The article below first appeared and published on Addis Standard

By J. Bonsa (PhD)

At the opening of Ethiopia’s parliament on 9th October 2017, Ethiopia’s President, Dr. Mulatu Teshome, stated that earning foreign exchange has become a matter of life and death for Ethiopia. Apparently he was hinting that devaluation of the birr was about to take place. Sure enough, devaluation happened – a day later. The National Bank of Ethiopia (NBE) announced its decision to depreciate the value of the birr by 15% with immediate effect. This sequence of events clearly indicated that Ethiopia is in desperate need of hard currency. It sounds the authorities are panicking because the country’s foreign exchange reserve has been rapidly depleting.

Ethiopia’s decision to devalue the birr brings to mind Albert Einstein’s definition of insanity: doing the same thing over and over again and expecting a different outcome. I thought the EPRDF regime has done it more than enough number of times to know that the country would not achieve any economic gain by devaluing the currency. It was time the authorities do something else to address Ethiopia’s economic malaise.

In a two part piece, entitled “Is devaluation of birr the answer to Ethiopia’s economic troubles?” and “Ethiopia’s trade data and the effect of devaluation on import prices”, I have previously covered the basics of devaluations, why it is necessary and how it works, specifically the political economy context of devaluations in Ethiopia. Hence, in this piece, I will limit my analysis to evaluation of the policy targets of the latest devaluation by relating it to achievements from the previous one. I will start by highlighting statements the authorities have put forward to justify depreciation of the birr.

Rationale – official version

Secrecy is a permanent feature of the authorities in Addis Abeba. Major decisions that most certainly will affect the livelihoods of tens of millions of Ethiopians get passed without any public debate, and the latest decision to devalue the birr is no exception. According to local media reports, the decision to devalue the birr was announced by Yohannes Ayalew, vice governor and chief economist at the NBE, “at a press conference where only the state media was invited to attend.”

Ironically, the National Bank of Ethiopia (NBE), the government body that announced this decision, did not even bother to put out any document for public record. I expected such a record to appear on NBE website, where I looked for further information on official version of the rationale for the decision to devalue the country’s currency. Even the press statement or even a rehashed version of what was broadcast in the government media did not appear even as a “news items” listed on NBE’s website.

But, two separate policies were coupled into one policy package in the announcement of the devaluation. First, the birr was devalued by 15%, raising birr per USD to 26.91. This is supposed to stimulate exports, discourage imports and hence reduce trade deficit. Second, in order to ease inflationary pressure, the authorities have raised interest rate (by 2% to 7%).

Let me separately examine the two elements in the policy package using Ethiopia’s own experience and by addressing what happened to the two target policies after the previous devaluation in 2010, when the birr was devalued by 17%?

Inflation

It is useful to remind ourselves where the link between devaluation and inflation begins. Post devaluation inflation pressures begin to build up through two channels.

First, devaluation makes the domestic currency cheaper in the foreign exchange market. Now that the birr is cheap, foreigners would buy Ethiopia’s goods at a cheaper price than before, hence export competitiveness improves. The latter simply means the quantity of export goods foreigners demand will rise. If there is already a stock of exportable goods then more goods will be sold in the world market. The decrease in the stockpile of goods or the new orders will stimulate producers of exportable products, and hence they will engage in expanding their activities, which means more investment expenditure will take place. Payments for salaries or other supplies will mean new money will enter circulation and hence inflationary pressure builds up.

Second, and more straightforward, is the price increase coming through imports. Devaluation makes imports expensive in domestic markets. Prices of new orders for imports or even those that were already imported and currently in stock will immediately translate to an increase in their prices, at the very least by the rate of devaluation. Inevitably, one way or the other, devaluation will trigger an upward inflationary pressure.

