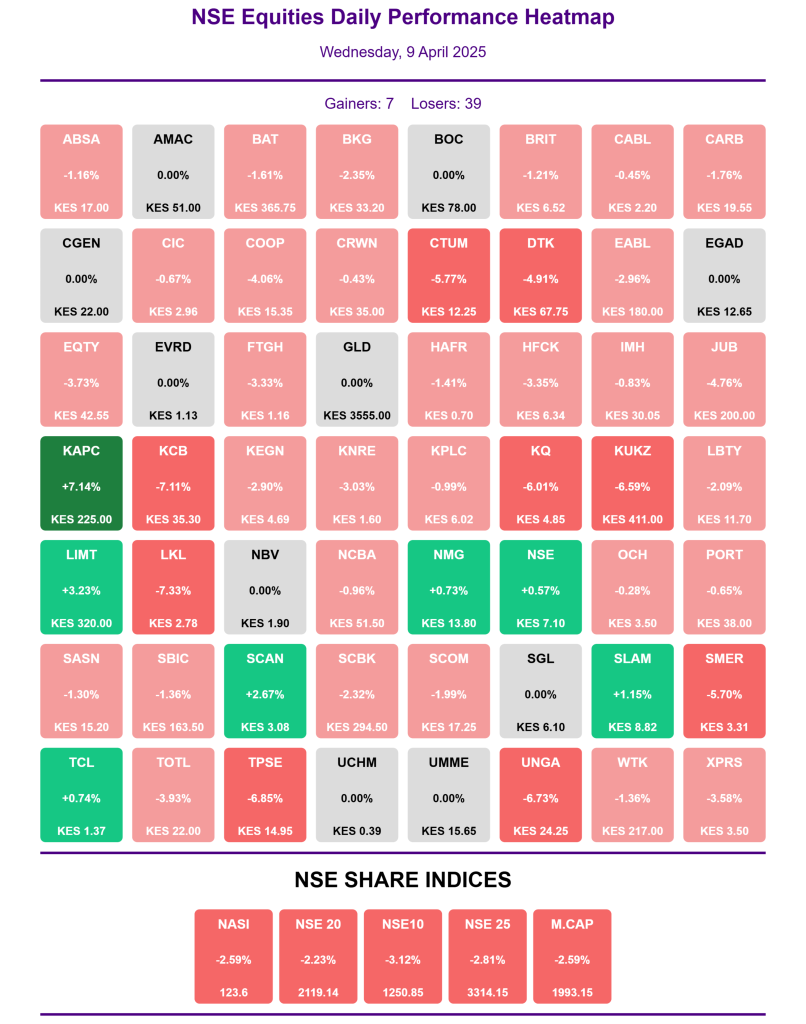

Nairobi’s All Share Index (NASI) fell 2.59% on 9th April 2025, marking its steepest single-day drop since 28th March 2024, when it slid 3.98%.

Foreign investors turned aggressive sellers, offloading a net KSh14.7 million on Monday alone. Local investors joined the exodus mid-week, contributing to the worst one-day market cap loss (KSh51.5 billion) in over a year. Many expect bond markets to absorb the cash fleeing equities.

Johannesburg: Trade-Exposed and Directly Targeted

South Africa’s JSE suffered steep losses amid direct inclusion in Trump’s tariff list. On Monday, the market plunged nearly 5% in early trade—hitting a nine-month low—before trimming losses to close slightly lower. The Top-40 Index closed just 0.3% down that day, but the JSE remained ~3% lower by mid-week.

Heavyweights such as Anheuser-Busch InBev (-4.2%), Richemont (-3.2%), Naspers (-3.5%), and Anglo American (-1.6%) led declines. Analysts cited fears that South Africa’s exposure to U.S. tariffs (notably a 30% duty) could disrupt supply chains and trigger economic contraction.

