First Published on August 26th, 2022 by Bob Ciura for SureDividend

At Sure Dividend, we are huge proponents of investing in high-quality dividend growth stocks. Among the thousands of dividend stocks out there, investors can focus on the “cream of the crop”: the Dividend Aristocrats, and the Dividend Kings.

The Dividend Aristocrats are a group of stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. You can see all 65 Dividend Aristocrats here.

You can download an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

There is an even more exclusive club than the Dividend Aristocrats — the Dividend Kings, a list of just 45 stocks with 50+ consecutive years of dividend increases. You can see all 45 Dividend Kings here.

The reason why we are so adamant about dividend growth stocks is simple.

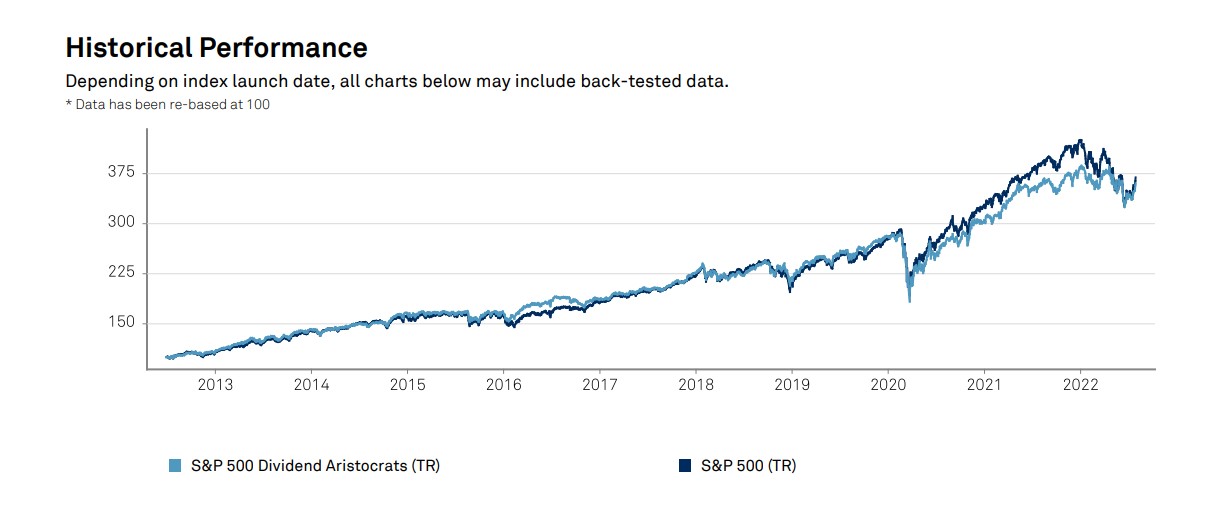

Research has shown the Dividend Aristocrats have generated higher risk-adjusted returns than the broader S&P 500 Index, over the long term.

According to Standard & Poor’s, the Dividend Aristocrats producedannualized returns of 13.5%, compared with annual returns of 13.8% for the broader S&P 500 Index.

