This silent revolution, spearheaded by the Central Depository & Settlement Corporation (CDSC), is rewriting the rules of market participation, security, and efficiency in Kenya’s financial ecosystem.

As of April 2025, an impressive 79% of all shares traded on the Nairobi Securities Exchange (NSE) have been immobilized in electronic form—a staggering increase from just 50% in January 2024.

- •57% surge in electronically held shares (from 51.7B to 81.2B shares).

- •21.4B shares remain in physical certificates (down from 46.5B).

- •Top performers: KenGen (99% immobilized), Kenya Re (99%), Equity Bank (99.6%)

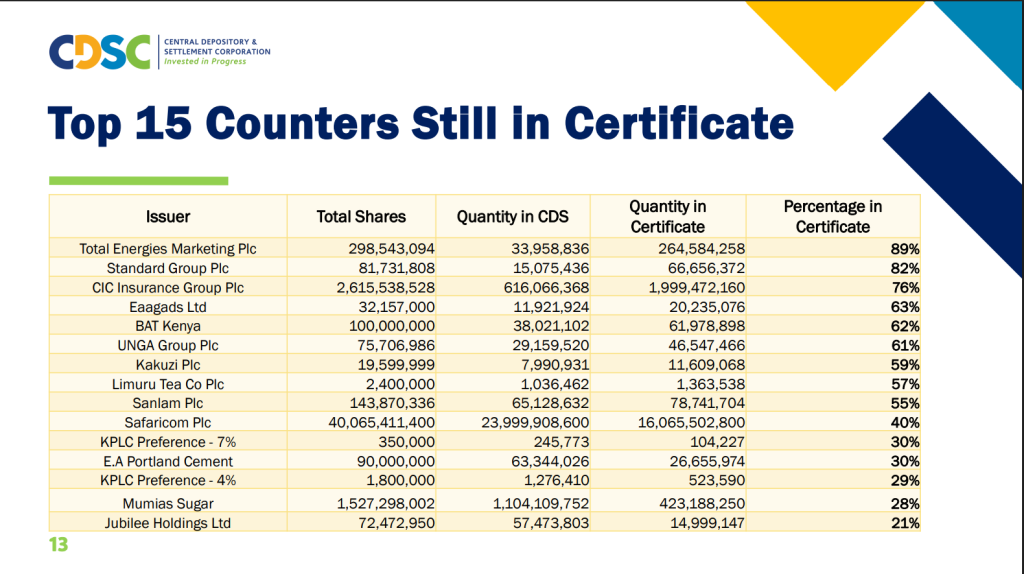

- •Laggards: TotalEnergies (89% still physical), CIC Insurance (76%), BAT Kenya (62%)

Why This Digital Shift Matters

1. Fortress-Level Security for Investors

Gone are the days of lost, stolen, or forged share certificates. CDSC’s electronic system offers:

- •Fraud-proof holdings with encrypted records.

- •Instant freeze capabilities for suspicious activity.

- •Beneficiary management for estate planning.

2. Supercharged Market Efficiency

The NSE now operates at unprecedented speed:

- •Settlement times reduced from T+4 to T+2.

- •Dividend payments processed in 48 hours (vs. weeks for cheques).

- •Corporate actions executed with 100% accuracy.

3. Global Market Integration

The immobilized structure enables:

- •Cross-border trading through Africa’s Exchanges Linkage Project.

- •Real-time visibility for foreign institutional investors.

- •Standardized processes meeting global best practices.

“Share immobilization marks a transformative step for the capital markets. This shift enhances liquidity, improves market efficiency, reduces settlement times, and opens up the market to global access. It’s not just a technological change but a crucial move toward creating a more secure, transparent, and accessible market for all stakeholders.”

NSE Chairman Kiprono Kittony

What makes this achievement extraordinary is that CDSC earns zero revenue from immobilization. This purely pro-market initiative has succeeded through:

Strategic Prioritization

- •Big fish first: Targeting Treasury holdings and billionaire portfolios (80/20 rule).

- •Institutional partnerships: Collaborating with registrars like I&M and Standard Chartered.

Innovative Solutions for Stubborn Cases

- •Deceased shareholder portal: Streamlining estate transfers.

- •Mobile conversion units: Reaching rural certificate holders.

- •Amnesty programs: Waiving legacy penalty fees.

The Road to 85%: Challenges Ahead

While celebrating progress, CDSC CEO Jesse Kagoma acknowledges the final hurdles:

- •The “Last Mile” Problem

- •5-6% of shares held by deceased/inaccessible investors.

- •Legal complexities around estate settlements.

- •Behavioral Resistance

- •Older investors clinging to paper certificates.

- •Misconceptions about digital security.

- •Infrastructure Gaps

- •Limited registrar bandwidth in counties.

- •Cybersecurity reinforcement needs.

What’s Next? The Digital Dividend Revolution

CDSC’s 18-month roadmap includes:

▪️Eliminating cheque dividends (saving issuers 300M KES annually).

▪️AI-powered investor outreach using predictive analytics.

▪️Blockchain pilot for secondary market transactions.

“This achievement is a testament to the collective commitment of our market stakeholders in advancing Kenya’s capital markets. We encourage all investors still holding physical share certificates to work with their registrars and stockbrokers to immobilize their shares. This will ensure the security of their investments and enable seamless trading, corporate action benefits, and faster transaction processing.”

— Jesse Kagoma, Chief Executive, CDSC muses.

References & Resources