The rand fell to an 18-month low (R19.31/$) amid the global risk-off wave, while bond yields on the 2030s initially spiked before stabilizing. Some recovery in bank and retail stocks occurred by Tuesday, but sentiment remained fragile.

Nigeria: Global Selloff Meets Local Sensitivity

The NGX All-Share Index dropped 1.23% on Monday, falling 1,295 points to 104,216.87—its steepest daily loss in three months. The decline erased recent gains and left the index up just 1.3% year-to-date.

Blue-chip stocks bore the brunt: OANDO hit the 10% daily loss limit, while foreign selloffs triggered outsized losses across major sectors. Foreign portfolio sensitivity remains high in Nigeria, where tariff concerns also weighed on the naira. The Central Bank intervened with a US$198 million injection to steady the currency as oil prices dropped below US$63 on demand fears.

Egypt: Early Losses, Brief Recovery, Renewed Decline

Trading Sunday through Thursday, Egypt’s EGX was first to react. On Sunday, the EGX30 fell 3.34%, wiping over 1,050 points. Small- and mid-cap indices (EGX70, EGX100) shed even more.

Foreign investors initially bought into the weakness, but by Wednesday had turned net sellers. The Egyptian pound weakened to LE51.7 against the dollar before rebounding slightly. For the week, Egypt’s main index was down ~4–5%, as trade war headlines drove volatility.

Morocco: Market Shaken Despite Low U.S. Exposure

Casablanca’s MASI index fell over 5% on Monday, erasing roughly 800 points—its steepest drop in years. Despite Morocco’s limited direct exposure to U.S. trade (only ~3% of exports), investors reacted to the global risk environment.

A modest rebound on Tuesday (+1.3%) was short-lived, as renewed trade tension headlines sent the index down nearly 3% again on Wednesday. Analysts pointed out that Morocco’s strong fundamentals may help it weather the storm longer term, but for now, investor flight has left the market down about 6–7% on the week.

Wider Africa: Contagion and Currency Pressure

Markets such as Ghana and the BRVM saw less dramatic losses, but the global rout still echoed across West Africa. Currency pressure was a consistent theme: central banks in Nigeria, Kenya, and Egypt all stepped in to shore up weakening exchange rates. Ghana’s cedi held steadier, but officials flagged risks to cocoa and oil earnings.

Global Selloff Context: V-Shaped U.S. Rebound, Africa Lags

Global markets initially plunged on Trump’s tariff announcement, with U.S. indices like the S&P 500 and Nasdaq falling sharply Monday before rebounding on Wednesday after a surprise 90-day tariff pause for most nations (excluding China). Asian indices such as the Hang Seng saw double-digit losses, while European markets like the DAX and FTSE stayed underwater through mid-week.

In contrast, African markets did not benefit from the same relief rally. Slower information flow, lower liquidity, and less algorithmic trading meant African bourses tracked the risk-off sentiment without a rebound kicker.

Sector Trends: Exporters, Banks, and Commodities Suffer

- •Exporters: Stocks reliant on global trade (e.g. South Africa’s Naspers, Morocco’s manufacturers) were heavily sold.

- •Banks: Equity Group and KCB in Kenya, South African lenders, and Nigerian banks all declined as recession fears mounted.

- •Commodities: Oil and copper fell sharply, pressuring Nigeria and Zambia; gold rose, boosting miners and reserve assets.

- •Safe havens: Investors fled to gold, U.S. dollars, and bonds, leading to sharp FX moves across African markets.

Foreign investors led the selloff across key markets—South Africa, Kenya, Nigeria—while local institutions selectively bought into weakness. In Egypt, local investors absorbed some of the foreign outflows mid-week. The dynamic highlighted Africa’s growing integration with global capital flows: when global sentiment sours, frontier markets bleed first and recover last.

While some African bourses may find a floor if U.S. policy softens further, any new escalation in trade tensions could extend losses. Policymakers across the continent face a tough balancing act: supporting currencies, guarding reserves, and maintaining investor confidence amid volatile capital flows.