Source: S&P Dividend Aristocrats Fact Sheet

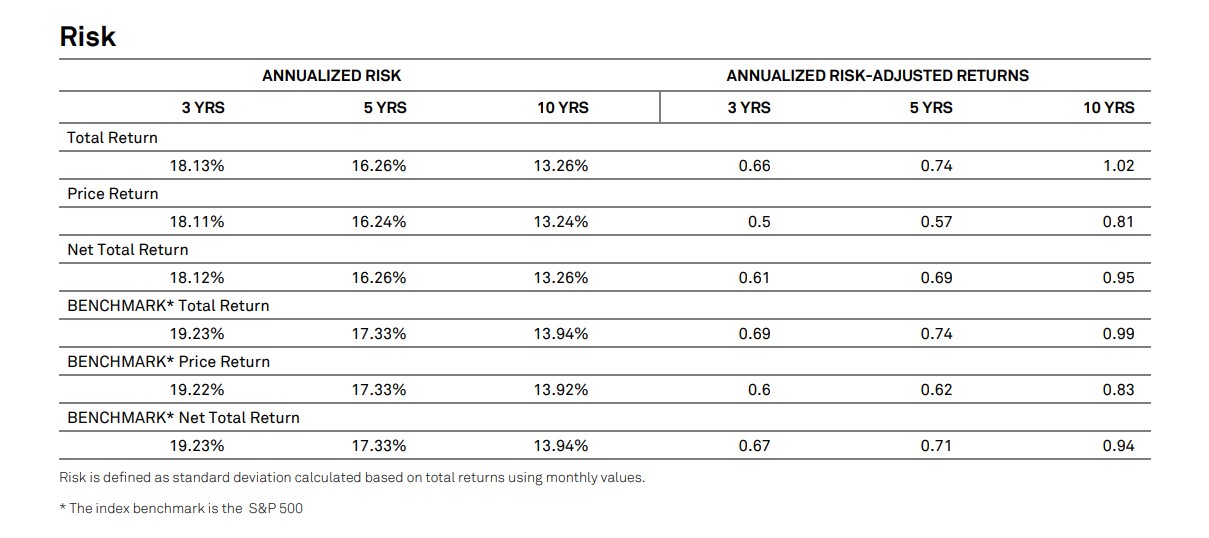

But in terms of risk-adjusted returns, which incorporates volatility (as measured by standard deviation), the Dividend Aristocrats produced higher annualized risk-adjusted returns over the past decade.

You can see this difference in the image below:

Source: S&P Dividend Aristocrats Fact Sheet

Earning a place on the Dividend Aristocrats list is a great sign that a company has durable competitive advantages and a strong business model.

There are many financial products that investors can build a portfolio around. At Sure Dividend, we have a particular fondness for dividend stocks. But annuities are another popular financial vehicle, utilized by millions of Americans.

This article will compare-and-contrast dividend stocks versus annuities.

Table of Contents

You can instantly jump to any specific section of the article by utilizing the links below:

- •Why Invest In Dividend Stocks?

- •Annuities: Pros and Cons

- •Real-World Examples of the Power of Dividend Growth Investing

- •Final Thoughts

Why Invest In Dividend Stocks?

Given the returns generated by dividend stocks mentioned in the opening paragraph, a better question might be: why not invest in dividend stocks?

The S&P 500 Index delivered annualized total returns of 10%-11% from 1926 through 2018.

Even better, stocks that pay dividends (and raise their dividends on a regular basis) have proven to outperform stocks that don’t pay dividends. Dividends provide a buffer against falling markets, and help boost returns even further during bull markets.

In 2008, the worst year of the Great Recession, the Dividend Aristocrats Index declined 22%, while the S&P 500 declined 38%.

