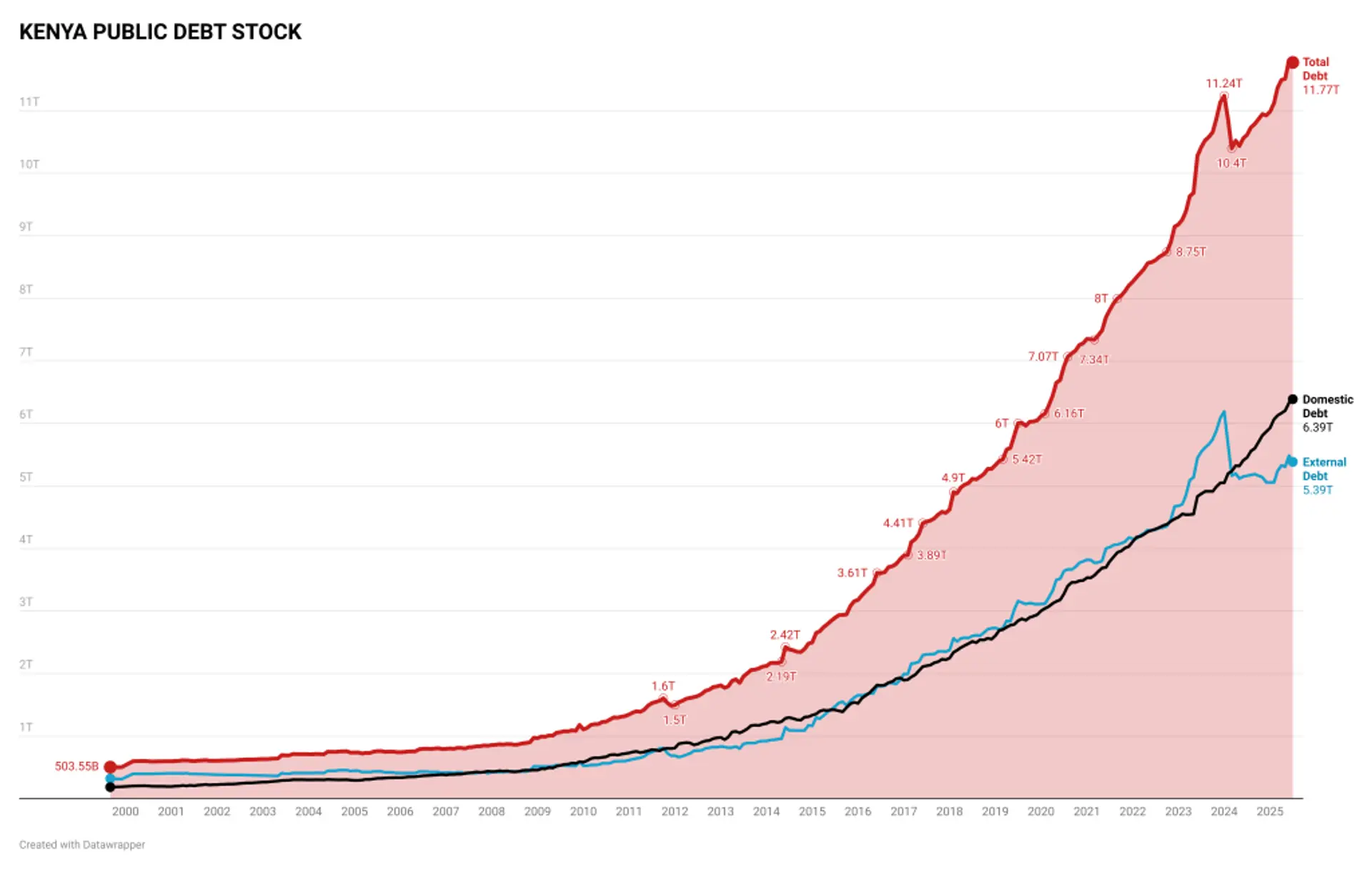

Kenya’s total public debt stood at KSh 11.77 trillion at the end of July 2025, equivalent to 66.9% of GDP, according to the National Treasury’s latest Monthly Debt Bulletin.