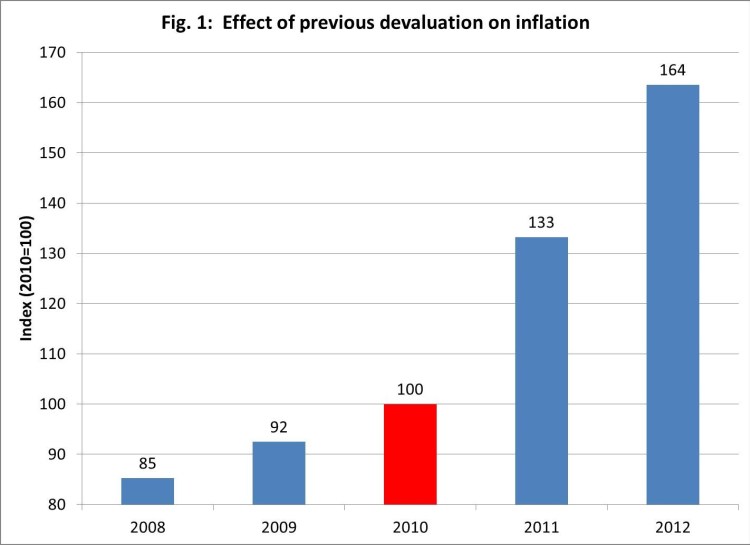

Fig. one above presents Ethiopia’s consumer price index Inflation, CPI (with 2010 = 100). The bar over 2010 is shaded in red to indicate that Ethiopia’s birr was devalued in that year, by 17%.

In two years preceding the devaluation, inflation was rising at much slower pace compared to the post devaluation year. The CPI rose only by 7% between 2008 to 2009 and then 8% between 2009 and 2010. The 2010 devaluation caused massive increase in inflation; it immediately rose by 33 points in 2011 and then by 32 points in 2012. This figures are taken from the World Development Indicators database, which is likely to be a highly conservative estimate. It was further reported in local press that the 2010 devaluation has resulted in about 40% increase in inflation.

Normally devaluation is not coupled with an interest rate hike, but the authorities in Ethiopia seem to implicitly admit that the situation was not so normal in Ethiopia so they had to resort to an unusual measure. Apparently, they were worried that large increase in inflation may result from the latest round of devaluation, again, so they seem to preempt it by raising the interest rate. There are two strange things in this saga.

First, a two per cent increase in interest rate is just a drop into an ocean, it cannot stop a powerful inflationary pressure, the kind of which the country had previously experienced. After all, the rates of devaluations are about the same, and inevitably inflation is likely to rise by about the same magnitude as before. Surely, the authorities are aware that this is the case, but they are just trying to find shortcuts by giving the impression that they have done something to stop inflation. For instance, the last devaluation was accompanied by some adjustments to salaries, e.g. for civil servants. This one is a quiet affair, no hint of possible salary adjustments. If civil servants ask for one, then the government would have a readily available answer – “look, we have increased interest rates and inflation won’t happen”, a dishonest way to address a legitimate public concern.

Second, perhaps the authorities are unaware about contradictions or conflicts in the their policy package. As noted above, the potential effect of devaluation on export promotion can be realized if and only if economic activities on export productions expand. This requires investment but interest rate increase is likely to work against investment expansions in exports production. While currency depreciation tends to stimulate exports, interest rate increase as well as increases in prices of intermediate and capital goods imports become powerful disincentives against investment.

In any event, even without creating additional hurdles in the way of export producing sectors, the benefits from devaluation would be realized only in the long run. Inevitably, devaluation would have contradictory effects in the short run. It would take time for investment decisions to be made and actual investments to take place. Given this situation, the authorities were expected to reduce interest rate to encourage economic activities, rather than doing the exact opposite.

Exports

It is appropriate to examine the likelihood that devaluation of the birr would lead to exports growth. Let’s see the extent the previous devaluation has stimulated exports. Ultimately, whether or not devaluation has succeeded would depend on the effect on trade deficit, which is given as sum of earnings from exports minus expenditure on imports. Bear in mind that export growth by itself is not enough to indicate success with devaluation. Since devaluation will make imports more expensive, then increase from exports should more than compensate for the inevitable increase in expenditure on imports . In a nutshell, although devaluation is often discussed as a means of encouraging exports, the ultimate policy target is improvement of trade deficit.