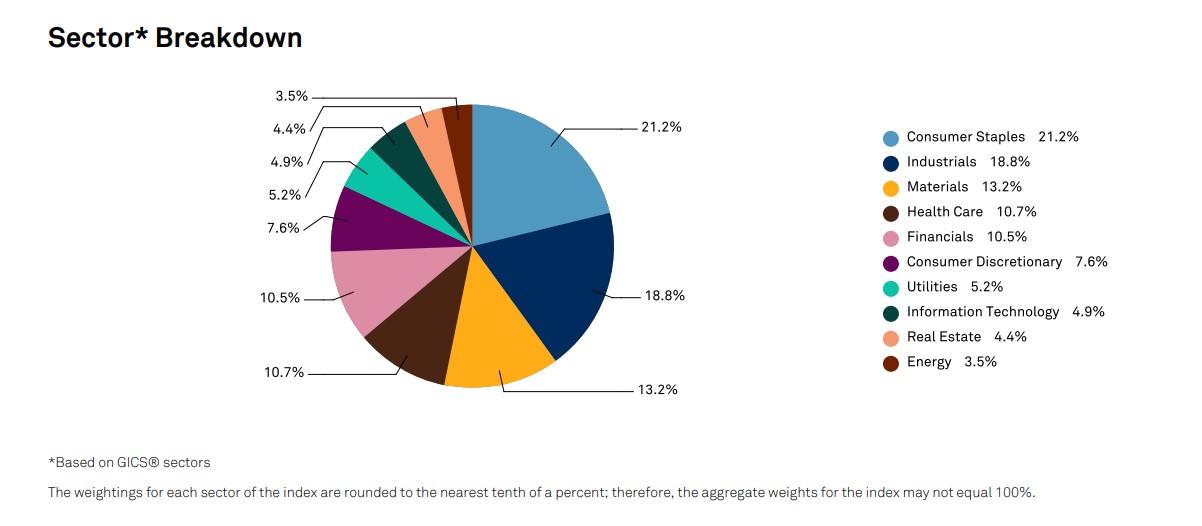

The list of Dividend Aristocrats is balanced across market sectors.

Source: Fact Sheet

The highest allocation of the Dividend Aristocrats is in the consumer staples, industrials, and materials sectors. This should come as no surprise, as these industries enjoy steady product demand from year to year, even during recessions.

Not all stocks choose to pay dividends to shareholders. On the other hand, many stocks do pay dividends, and these are the types of stocks we focus on at Sure Dividend. In particular, we frequently recommend investors begin their search with the Dividend Aristocrats.

The benefits of dividends can be overlooked, particularly during bull markets. Investors have a tendency to dismiss dividend stocks as boring, especially when markets keep setting new highs.

But market downturns do happen, and by several economic measures, the U.S. stock market appears to be overvalued.

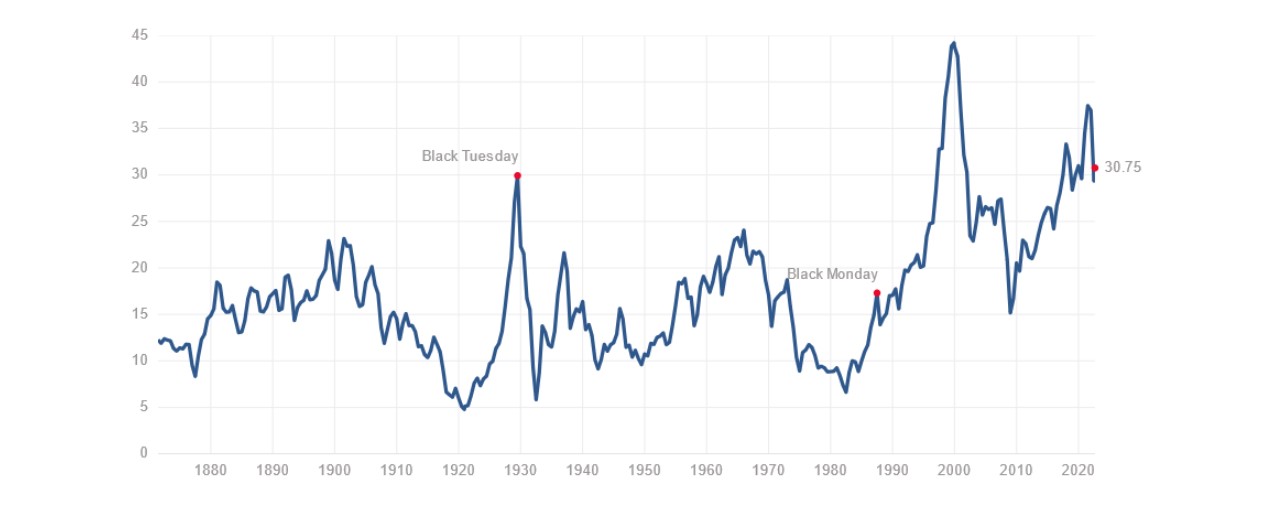

For example, using the widely-followed stock valuation metric known as the Cyclically Adjusted Price-to-Earnings ratio (also called the Shiller P/E ratio), stocks are valued at a price-to-earnings ratio of nearly 31.