- •The figure represents a 10.9% increase from July 2024 but a KSh 41 billion decline from June, marking the first month this year that the country’s debt stock has fallen.

- •The Treasury attributed the month-on-month decline to exchange-rate gains that reduced the value of foreign obligations.

- •External debt fell by KSh 103 billion to KSh 5.39 trillion, largely due to the shilling’s appreciation against the euro, yen, yuan, and pound.

The local currency remained broadly stable against the U.S. dollar at an average rate of 129.24 during the month.

External Debt Declines on Currency Appreciation

Bilateral debt dropped by KSh 55 billion to KSh 977 billion, led by China whose exposure fell to KSh 608 billion.

- •France and Japan followed with KSh 96.9 billion and KSh 85.9 billion respectively, while Germany and Italy each held around KSh 55 billion and KSh 44 billion.

- •Multilateral creditors such as the World Bank’s International Development Association (KSh 1.64 trillion) and the African Development Bank Group (KSh 543 billion) continued to account for the bulk of external financing.

External Debt by Category (KSh Billions)

| Category / Creditor | June 2025 | July 2025 | Change (KSh Bn) |

|---|---|---|---|

| Bilateral | 1,032.81 | 977.47 | ▼55.35 |

| China | 653.11 | 608.28 | ▼44.83 |

| France | 101.37 | 96.94 | ▼4.43 |

| Japan | 88.88 | 85.91 | ▼2.96 |

| Germany | 56.02 | 54.95 | ▼1.08 |

| Italy | 44.70 | 43.59 | ▼1.11 |

| United States | 23.97 | 23.93 | ▼0.04 |

| Spain | 13.48 | 13.30 | ▼0.18 |

| Belgium | 25.44 | 24.80 | ▼0.64 |

| Other bilateral (Paris & non-Paris Club) | 23.75 | 23.74 | ▼0.01 |

| Subtotal Bilateral | 1,032.81 | 977.47 | ▼55.35 |

| Multilateral | 3,045.39 | 3,006.43 | ▼38.96 |

| World Bank (IDA) | 1,665.40 | 1,643.12 | ▼22.28 |

| AfDB/ADF | 550.24 | 543.37 | ▼6.87 |

| EEC/EIB | 29.82 | 28.79 | ▼1.03 |

| Other multilaterals | — | 791.15 | — |

| Subtotal Multilateral | 3,045.39 | 3,006.43 | ▼38.96 |

| Commercial | 1,327.02 | 1,320.63 | ▼6.39 |

| Guaranteed | 83.24 | 80.77 | ▼2.48 |

| Total External Debt | 5,488.46 | 5,385.30 | ▼103.18 |

Domestic Borrowing Edges Higher

Domestic debt rose by KSh 61 billion to KSh 6.39 trillion as the government leaned on Treasury securities to fund operations. The stock of Treasury bonds expanded to KSh 5.18 trillion, while Treasury bills increased to KSh 1.05 trillion.

Stock of Domestic Debt by Holders (KSh Millions)

| Holder | June 2025 | July 2025 | Change (KSh Mn) |

|---|---|---|---|

| Commercial Banks | 2,692,070.36 | 2,727,812.69 | +35,742.32 |

| Insurance Companies | 457,354.96 | 466,743.97 | +9,389.01 |

| Pension Trusts | 1,820,414.54 | 1,853,802.19 | +33,387.65 |

| Others | 1,356,169.44 | 1,339,007.59 | ▼17,161.84 |

| Total Domestic Debt | 6,326,009.29 | 6,387,366.43 | +61,357.14 |

Banks remained the dominant holders with KSh 2.73 trillion, followed by pension funds at KSh 1.85 trillion and insurers at KSh 467 billion.

The Treasury reported that government securities worth KSh 146 billion were advertised in July, attracting bids of KSh 189 billion and resulting in KSh 161 billion accepted. Redemptions during the month stood at KSh 79 billion.

The overall debt mix at the end of July stood at 54.3% domestic and 45.7% external. The bulletin noted that the yield curve turned upward during the month, reflecting softer short-term rates and higher long-end yields as the government continued to manage refinancing risks under a stable monetary environment.