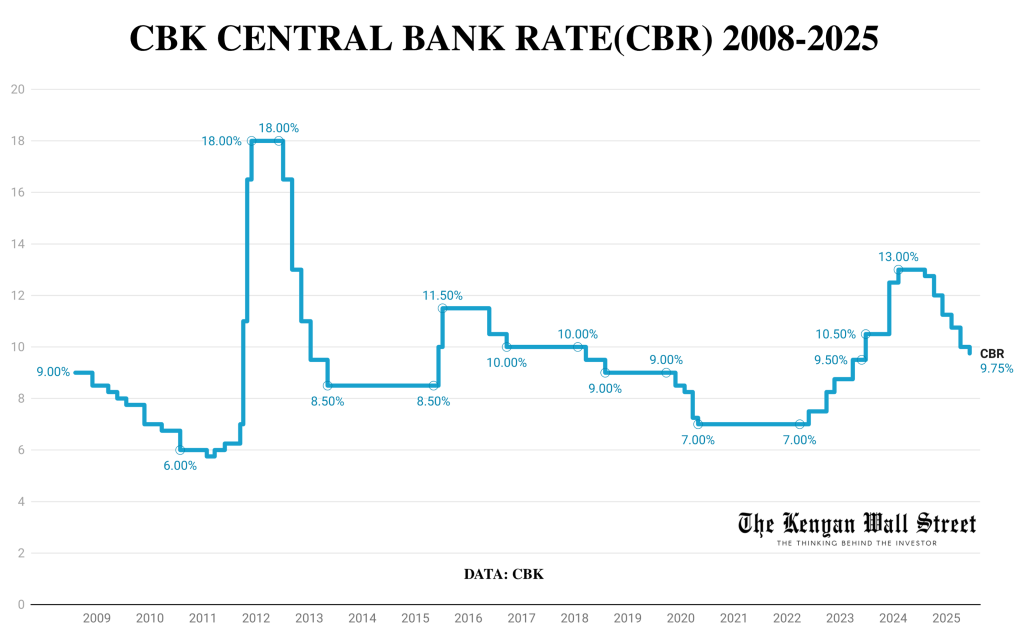

The Central Bank of Kenya Monetary Policy Committee (MPC) has lowered its benchmark interest rate by 25 basis points to 9.75%, returning it to single digits for the first time since May 2023.

- •This move signals the continuation of the CBK’s monetary easing cycle to boost lending and support the economy amid easing inflation.

- •Since August 2024, the CBK has delivered six consecutive rate cuts, moving the rate from 13.00% to 9.75%.

- •The MPC has also revised Kenya’s expected GDP growth rate for 2025 from 5.4% to 5.2%, which it attributes to higher tariffs that will affect trade and have ripple effects on some key sectors.

“The projected growth of the economy in 2025 has been revised to 5.2 percent from 5.4 percent, on account of higher tariffs on trade,” the MPC added. It also stated that “the resilience of key service sectors and agriculture, expected recovery in growth of credit to the private sector, and improved exports, are expected to support the pickup of growth in 2025.”

- •The rate cut to 9.75% reflects the MPC’s confidence that inflationary pressures have eased sufficiently to justify more supportive monetary policy.

Kenya’s overall inflation dropped to 3.8% in May 2025, down from 4.1% in April. This figure remains well below the CBK’s 5±2.5% target range. Non-core inflation declined to 6.0% due to lower food and energy prices, while core inflation edged up to 2.8%, mainly because of higher processed food prices.

The CBK closely monitors these inflation trends and uses them as a key input in setting the Central Bank Rate. By assessing inflation’s trajectory alongside domestic and global factors, the CBK aims to maintain price stability while supporting economic growth.

The MPC highlighted other key indicators:

- •The current account deficit narrowed to 1.8% of GDP in the 12 months to April 2025, helped by strong exports and diaspora remittances.

- •Foreign exchange reserves stand at USD 10.8 billion, equivalent to 4.75 months of import cover.

- •Private sector credit growth rose to 2.0% in May 2025, reversing earlier declines.

- •Non-performing loans (NPLs) slightly increased to 17.6% in April, but banks remain stable with adequate provisioning.

Looking ahead, the MPC expects inflation to stay below the target mid-point in the near term, thanks to stable food and energy prices. The CBK’s decision highlights its commitment to supporting growth while safeguarding price stability. The next MPC meeting is scheduled for August 2025.

A pre-meeting Twitter poll showed that 41% of respondents expected the CBK to maintain the rate at 10.00%, while 27% anticipated a 25–50bps cut—matching the MPC’s actual decision to cut by 25bps to 9.75%.