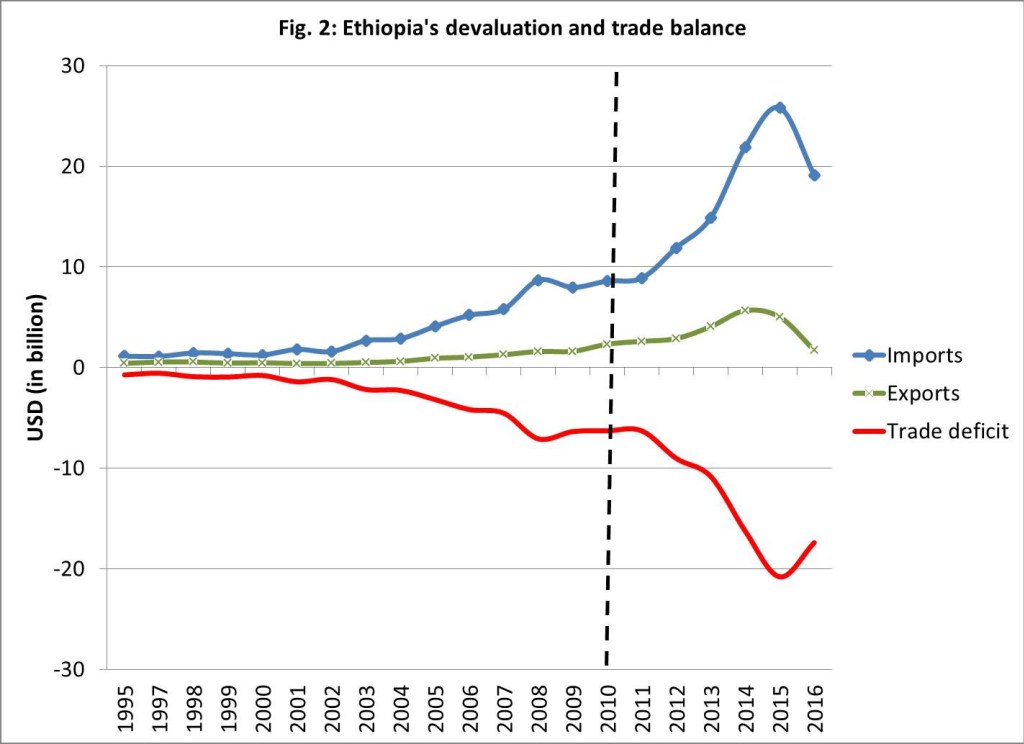

Fig. 2 displays relationships between Ethiopia’s exports, imports and trade deficit over 20 years period.

We are mainly interested in observing differences in the patterns of relationships between the three variables before and after 2010, the year of the previous devaluation, marked by the broken vertical line. Export revenues have increased from $2 billion in 2010 to $6 billion in 2014. Since the eruption of Oromo Protests, which eventually triggered the protest in Amhara regional state, export revenues have sharply declined and fell back to $2 billion in 2016, exactly where it was in the year of previous devaluation. Note that this figures are given in nominal terms, that is to say without taking the effect of inflation into account. The cumulative change in general price level (CPI) from 2010 to 2016 was 2.24; on average there has been more than two-fold increase in prices of goods and service in just six years (2010-2016). Therefore, in real terms Ethiopia’s export revenues in 2016 was less than 50% of the amount earned in 2010.

On the other hand, expenditure on imports have sharply increased from $9 billion in 2010 to $26 billion in 2015, nearly a three-fold increase. The sluggish growth in export earnings and rapid growth in expenditure on imports means Ethiopia’s current trade surplus has deteriorated, rising from about $6 billion in 2010 to $17 billion in 2016, again nearly three-fold increase.

Why doesn’t Ethiopia’s export respond to devaluation? The answer is clear and straightforward. It would be a gross understatement to say that the authorities do not do anything to stimulate export production. In fact, oddly enough, existing policies do actively discriminate against Ethiopia’s mainstay of exports such as coffee, through regional and sectoral bias. The current export policy is to encourage a pocket of new export sectors, but their contribution to overall exports growth is a drop into an ocean.

Why have expenditure on imports undergone such an explosive growth? Devaluation is an act of deliberately making imports expensive in the hope that high prices will discourage uses of imported products. However, Ethiopia’s imports are mostly essential items, necessities, such as petrol, intermediate inputs for manufacturing, and fertilizer for agriculture, among others. Importantly, proliferation of large public infrastructural projects means the very government which tries to discourage imports is actively engaged in importing capital goods at massive scale. Therefore, devaluation would not cause reduction in quantities of goods Ethiopia imports, but it just makes imported items unnecessarily more expensive.

