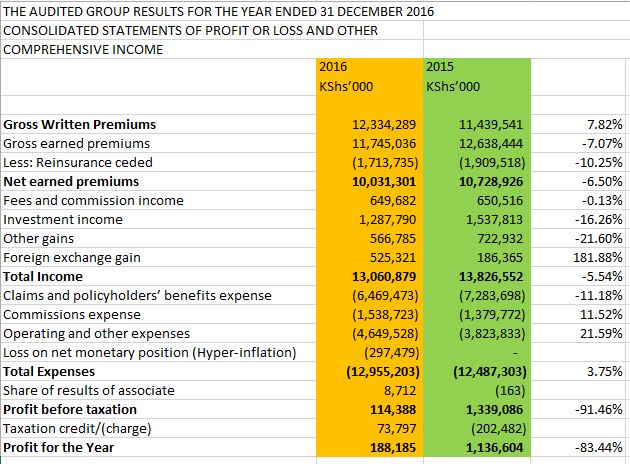

CIC Insurance Group released its full year results for the financial year ending 31 December 2016. The bottom-line was expected to be affected after the company issued a profit warning. Since listing on the Nairobi Stock Exchange in 2012, note that the 2016 bottom-line figures have been the worst. Net profits were down by 83.4% to stand at Ksh 188 million vs a net profit of Ksh 1.1 Billion in 2015.

Gross Written Premiums were up by 7.8% from Ksh 11.4 Billion in 2015 to Ksh 12.3 Billion in 2016. Net earned premiums were down by 6.5% from Ksh 10.728 billion in 2015 to Ksh 10.031 billion in 2016. Investment income dropped by 16.2% from Ksh 1.537 billion in 2015 to Ksh 1.287 billion in 2016. Effectively Total Income dropped by 765 million (5%) from Ksh 13.826 billion in 2015 to Ksh 13.060 billion in 2016.

Total Expenses went up by 3.75% from Ksh 12.487 billion in 2015 to Ksh 12.955 billion in 2016. This increase in expense was due to a 11.5% increase in commission expense, a 21.6% increase in operating expenses and a loss of Ksh 297 million due to hyper-inflation experienced in South Sudan as a result of the South Sudanese Pound devaluation.

The company cited strong top-line growth is expected to continue going forward. It blames the adverse impact on profits was due to:

- Continued depressed NSE prices resulting in further unrealized losses of Ksh. 143m.

- Change in reserving methodology by IRA which increased our Life Business reserves by Ksh. 704m.

- Aggressive provisioning of debtors in our General Insurance Business resulting in an additional Ksh. 326m provision.

- Loss of Ksh. 297.5m following the hyper-inflation reporting in South Sudan as a result of SSP devaluation.

- As the biggest insurer of schools in the country, it experienced a loss of Ksh. 89m following uncharacteristic school fires in 2016

The company retained its dividend and recommended a dividend of Ksh 0.105 per share totaling Ksh 274,635,699

In the markets CIC closed Friday’s (10 March 2017) trading session at Ksh 3.60 per share.

Download: CIC Insurance Group_FY_31-Dec-16

Source: (CIC Insurance, Kenyan Wall Street, FT)