Source: Multipl.com

The CAPE ratio is based on average inflation-adjusted earnings of the S&P 500 Index from the previous 10 years. Based on this metric, U.S. stocks are currently trading at above-average levels.

Going back further, a Shiller P/E of ~31 is higher than both Black Monday and Black Tuesday. The median Shiller P/E ratio, going back over 100+ years, is just 15.88.

Many high-quality dividend growth stocks are not as aggressively overvalued right now as other sectors, such as technology stocks. This will help lessen the damage, during the next market downturn.

More broadly, steady and growing dividends are a sign of a disciplined management team. Companies that do not pay dividends are under no obligation to return cash to shareholders. That leaves a lot of cash flow left over each year, which can be used to benefit shareholders, or not.

Instead of paying dividends to shareholders, management can pay themselves huge bonuses, or conduct empire-building campaigns, marked by wasteful spending or foolish acquisitions. Put simply, dividends keep a management team honest.

When markets are in rally mode, most of the attention goes to the high-fliers, such as tech stocks. Dividends are often seen as too boring—but nothing could be further from the truth.

Annuities: Pros and Cons

To be sure, dividend stocks are not the only way to build wealth over the long-term. There are many different routes one can take, on the long road to financial freedom. Annuities can also serve a valuable purpose.

An annuity is a financial contract with an insurance company. The purchaser of the annuity makes either a lump-sum, or periodic payments. In return, the insurer will make payments to the purchaser, at some point in the future, depending on the type of annuity purchased.

There are a number of good reasons to purchase an annuity, chief among them the ability to manage income during retirement. Annuities provide steady, periodic payments for a certain period of time, such as the duration of the purchaser’s life, or the life of another person. You can figure out whether it’s good or not with this report builder which will give you valuable insight into the stock. This will help you make an informed decision when investing.

Annuities also have death benefits. If the purchaser dies before payments begin, a designated beneficiary can receive the payments.

Lastly, annuities offer tax-deferred growth. Income and investment gains from annuities are not taxed until withdrawals are made.

There are many different kinds of annuities, the three most popular being fixed, variable, and indexed. A fixed annuity is the simplest form. The insurer provides a minimum interest rate with fixed periodic payments.

Variable annuities can provide higher returns than fixed annuities, but also have higher risk, as the insurer will direct annuity payments toward investments, such as mutual funds. Payouts will vary, depending on the rate of return of the selected investments.

The last type of annuity is the indexed annuity, which is a blend between an insurance and investment product. An indexed annuity tracks the performance of a benchmark stock market index, such as the S&P 500 Index.

The appeal of annuities is that they are relatively low-risk, particularly when it comes to fixed annuities. Fixed annuities have guaranteed payments. However, annuities are not risk-free.

For example, purchasers must consider the financial strength of the issuer. It is critical to assess whether the insurance company will still be around once payouts are scheduled to begin.

In addition, while fixed annuities are low-risk products, variable annuities involve market risk, as investors will be exposed to the stock market.

Annuities also carry fees, which is a significant disadvantage, compared with investing in individual stocks. Whereas the only cost of stock market ownership is brokerage trading fees, which are often very low, annuities often have a multitude of fees. For example, annuities can charge administrative fees, mortality fees, and in the case of variable annuities, the mutual funds’ annual expenses.

Fees can really add up over time. For example, say an investor purchases a basket of dividend growth stocks that earns 10% per year. A different investor purchases a mutual fund with a 1.25% annual expense ratio, and the mutual fund also earns 10% per year. Assume a $10,000 investment in each case.

In the first example, in 30 years the dividend stock investor will have a portfolio worth $175,000. But the second investor will only have $108,000—a difference of roughly $67,000, or 38% less than the first investor. This shows the dramatic impact of a seemingly-innocuous 1.25% annual expense ratio.

