Money sent home by Kenyans living and working in the diaspora dropped by 2% in September compared to August partly owing to a slowdown in major economies.

- •Diaspora inflows decreased to KSh 53.9 billion (US$418.5) from KSh 55.1 billion (US$427.2) in August 2024.

- •The decrease was primarily driven by downticks in Asia and North America, however watered down by increases in Europe and Africa.

- •Since 2015, diaspora remittances have been the largest source of foreign inflows into the country, ahead of tourism, foreign direct investments, and key agricultural exports such as horticulture and tea.

“The remittance inflows continue to support the current account and the foreign exchange market,” noted CBK in its weekly bulletin.

In the 12 months to September 2024, cumulative remittances increased by 14% to US$ 472.3 billion compared to US $414.2 billion in a similar period in 2023.

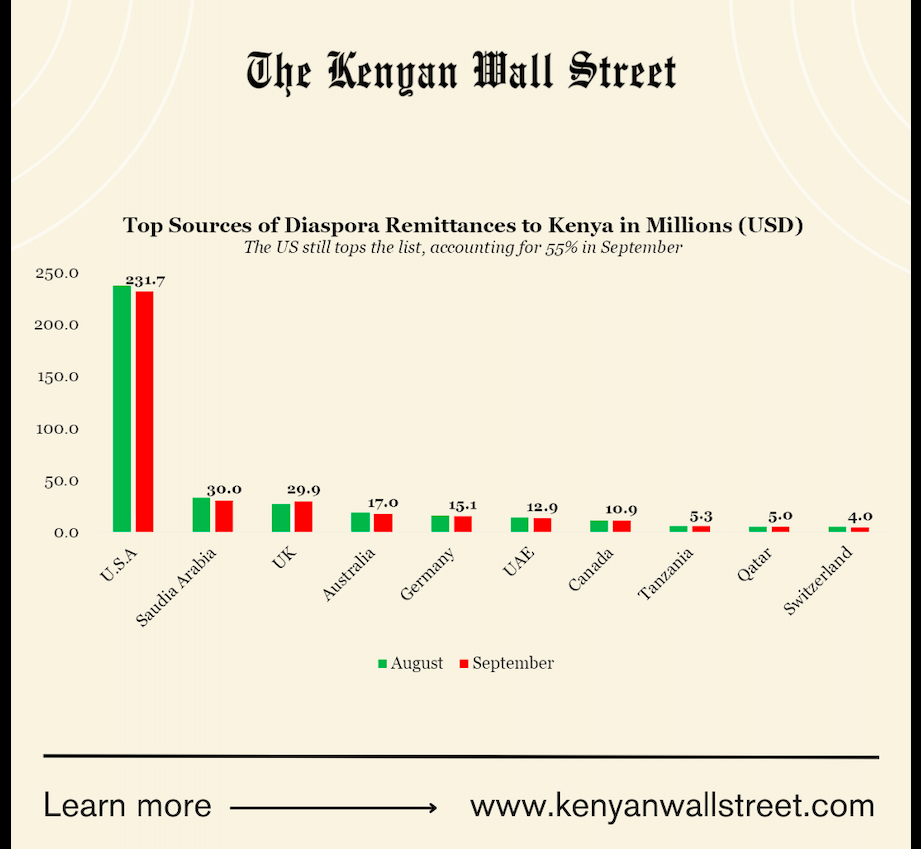

The US remained the largest source of remittances to Kenya, accounting for 55% in September. Inflows from the US saw a 2.5% slowdown in the same month.

Saudi Arabia has maintained the second source of remittances to Kenya for months, after surpassing the UK in March 2024. The shift to the Gulf region directly reflects the evolving migration laws that have made it harder for Kenyans to move to European countries, while Gulf countries have become a favorable destination due to their burgeoning labor needs.

In Africa, Uganda tops the list with remittances amounting to US$5.4 million followed by Tanzania (US$5.3 million) and South Africa (US$3.1 million) in September.

According to IFDR, Kenya is the third largest remittance recipient in sub-Saharan Africa and the fifth largest receiving country in Africa. In 2023, according to the Central Bank of Kenya, remittance flows totalled about US$4.2 billion, accounting for nearly 3.6% of the country’s GDP.