You might want to consider saving in Bitcoin, like i did after coming across Bitcoin in late 2013. I committed to saving 3,000 KES every first day of the month since January 1 2014 and today, my bitcoin savings are worth 392,679 having grown 211% in 42 months. If I had instead tucked away this same amount in a traditional Kenyan shillings bank account lets say Mshwari, my savings would total 138,386 today, a little over 9.8% more than my initial. My Bitcoin savings turned out to be a great investment opportunity!

When I first came across Bitcoin, I was in my final year at the University and was slaving away at the ex Ministry of Justice as an IT and network intern. I was immediately fascinated by this newly fangled digital currency. Rather than partake in discussing siasa, over newspapers, chai and mandazi, as happens at most serikali offices, I dedicated the last month of my internship to understanding Bitcoin.

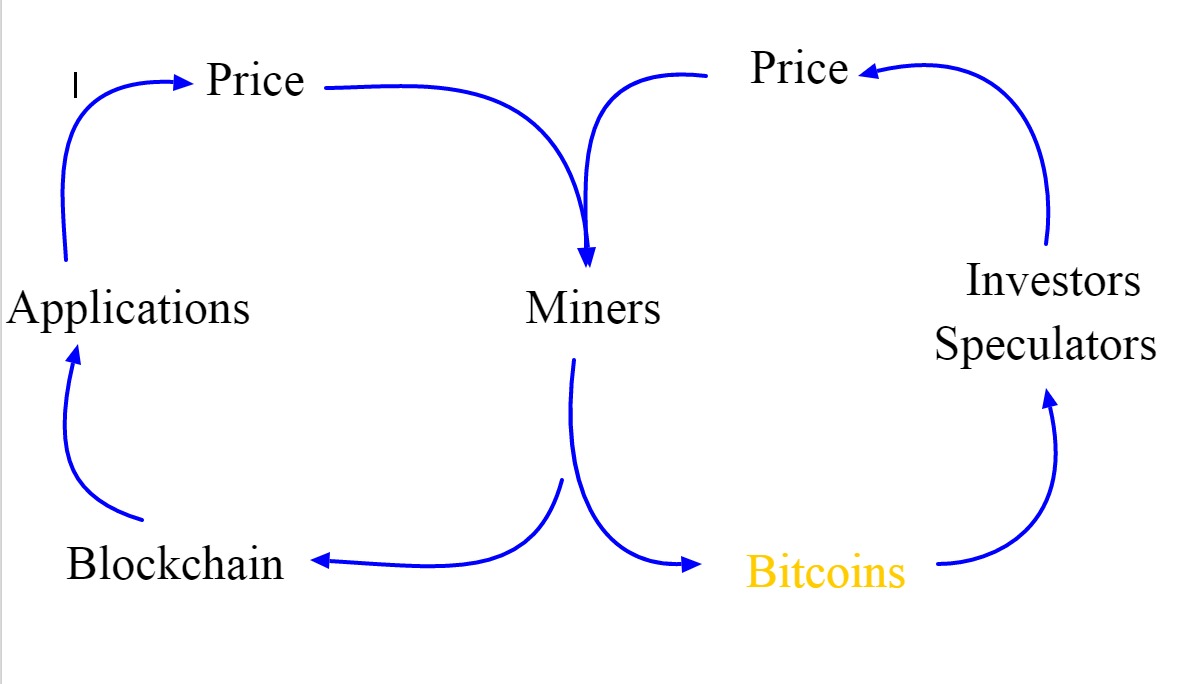

I found out that Bitcoin was a digital token native to a distributed network known as the blockchain. There were only 21 million digital coins, a fixed limit that was hard coded on a public transparent ledger, known as the blockchain. A network of miners were entrusted to secure the integrity of this public ledger, and make sure no one tampered with it. In turn, the ledger could be used to store sensitive data for real world applications and keep track of the ownership of these coins.

Bitcoins were the economic incentive for miners to secure the blockchain for all the disruptive applications that were now possible on the blockchain. Every expert I came across agreed it solved one of the greatest puzzles in modern day internet; how to enforce trust online without relying on a single person, entity or institution.

