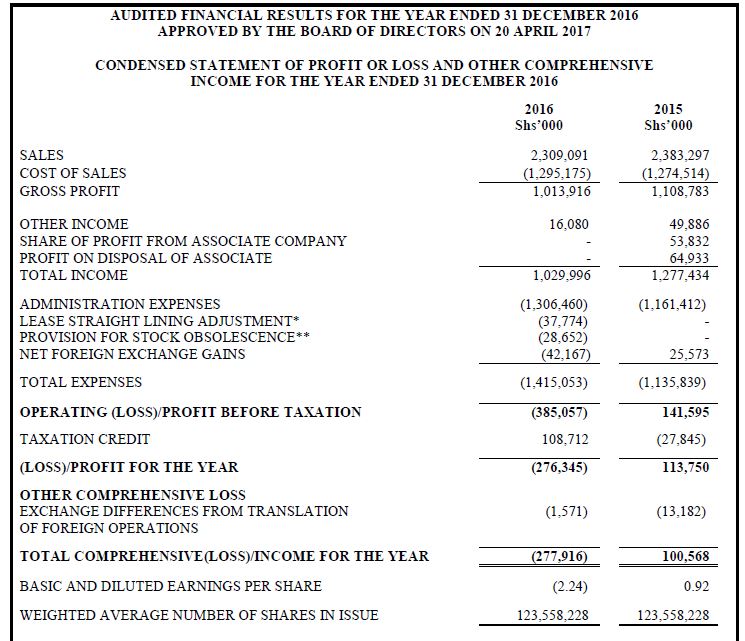

Nairobi Securities Exchange listed company Deacons (East Africa) Plc posted an operating loss of Ksh 385 Million in financial year ending 31 December 2016 compared to an operating profit of Ksh 141.6 Million made in 2015.

The retailers sales softened by 3.1% to stand at Ksh 2.309 Billion in 2016 compared to Ksh 2.383 Billion in 2015. The company in its statement mentioned that the business recorded positive results in H1 of 2016. However, in H2 of 2016, several factors negatively impacted the peak trading season that resulted in suppressed sales and margins. Existing malls registered lower footfall and new retail property registered lower purchase conversion rates that led to cannibalization. The retailer further blamed the interest rate capping on bank lending that led to a further reduction in liquidity in the market, thereby decreasing customer spend and store productivity.

Total expenses for the company shot up by 24.6% this is largely due to a Ksh 145 million increase in administration costs which the company says is due to early deployment of shop fittings, staff and stock of an additional 8 stores which haven’t opened yet due to a delay in mall openings. The company made a Ksh 42 million Foreign exchange loss.

Net loss for the company came in at Ksh 276.3 million in 2016 compared to a net profit of Ksh 113.7 million in 2015. Note that the company sold their brand Woolworths in 2015.

The company did not recommend any dividends for 2016.

Going forward the company is confident in their strategies in place and has mentioned that they are confident in the new brand F&F by Tesco which was opened in The Hub, Karen on December 2016 and in The Sarit Center, Westlands on February 2017. The Two Rivers Mall which was opened on February 2017 has four Deacons brands namely: Mr Price Apparel, Mr Price Home, Adidas and Bossini. In addition to this, the Company launched two brands (Bossini and Mr Price Apparel) at the Kigali Heights Mall in Rwanda and initial results have been encouraging. The sales from these new outlets and the full year impact of the stores opened in 2016 according to the company are expected to contribute to overall sales growth in 2017.

In the markets Deacons was last spotted trading at Ksh 4.4 per share.

Source: Deacons, Kenyan Wall Street