According to Citi, Kenya is among the top frontier markets that could offer big opportunities for money managers around the globe in 2018.

The American multinational investment banking group has picked its most attractive frontier markets for the year namely, Sri Lanka, Romania and Kenya. Other markets that could perform better over the period are; Argentina, Egypt, Morocco, Nigeria and Vietnam. Listed stocks in these markets have typical cheap valuations than comparable stocks in developed markets, or indeed emerging markets.

Looking at performance in 2017, frontier markets delivered returns of up to 32.3% including dividends. This was the best year since 2007 and a sharp rebound from a three year period of difficulties.

“Argentina, Kazakhstan and Vietnam had strong years; Kenya, Nigeria and Romania also did well. Sri Lanka and especially Pakistan lagged.” Citi says in a note to investors.

“Our own ranking model favors Sri Lanka, Romania and Kenya. We weigh a range of factors in 6 categories (macro growth, imbalances, monetary factors, valuations, earnings momentum and price momentum).” said Citi.

According to Citi, Kenya scores well on valuations as well as on earnings momentum, offset by monetary factors that have tightened over the past 6 months.

“The Kenyan market did quite well in 2017 (+36% total return), despite the dual headwinds of the 2016 Banking Law, proscribing limits on deposit and lending rates, and the general elections. With elections now behind us, we see 2018 as a more straightforward year of good economic performance, supporting earnings. Easing the constraints of the Law, if not outright repeal, could further support sentiment.” Says Citi.

Top stocks

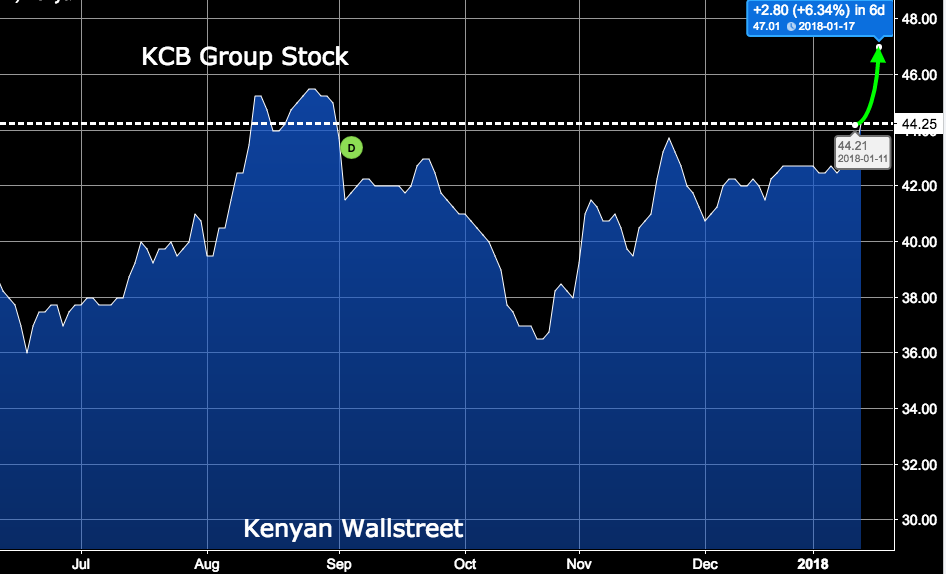

Citi also identified Kenya’s largest bank by assets KCB Group among the companies that are well run and could generate exceptional returns for investors interested in frontier markets. Other stocks mentioned include are BGEO Group (Georgia), Humansoft (Kuwait), IDH (Egypt) and MHP (Ukraine).

Citi says they find KCB’s growth profile reasonably strong, and its valuation undemanding. They believe the bank’s corporate and payroll client base leaves it in a strong position to navigate the current more challenging asset quality environment and grow market share further.

In the short term, Citi’s target price for KCB is Sh 47 per piece, which is +6.34% from Friday’s closing price of Sh 44.