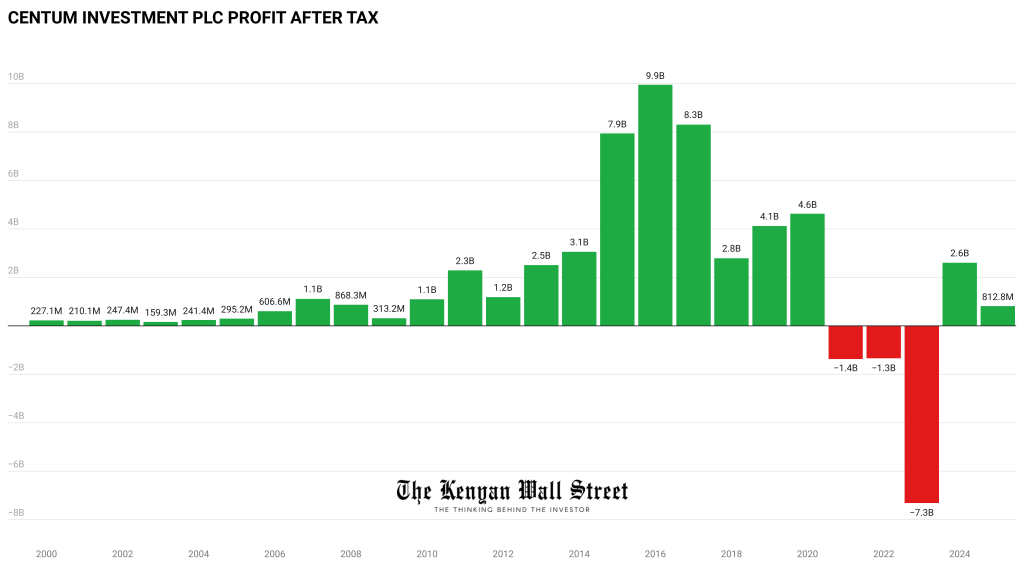

Centum Investment Company Plc reported a sharp decline in earnings for the year ended March 2025, with net profit tumbling 69% to KSh 812.8 million, from KSh 2.6 billion the prior year.

- •The drop aligns with a June profit warning and reflects significant reductions in non-cash fair value gains, particularly from its real estate assets.

- •Once known for billion-shilling profits that peaked at KSh 9.9 billion in 2016, Centum PLC has battled earnings volatility in recent years.

- •Despite the earnings slump, Centum’s revenue mix showed divergent performances across its main business segments.

Centum continued reducing debt, repaying KSh 1.2 billion in investment acquisition debt, lowering the outstanding balance to KSh 690 million, down from KSh 1.9 billion the prior year. This contributed to a 32% reduction in finance costs and a net debt-to-equity ratio of just 1.5% as of March 2025.

- •In trading, revenue dipped to KSh 498 million but losses narrowed 30% on lower costs.

- •Financial services swung to a KSh 90 million profit from a KSh 500 million loss, helped by reduced funding costs despite lower income.

- •Real estate profits halved to KSh 1.5 billion as fair value gains fell from KSh 3.7 billion to KSh 2 billion with softer home sales.

- •At Two Rivers Development, losses reduced by 75%, supported by stable revenues and lower costs.

- •Two Rivers SEZ profits slumped 97%, reflecting one-off prior-year gains.

- •Investment operations reversed a loss, delivering KSh 1.18 billion profit, driven by higher investment income and lower finance costs.

- •Total comprehensive income rose 28% to KSh 3.26 billion, buoyed by valuation adjustments outside of profit or loss. Centum’s net asset value per share increased by 9% to KSh 66.93, while its total assets climbed 8% to KSh 82.35 billion.

Much of the Group-level decline was tied to non-cash adjustments, including a KSh 1.2 billion deferred tax hit and a reduction in revaluation gains. However, underlying cash performance improved across most portfolio companies.

Standalone company performance remained resilient, recording a net profit of KSh 547 million, with profit before tax rising 86% to KSh 517 million, aided by a 17% growth in investment income to KSh 1.3 billion. Operating expenses increased by a modest 8%, broadly in line with inflation. The holding company’s shift toward investment annuities, shareholder loan repayments, and monetization of mature assets continues to underpin its standalone resilience.

| Segment | FY 2025 | FY 2024 | YoY Change |

|---|---|---|---|

| Trading Loss | (489.8 Mn) | (705.9 Mn) | +30.6% |

| Financial Services Profit | 90.2 Mn | (500.4 Mn) | Swing to profit |

| Centum Real Estate Profit | 1.50 Bn | 3.60 Bn | -58.3% |

| Two Rivers Development Loss | (242.7 Mn) | (965.5 Mn) | +74.9% |

| Two Rivers SEZ Profit | 88.4 Mn | 2.92 Bn | -97.0% |

| Investment Operations Profit | 1.18 Bn | (352.9 Mn) | Swing to profit |

| Group Net Profit | 812.8 Mn | 2.60 Bn | -68.8% |

| Comprehensive Income | 3.26 Bn | 2.54 Bn | +28.5% |

| NAV per Share | KSh 66.93 | KSh 61.68 | +8.5% |

| Total Assets | 82.35 Bn | 76.17 Bn | +8.1% |

Cash Generation and Buybacks Provide Stability

In a bid to shore up shareholder returns, Centum retained its KSh 0.32 per share dividend, amounting to KSh 210 million. It also repurchased 150,800 shares at KSh 9.03 each, fulfilling just 0.23% of its October 2024 buyback authorization by June 2025.

The group monetized part of its Sidian Bank stake, cutting ownership from 40.03% to 29.26% through a combination of partial sales and dilution during a KSh 1.9 billion rights issue. The proceeds contributed to KSh 3.1 billion in free cash flow, helping reduce debt and fund shareholder distributions.

From Billion-Shilling Profits to Volatility

The company posted consecutive losses between 2021 and 2023 before returning to profit in FY2024. The FY2025 performance reinforces the challenges of a valuation-heavy earnings model, particularly in real estate, where non-cash gains once drove peak profits.

Still, with Centum’s pivot toward real cash generation, leaner debt, and strategic capital recycling, FY2026 could offer a more stable path forward, if market volatility and tax changes remain contained.

The results come amid Centum’s ongoing 5.0 strategy, which focuses on reducing debt, enhancing cashflows, and repositioning toward scalable, high-yielding investments.