Kenyan listed Investment Company, Centum, in its latest half year results for the period ending 30 September 2016 recorded a slight increase in group investment income by 1.3% from Ksh 8.38 billion to Ksh 8.49 billion. Operating expenses also increased marginally by 1.2% to Ksh 5.1 billion. Finance costs decreased by 25% from Ksh 1.26 billion to 0.95 billion, the company in its published statement mentioned that the reduced finance costs were as a result of reduced fx losses on USD borrowings and in addition they made a capitalization of interest on their real estate projects.

Centum’s group profit before tax went up by 22.8% to Ksh 2.76 billion compared to Ksh 2.25 billion in the previous period. Group profit after tax was up by 7.9% to Ksh 2.06 billion compared to Ksh 1.91 billion in the previous period. The company attributes profitability was due to consolidation of Longhorn Publishers financial results which it acquired a controlling stake (60%) earlier in May 2016 and a general improved profitability in the group’s portfolio companies.

No interim dividend was declared.

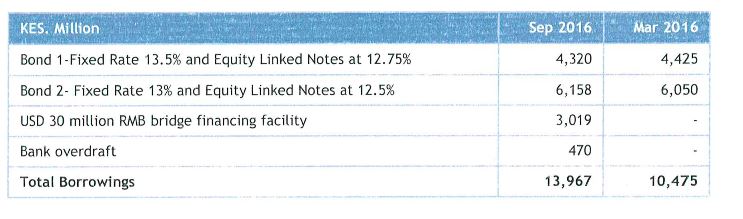

During the period Centum tapped into an 18 month USD 30 Million (roughly Ksh 3 Billion) bridging facility from First Rand Bank that has been channeled towards capital expenditures. The company is still confident about it’s gearing position despite acquiring that short term loan and projects its gearing position to trend downwards by 31 March 2017 as they expect to realize various proceeds from investment disposals during the remaining half of the financial year.

Centum’s share price is currently (Nov 15, 2016) trading at Ksh 41.00/share. The share price is down by roughly 11.7% year-to-date.

Some Institutional Holders in Centum are:

- •Silk Invest – 1.22%

- •Nile Capital Management LLC – 0.43%

- •Stanlib Asset Management – 0.36%

- •BI Asset Management Fondsm glerselskab A/S – 0.33%

- •Ashburton Fund Managers (Pty) Ltd. – 0.29%

- •Parametric Portfolio Associates LLC – 0.29%

- •Evli Fund Management Co. Ltd. – 0.15%

- •Mori Capital Management Ltd. – 0.11%

- •Old Mutual Customised Solutions (Pty) Ltd. – 0.11%

- •J. M. Finn & Co. Ltd. – 0.10%

Sources: (Centum, Kenyan Wall Street, NSE, Financial Times)