Centum Investment Company Plc has issued a profit warning for the financial year ending March 2025. It expects net earnings to drop by at least 25% from the KSh 2.6 billion profit posted in FY2024.

- •The decline is mainly due to reduced fair value gains on investment properties—non-cash items that drove last year’s performance.

- •The board clarified that the decline is not from weaker operations, but from accounting rules under International Financial Reporting Standards (IFRS).

In the six months to 30 September 2024, Centum posted a KSh 347 million after-tax loss, from a KSh 426 million loss a year earlier.

The standalone company remained profitable, earning KSh 431 million. This was lower than KSh 1.4 billion in HY2024, mostly due to reduced investment income. Group cash from operations was KSh 842 million. The company reported KSh 2.2 billion, boosted by annuity income, exits, and loan repayments. A portion supported Centum’s share buyback programme.

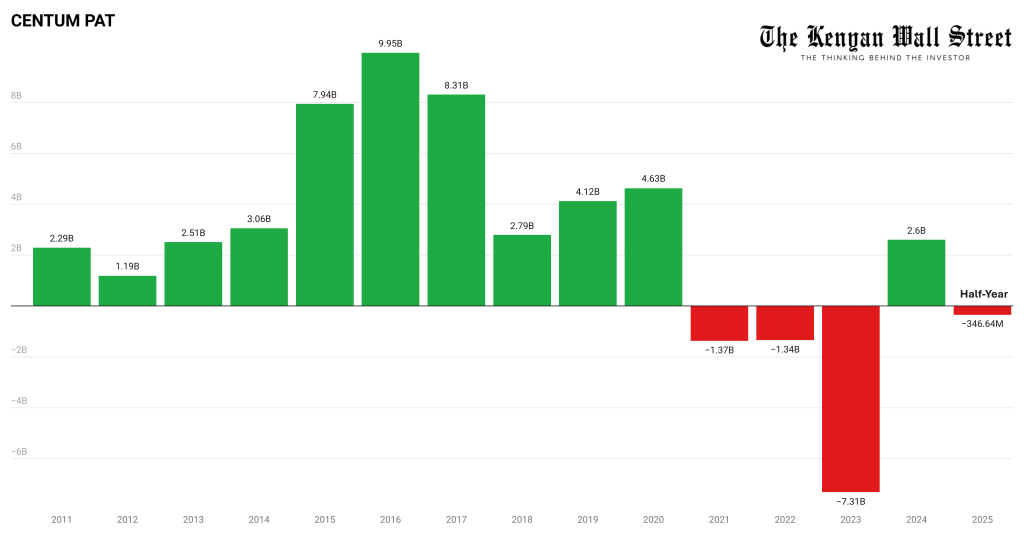

14-Year Profit Trend Reflects Earnings Volatility

Centum’s profit history shows cycles of strong performance and sharp declines. Between FY2011 and FY2016, profits rose steadily, peaking at KSh 9.9 billion.

Since then, results have swung widely, with three straight losses from FY2021 to FY2023. FY2024 returned to profit, helped by over KSh 7 billion in revaluation gains. These gains are unlikely to recur, and the profit warning highlights concerns over earnings sustainability.

Strategic Developments and Recent News

Centum has made several strategic moves. Centum Real Estate secured KSh 2.6 billion from the IFC to fund nearly 2,000 affordable homes at Two Rivers. Separately, Centum partnered with Arise to launch the Vipingo Special Economic Zone, a planned $3 billion coastal industrial hub. These projects reflect a pivot toward scalable, income-generating assets.

The company is also executing its Centum 5.0 strategy. This includes value optimization, asset monetization, and reinvesting in marketable securities. Centum’s management is also pivoting from one-off gains, targeting recurring income instead.