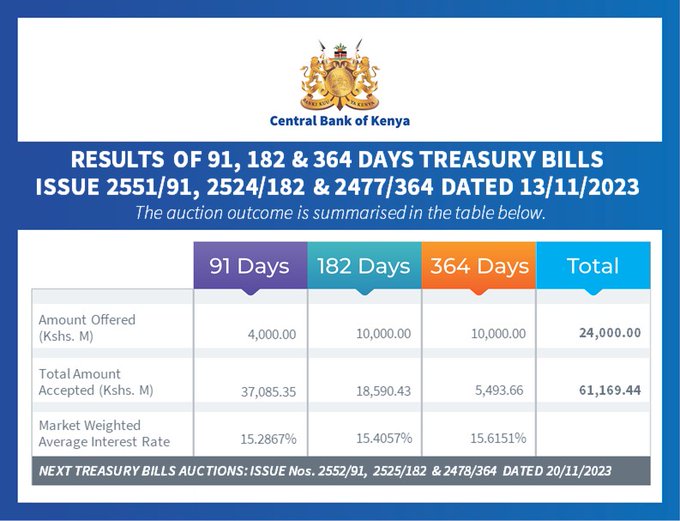

The Central Bank of Kenya(CBK) received bids worth KSh 61.4 billion at the weekly treasury bills auction, out of KSh 24 billion on offer, an oversubscription of 255.6%. It accepted bids totaling KSh 61.2 billion, made up of KSh 44.9 billion in competitive bids and KSh 44.9 billion in non-competitive bids.

Bidders at this auction continued to show their preference for the 91-day treasury bills and the three-month- debt instruments-which recorded an oversubscription for the first time in months.

The most attractive debt instrument was the 91-day treasury bills, which received bids worth KSh 37.3 billion out of KSh 4 billion on offer, an oversubscription of 931.4% with the CBK accepting KSh 37.1 billion worth of the 91-day T-bills.

- •The least attractive debt instrument was the 364-day treasury bills, which received bids worth KSh 5.5 billion out of KSh 10 billion on offer, with the CBK accepting KSh 5.4 billion.

- •The 182-day treasury bills issue received bids worth KSh 18.6 billion out of the KSh 10 billion on offer, an oversubscription of 185.9% with the CBK accepting the entire amount.

CBK offer to successful bidders

Successful bidders will be offered a return of 15.3%, 15.4%, and 15.6% for the 91-day, 182-day, and 364-day treasury bills bids accepted at this auction. This is compared to average interest rates of 15.2%, 15.3%, and 15.4% for the three-month, 6-month and one–year treasury bills at the prior auction.

In a notice, the Central Bank of Kenya said that in view of the public holiday, payments for government securities value dated Monday, 13th November 2023 must reach the CBK no later than 2.00 p.m. on Tuesday, 14th November 2023.

- •Bids closure and the next auction is 16th November 2023 while results will be announced on 17th November 2023.

- •Individual bids must be of a minimum face value of KSh 50,000.00 for Non-Competitive and KSh 2,000,000.00 for Competitive bids.

- •Only investors with active CSD accounts are eligible.

At the next auction, CBK intends to collect KSh 47.7 billion to be used for loan redemptions and KSh 23.7 billion as new borrowings and or net repayments.

ALSO READ: Kenya Shilling Exchange Rate Overvalued Against US$, says CBK Governor