The discrepancies between trade value and quantity would have far reaching implications. Welfare changes happen in response to changes in quantities of goods and services consumed, rather than their values. Exports are made cheaper, earnings from total exports do not grow that much, but most certainly the quantity of goods exports might have increased by significantly larger proportions than what exports in value terms would imply. There is some opportunity cost for scarce resources utilized to produce the additional goods unnecessarily made cheap and exported to earn about the same export revenue as before devaluation. On the other hand, households or businesses pay more for the same quantity of consumer or capital goods imported.

Targeted beneficiaries

The analysis so far has been confined to aggregate variables – inflation, exports, imports, and trade deficit. These tell us the effect of devaluation on the country’s economy, what is likely to happen to an average Ethiopian in the post devaluation period? Fig. 1 and 2 imply on average Ethiopians are likely to suffer. However, we know averages reveal something important but they do hide really essential elements. For this reason, we need to unpack the figures.

The bottom line is that the authorities are not as oblivious to the disastrous outcomes of devaluation as we might think, it is just a matter of isolating the target groups, whom the government targets to benefit at the expense of others. We need to shed some light on the distributional effects of devaluation, how differently various communities in Ethiopian are likely to be affected.

This requires using a specific category of trade data. For instance, aggregate exports revenue plotted in Fig. 2 does not reveal exports by type of products or their destinations. Ethiopia’s bilateral trade by product groups is likely to reveal beneficiary groups. For this purpose, I use Ethiopia’s exports to USA.

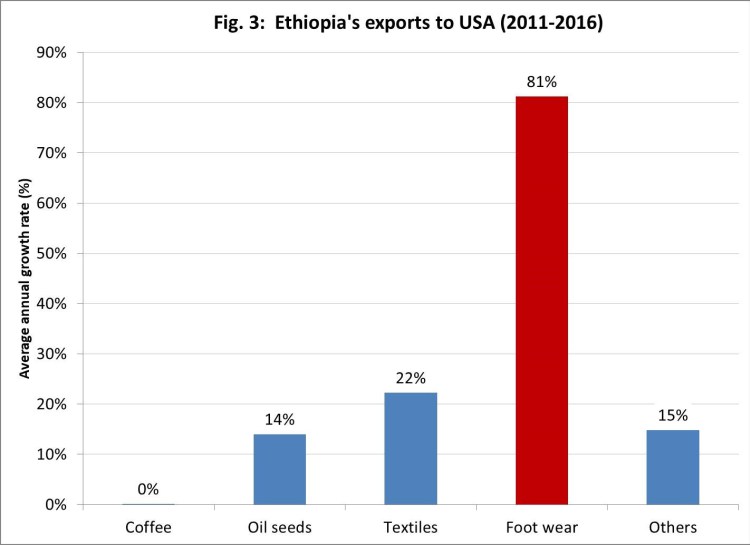

Fig. 3 is plotted from US trade statistics, where details of imports by country and types of products are available. The chart presents average annual exports growth rates by product groups for the years between 2011 and 2016, the post devaluation years. This shows sharply contrasting exports situations.

On the one hand, the USA has traditionally been one of the major destinations of Ethiopia’s coffee exports. In recent years, however, coffee exports to USA experienced near zero growth. In sharp contrast, footwear exports to USA has grown by a whopping 81% per year; that is to say footwear exports in one year being nearly double of the amount a year before. Textile and oil seeds have also experienced modest growth rates, on average by 22% and 14% per year respectively.

This brings us to the crust of the matter, the core of Ethiopia’s political economy of government policy during the EPRDF era. Take for example coffee growers – they are the marginalized farmers. On the other hand textile has become a budding manufacturing sector largely dominated by foreign businesses through the construction of industrial parks.

Let’s take one example of footwear products. I would digress a bit at this point. Late in 2016, the Ethio-Chinese connection in footwear production made headlines in mainstream media, moving to prime time broadcasting in USA. What caught media attention was the specific case of a “decision” by the footwear producer, Huajian Group, to relocate to Ethiopia. The reason was that the Huajian Group has been supplying Ivanka Trump’s fashion business with shoes branded in her name. Apparently it was thought the Huajian Group’s link with the dictatorial regime in Addis Abeba would be damaging to the Trump administration. The headlines in the USA coincided with the height of widespread protests, when peaceful protesters in Oromia and Amhara regional states were gunned down by Ethiopia’s security forces in their several hundreds. Little did the media know that the Huajian Group was already in Ethiopia for a few years before the case was made into headlines in the USA.

