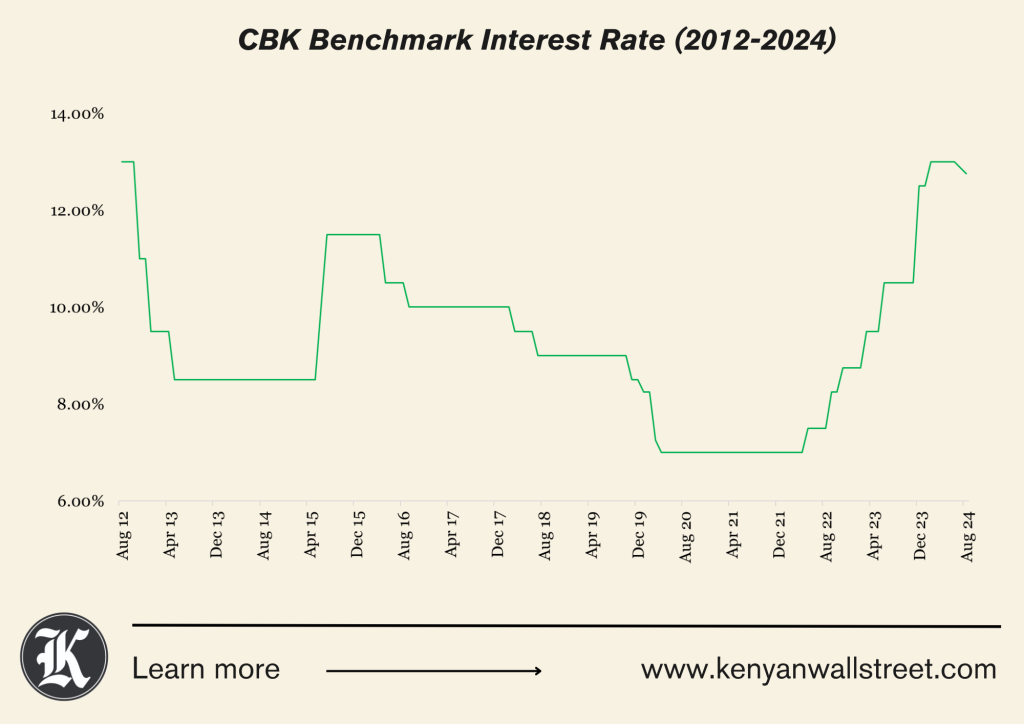

The Central Bank of Kenya (CBK) cut its benchmark lending rate by 25 basis points to 12.75 percent, reducing the cost of loans for the first time in four years.

- •The Central Bank raised the key lending rate from 10.5% to 12.5% in December 2023, before hiking it to 13% in February.

- •The apex bank noted an uptick in the banking sector’s gross non-performing loans (NPLs) ratio, which stood at 16.3 percent in June 2024 compared to 16.1 percent in April.

- •CBK last lowered its key rate in at the peak of the Covid 19 global pandemic.

Banks have been raising lending rates since the Monetary Policy Committee (MPC) set the benchmark rate at 13% in February: KCB Kenya’s base lending rate stands at 15.6%, while Equity Bank raised its base lending rate from 17.56% to 18.2% in February.

“The MPC will closely monitor the impact of the policy measures as well as developments in the global and domestic economy and stands ready to take further action as necessary in line with its mandate,” CBK noted in the MPC press release. The MPC further noted that the previous hikes were key in anchoring inflationary expectations and stabilizing the exchange rate.

The latest data from KNBS showed a continued easing in overall inflation to 4.3 percent in July 2024 supported by lower food prices ahead of the harvest season coupled with a continuous drop in fuel prices, and the stable exchange rate.

The dovish stance, CBK says, is on the back of easing inflation to below the midpoint of the target range coupled with the stability of the shilling and a resilient economy.

Private sector credit growth on the other hand, decelerated to 4.0 percent in June 2024 compared to 4.5 percent in May. Additionally, CBK says, this reflects exchange rate valuation effects on foreign currency denominated loans following the gaining shilling.

Both exports and imports were higher in the first half of 2024 compared to a similar period in 2023 recording 5.0 percent and 3.6 per cent increases respectively. Similarly, tourist arrivals improved by 27.2 percent in the 12 months to June 2024.

The marginal cut comes after the banker’s lobby urged the CBK to hold the interest rates. “Considering these developments, and the balance of risks, we argue that maintaining the current monetary policy stance – in keeping the CBR unchanged at 13.0 percent – would be appropriate,” KBA says in a recent research report.

The MPC will meet again in two months.