The Capital Markets Authority (CMA) is eyeing privatization of state-owned enterprises to end listing drought at the Nairobi Securities Exchange (NSE). This was highlighted during the release of the Capital Markets Soundness Report Q3.

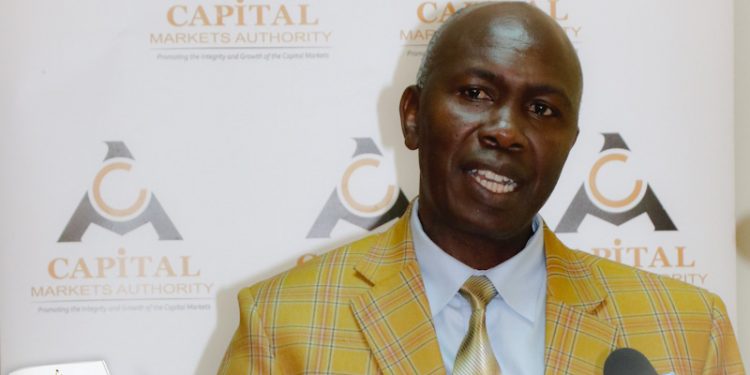

According to CMA Director Regulatory Policy and Strategy, Luke Ombara, the treasury should sell additional shares in already listed and profitable state-owned enterprises. Ombara says that should the proposals go through, state firms can raise the market turnover at the NSE.

The government through the national treasury owns stakes in 10 listed companies; Safaricom (35%), Kenya Reinsurance (60%), Kenya Airways (48.9%), Kenya Power (50%), East African Portland Cement (25.3%), Uchumi (14.67%), Mumias Sugar (20%), HF Group (2.41%), KCB (19.76%), and Stanbic bank (1.1%).

Ombara believes that privatization of some of the state firms will help reduce the market concentration by the five big-cap companies.

Green bonds and Sukuk Bonds

CMA is working to introduce Islamic finance products in the industry to increase market liquidity. In the report, the regulator says it is working closely with the National Treasury and the Financial Sector Deepening Africa in ensuring the issuance of a Sukuk bond in the medium term.

There are also discussions on the issuance of a sovereign diaspora bond structured like the treasury bonds but targeting Kenya’s diaspora community. However, the issuance is subject to effective governance and assessment of investor appetite.

RELATED

CMA Gives Nod to Pezesha’s Crowdfunding Platform

CMA Re-advertises Vacancy for Chief Executive Officer