I have two reasons to choose 2011 (in Fig. 3) as a start year in calculating the growth rates. First, 2011 was a year following the previous devaluation, a time frame we would expect to see devaluation having effects on exports. Second, it was in 2011 that the Chinese footwear producer, Huajian Group, decided to relocate or expand operation in Ethiopia. The group has already been using Ethiopia as an export platform to access the US market.

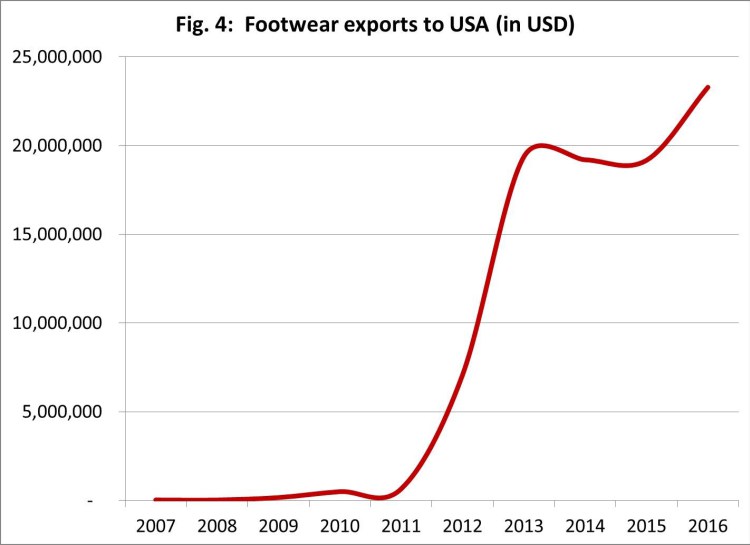

The red bar in Fig. 3 and the line chart in Fig. 4 above measure Huajian Group’s exports of footwear to USA by using Ethiopia as an export platform. Huajian’s entry in Ethiopia was followed by an explosive growth of footwear exports to USA – a 2,846% growth rate in just two years between 2011 and 2013, nearly a 30-fold increase.

It is highly significant that Huajian entered Ethiopian in a big way just one year after the year of the previous devaluation. It is possible that authorities in Ethiopia have undertaken the 2010 devaluation primarily to entice Huanjian to invest in Ethiopia, although devaluation also benefited other crony domestic and foreign firms.

The preceding sections established that the latest devaluation is likely to harm most producers and producers in the Ethiopia except for very a few domestic and foreign businesses, who are likely to come out as net beneficiaries, as it was the case with the previous devaluation.

AGOA

The most outstanding story emerging from discussions in the preceding section is the eye catching success story of footwear exports, which essentially is Huajian’s exports, at least so far. I have chosen exports to USA for a reason – in addition to providing specifics on bilateral trade on product by product basis, this will also reveal additional information on types of producers that have benefited from the special privilege the USA offered to poor African nations through AGOA (The African Growth and Opportunity).

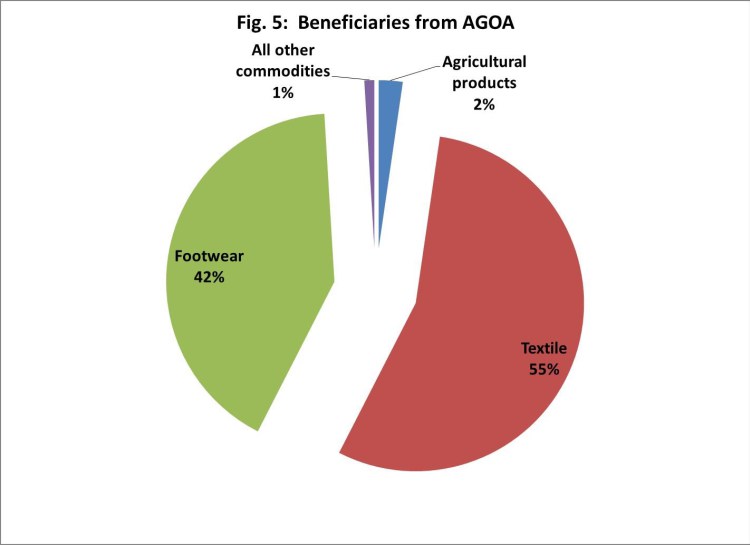

It is appropriate to ask two interrelated questions and try to seek answers for them: (a) Is the Chinese giant footwear manufacturer using the AGOA privilege? (b) if yes, then would that be a misuse and abuse of the AGOA scheme by the Ethiopian government? Fig. 5 below provides a clear answer for the first question. Textiles and footwear have got 55% and 42% of total exports of Ethiopia to USA through AGOA privilege, leaving a margin of 3% for the rest of Ethiopia’s poor and marginalized producers. So, yes, the Huajian Group has utilized the AGOA privileges that the USA government extended to Ethiopia, and perhaps that is the main reason the firm had relocated to Ethiopia in the first place.