Moreover, one of the biggest benefits of annuity ownership—tax-deferred growth—can also be achieved with dividend growth stocks. Investors can open a tax-advantaged account, such as a workplace 401(k) or an Individual Retirement Account. And, when it comes to the Roth IRA, all gains are tax-free.

Plus, returns from dividend growth stocks are hard to beat, particularly after annuity expenses are taken into account.

Real-World Examples of the Power of Dividend Growth Investing

To demonstrate the power of dividend growth investing over long periods of time, investors can consider healthcare giant Johnson & Johnson (JNJ), consumer products manufacturer Procter & Gamble (PG), and beverage behemoth Coca-Cola (KO).

All three stocks are Dividend Aristocrats, and are also Dividend Kings.

Consider the returns these stocks have generated over the past 30 years, had investors simply bought and held, while reinvesting dividends along the way. In the past 30 years through August 25th, annualized total returns for J&J, PG, and KO totaled 11.7%, 11.4%, and 8.7%, respectively.

As you can see, all three stocks provided at least 9% returns each year, over the past 30 years. Importantly, the rate of return over those three decades includes reinvested dividends.

These kinds of returns can be incredibly powerful, over long periods of time. At a compound annual growth rate of 9%, an investment doubles every 8 years.

J&J, P&G, and Coca-Cola share a few key qualities. Not only do they all pay dividends, and have increased their dividends for 50+ consecutive years, but they also have strong brands and durable competitive advantages.

J&J has been in operation for over 130 years. It is a diversified healthcare company, with a huge presence across pharmaceuticals, medical devices, and consumer health products.

It is one of the world’s largest healthcare companies, with annual revenue above $90 billion, and more than 250 subsidiary companies. J&J stock has a current dividend yield of 2.6%.

Meanwhile, P&G is a global consumer products giant. It sells its products in over 180 countries around the world. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral–B, and many more. The company generates over $75 billion in annual sales.

P&G’s biggest competitive advantage is its brand strength. Top-quality products and brand recognition allow for steady growth each year. P&G has a current dividend yield of 2.5%.

P&G has increased its dividend for 66 consecutive years.

Coca-Cola is the world’s largest non-alcoholic beverage company. It owns or licenses more than 500 non-alcoholic beverages, including both sparkling and still beverages. It sells its products in more than 200 countries around the world.

The core sparkling beverage portfolio includes the flagship Coca-Cola brand, as well as other soda brands like Diet Coke, Sprite, and more. Coca-Cola also has a large portfolio of still beverages, including Dasani, Minute Maid, Vitamin Water, and Honest Tea.

Coca-Cola stock has a current dividend yield of 2.7%, and has increased its dividend for 60 consecutive years.

Final Thoughts

The beauty of high-quality Dividend Aristocrats and Dividend Kings, is that they have the ability to raise their dividends each year, regardless of the condition of the overall economy. Along with strong business models and industry-leading brands, their dividends help fuel impressive returns.

The best dividend growth stocks, such as J&J, P&G, and Coca-Cola, have provided strong returns over the past 30 years. Over long periods of time, these returns can provide a secure financial future.

Annuities can also serve a purpose for investors planning for retirement. Fixed annuities provide guaranteed payouts, while variable annuities provide future income streams, with some exposure to stock market gains.

However, annual fees can erode returns generated by annuities, and make them relatively unattractive when compared with dividend growth stocks.

Brokerage commissions have come down significantly in the past few years. Many brokerages now offer no commissions on stock trades. As a result, we believe buying and holding quality dividend growth stocks such as the Dividend Aristocrats and Dividend Kings is far more preferential to paying 1.25% (or more in some cases) each year, to invest in annuities.

Buying individual stocks requires more research, but the potential rewards are well worth it.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

2023 High Dividend Stocks List | Highest Yields Up To 20.2%

10 Things To Look For In A Dividend Portfolio Management Tool