Anyone who contributed computing power to secure the integrity of this public record, had a chance at claiming newly mined bitcoins, distributed as a reward for securing the network. Miners were rewarded with newly minted bitcoins. This is how the millions of bitcoins in circulation came into existence, versus say, having an authority like a Central Bank manage the issuance and distribution of coins.

The blockchain was cheap but not free to use, so the fees for using this network were only payable in the native currency, Bitcoin. The miners would therefore sell their shiny new bitcoins on the open market to pay for their electricity costs in the real world. Meanwhile, Bitcoin buyers varied from investors, application companies and speculators, who saw the potential of all the possibile blockchain applications. Others, reckoned this was the beginning of a global internet money free from government control. Regardless of demand incentives, the net result was an organic price discovery on the open markets in USD, EUR, RMB, JPY and KES, where regular people, like myself could acquire bitcoins.

It was a lot to absorb. I mulled over of what I had stumbled on in the weeks that followed. It took me another month of recommended readings to realize that the state of money was not set in stone. Money had evolved from the large stone discs of the Pacific island of Yap, to cowrie shells, to paper currencies, to mobile money, airtime currency and bonga points today. The idea of a global digital currency was not far fetched after all.

I went on to learn how to send and receive bitcoins, how to open and secure a bitcoin wallet and where to buy and sell bitcoins. It had only been 5 years since it emerged, so I was not too late.

I wrapped up my research by crafting a Bitcoin savings plan, inspired by the 52 weeks savings challenge but with a twist. Mine was modelled on setting aside 3,000 KES for buying bitcoin at whatever price on the 1st day of each month and storing them in my secure bitcoin wallet. The idea was to average down the cost over time, so that, even if the price went up and down over time, I would accumulate returns in the long term. Stock investors often used dollar cost averaging to go long on promising companies.

I shared my findings and savings plan with my best friend Mutwiri. He was not convinced. At the time, Bitcoin had just spiked to $1100 on the back of Chinese demand, and was all over the news. “How could some stupid little internet magic money have value?” Mutwiri asked. It all sounded crazy to him. But, he liked the savings plan spreadsheet, and considered adapting it for his own version of an Mshwari savings plan. Mshwari paid 7% interest per annum compounded quarterly. He would put aside 3,000 KES every 1st day of the month into Mshwari.

On 1 January 2014 the price of 1 Bitcoin was 84,400; with my 3000 KES savings, i bought and saved 0.035545 BTC. The next month on February 1st price had dropped to 68,700 and my 3,000 bob bought me 0.043668122 BTC. I got more bitcoins for my fixed savings commit. I stuck to my plans over the next 3 years.

In the 42 months since i started saving in January 2014, I have amounted a total of 2.913049017 BTC and my savings are worth 392,676 KES as at 1st May 2017, a 211% return over 42 months. Even though the price of bitcoin has fluctuated wildly over the years, dollar cost averaging has served me well. In comparison, Mutwiri’s savings now total 138, 386 KES, 9.8% return over the same period.

I got 266,279 KES returns over and on top of my initial savings, while Mutwiri only got 12,385 over his savings. I intend on sticking to my plan for the foreseeable future, and hopefully have enough to buy a plot someday. For me, saving in Bitcoin certainly beats saving in Mshwari hands down.

Related; Bitcoin explained: The digital currency making millionaires

About Michael Kimani

Michael is a Bitcoin Market Analyst and Founder at Bloc Chain East Africa Ltd., a company bridging the gap between East Africans and Bitcoin blockchain technology. A recognized thought leader on Bitcoin in East Africa, Michael consults on Bitcoin as a new digital asset class with unprecedented upside potential. He has been featured on BBC Radio show, CNN, Fast Company and occasionally writes opinion for the Daily Nation and other online publications on the subject. Prior consulting,Michael traded derivatives on Chicago’s Mercantile exchange and most recently, worked with Emerging Futures Lab on human centered design research for East Africa’s informal sector and digital financial services.

Twitter: afrokoin

Email: [email protected]