One does not need to go through the myriads of AGOA legislation to establish whether or not Ethiopia has been abiding by the AGOA eligibility criteria. It would suffice to say a few words regarding Ethiopia’s surrender to the Huajian Group, a special privilege the US government extended to Ethiopia to lift small producers out of poverty. It is clear from the forgoing analysis that Ethiopia’s poor producers are not benefiting from AGOA. One of the AGOA eligibility determinations criteria is stated as “protection of internationally recognized worker rights”. According to a report by Bloomberg, Huagian pays only $40 per month to Ethiopian workers, about a tenth of the wage rate in China. This is the most degrading and unethical wage rate anywhere in the world.

There has to be some value-addition criteria that needs to be observed to ensure that giant foreign investors such as the Huajian Group do not expropriate all the benefits accruing from market access privilege through AGOA. For instance, if a pair of shoes is exported to the US and brought in, say $100 as export revenues to Ethiopia, then how much of it is remitted to China, directly or indirectly, and what proportion remains in Ethiopia?

With such low wage rate, and perhaps similarly appalling monopoly prices for domestic raw material suppliers, then it follows that the largest proportion of the selling price of each item goes to operating surplus of the Huajian group. Additionally, the Bloomberg reporter witnessed a highly regimented military style punishment of Ethiopian workers on factory floors, adding insult to injury.

Listed in AGOA eligibility criteria I found the following – rule of law; political pluralism; right to due process; economic policies to reduce poverty; a system to combat bribery and corruption; and respect for internationally recognized human rights. It is an open secret that the situation in Ethiopia does not meet any one of these criteria. Why then is the US government turning a blind eye to the appalling situation in Ethiopia is a question I would leave to the conscious of law makers in that country.

Summary

In present day Ethiopia, there are two economies: (a) the enclave economy, extremely sophisticated and highly interconnected domestic and foreign firms that jointly control the commanding heights of the Ethiopian economy, (b) the rest of the economy, traditional as well as modern sectors where ordinary Ethiopians try to desperately make a living against all odds.

The two components coexist in a parasite and host like relationship. Economic policies such as devaluation are essentially designed to benefit the enclave economy, with no regard whatsoever to the effects of such policies on the rest of the Ethiopian economy, which is being increasingly marginalized. The facts presented in this piece revealed only the tip of the iceberg.

The focus in this piece has been on identifying which group of export producers would gain and which ones would lose. I did not make any attempt to explain wider issues such as the devastation happening to other domestic producers, like Ethiopia’s traditional leather manufacturers, who are exposed to the Chinese giants, which are reaping the benefits that donors designed for them. Moreover, it does not require much analysis to establish that Ethiopian households as consumers would experience substantial welfare losses. Inflationary pressures from the latest devaluation would have at least as much effect as the previous one.

As noted earlier, the consumer price index had increased by 2.24 in just six years after 2010, that is to say, the welfare of an average Ethiopian family dropped at least by 50% in such a short span of time. This may sound an alarming figure, but this is only an average, which actually underestimates the cataclysmic welfare falls for fixed income groups, those who live on salaries and wages, such as civil servants.

This piece sets out to inquire the apparent insanity with which the decision to devalue the birr over and over again is made. Upon closer scrutiny, it becomes clear that the authorities are not that oblivious to the adverse consequences of devaluation; it is just that they have a set of priorities, which is at odds with what one would normally expect from a responsible government. The cunning element, the coupling of devaluation with interest rate hike, indicates that the authorities were aware of the looming inflationary pressure, which would adversely affect the welfare of the Ethiopian households as well as hurting domestic investment, but bizarrely the country’s government does not seem to be concerned with neither protecting household welfare nor the survival of domestic small businesses.

J. Bonsa is an Economist by training