East African CEOs believe their current business models will weather economic turbulence to remain viable for the next decade, according to the PwC East African CEOs survey.

- •70% of the 231 respondents from the region are optimistic about their company’s growth prospects over the next 12 months.

- •This can be attributed to the uptick in infrastructure investment in the region, tourism recovery and economic diversification.

- •Some of the challenges the respondents pointed out include inflation, macroeconomic volatility, cyber risk and geopolitical conflict.

The CEOs indicated that their revenues increased by 19 per cent, along with an 18 per cent boost in profit margins. They also said their return on assets or return on equity rose by a notable 14 per cent. Over half (53 per cent) of CEOs reported a significant market share increase of 5 per cent or more over the past three years.

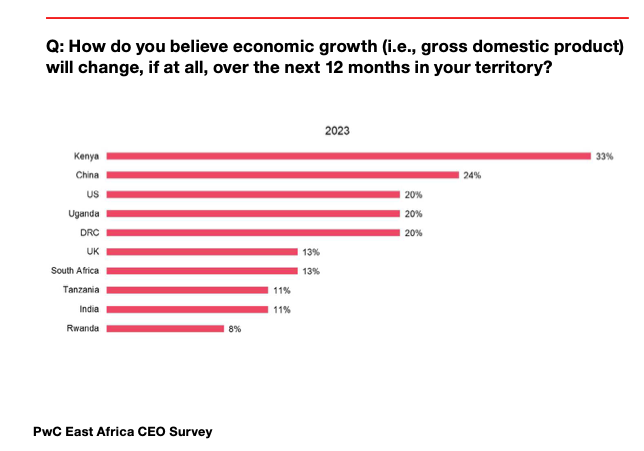

When asked about prospects for growth in external markets, Kenya (26 per cent) and China (21 per cent) continue to top the list as the most favourable countries for CEOs’ companies’ revenue growth prospects over the next 12 months. They also identified neighbouring countries that are members of the East African Community (EAC) as territories for future revenue growth.

Intra-EAC trade reached US$10 billion in September 2022, up from US$7.1 billion in 2019. The regional bloc aims to increase intra-EAC trade from 20 per cent to 40 per cent over the next five years, which could unlock future revenue growth opportunities. According to Africa’s Macroeconomic Performance and Outlook – January 2024, growth in East Africa (2024: 5.1 per cent; 2025: 5.7 per cent) will be aided by deeper regional integration alongside strategic public spending to improve infrastructure investment, ongoing efforts to modernise agricultural production systems and boost productivity in the services sector.

Medium-term Challenges

45 per cent of respondents identified the regulatory environment as a significant obstacle, indicating the potential impact of compliance requirements on operational flexibility. Limited financial resources also pose a constraint, with 35 per cent of CEOs citing financial constraints as inhibiting factors. Additionally, concerns were raised about the lack of skills within the company’s workforce (29 per cent) and competing operational priorities (26 per cent).

Infrastructure challenges (24 per cent) and a shortage of technological capabilities (23 per cent) added further pressure on operations. Supply chain instability (22 per cent) and bureaucratic processes within the company (14 per cent) were also cited as barriers to value creation.

“In an era of continuous reinvention, CEOs must spearhead the transformation journey to reshape both their organisations and themselves to flourish amid disruption. CEOs must lead the quest for strategic discovery and evolve sustainable approaches to value creation,” said Muniu Thoithi Advisory Leader PwC East Africa.